A Cost Model for Enrichment Services

From the TightSpreads Substack

"The Core Economics of Enrichment

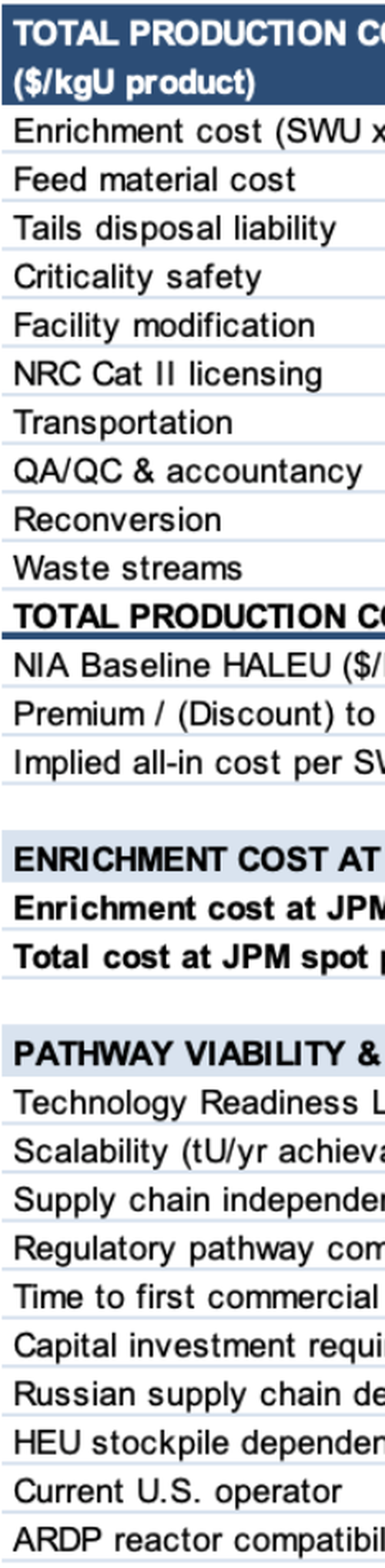

Capital charges represent ~60-70% of the levelized cost for any new Western enrichment facility. This makes enrichment a high-fixed-cost, low-variable-cost business where the single most important variable is capacity utilization — not technology, not energy, not labor.

A mature Western enricher (Urenco-class) produces SWU at ~$135/SWU all-in. A new-build U.S. greenfield requires ~$201/SWU to break even. Russia produces at ~$33/SWU. These three numbers define the competitive boundaries of the global market.

At current spot pricing ($195/SWU per JPM 2026E), a mature plant earns a 31% gross margin, a U.S. greenfield barely breaks even, and Russia earns an 83% margin. Against historical contract prices ($98/SWU), no new Western capacity is viable.

The financing structure matters as much as the engineering. A DOE loan guarantee at ~2.5% versus 8% commercial financing reduces the LCOE by ~$76/SWU, nearly closing the entire gap between a greenfield ($201) and a mature plant ($135).

Why General Matter’s DUF6 Model Works" ..

The rest of this article is available to Premium Subscribers of the TightSpreads Substack.

It discusses:

- The Competitive Landscape

- Capital Costs

- Operating Costs

- Tails Management

- Three-Scenario Framework: Base case, US greenfield, Russian optimization

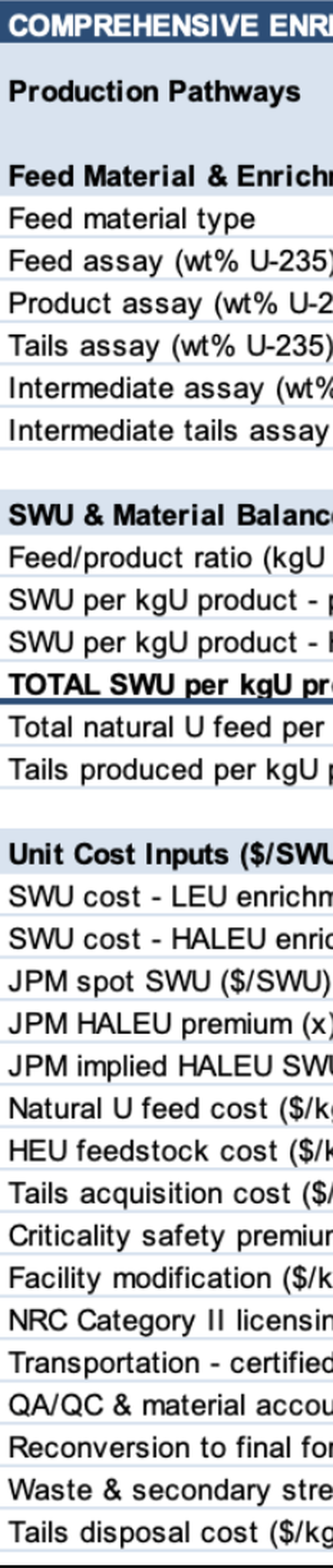

- Comprehensive Enrichment Cost Parameter Framework Assumptions Explained

- SWU Physics & Material Balance

- Regulatory, Licensing & Security

- Feed Material & Conversion Costs

- Tails Management & Disposal Pathways

- & Modeling 9 different enrichment pathways