Metal Price-Floors: New Front in Minerals War

TL;DR

• The United States has created a price floor framework for critical minerals aimed at cutting reliance on Chinese supply in materials tied to national security.

• According to Under Secretary of State for Economic Affairs Jacob Helberg, the framework was developed through interagency coordination and is now being discussed with allied governments.

• The proposed price supports are designed to protect non-Chinese producers from oversupply-driven margin compression and may be implemented through Pax Silica, a U.S.-led supply chain alliance.

Strategic Pricing as Industrial Policy

Authored by GoldFix

The United States has begun advancing a coordinated price floor system for critical minerals according to Bloomberg, marking a potential shift from passive market participation toward active price management in strategic commodity supply chains. The initiative is being positioned to allies as part of a broader effort by the Trump administration and more than 50 partner countries to reduce reliance on China for materials deemed essential to national security.

What Could Price Floors Do to Silver?

“Silver’s inclusion on the critical list magnifies the argument that supply scarcity should not be allowed to undercut domestic resilience.”

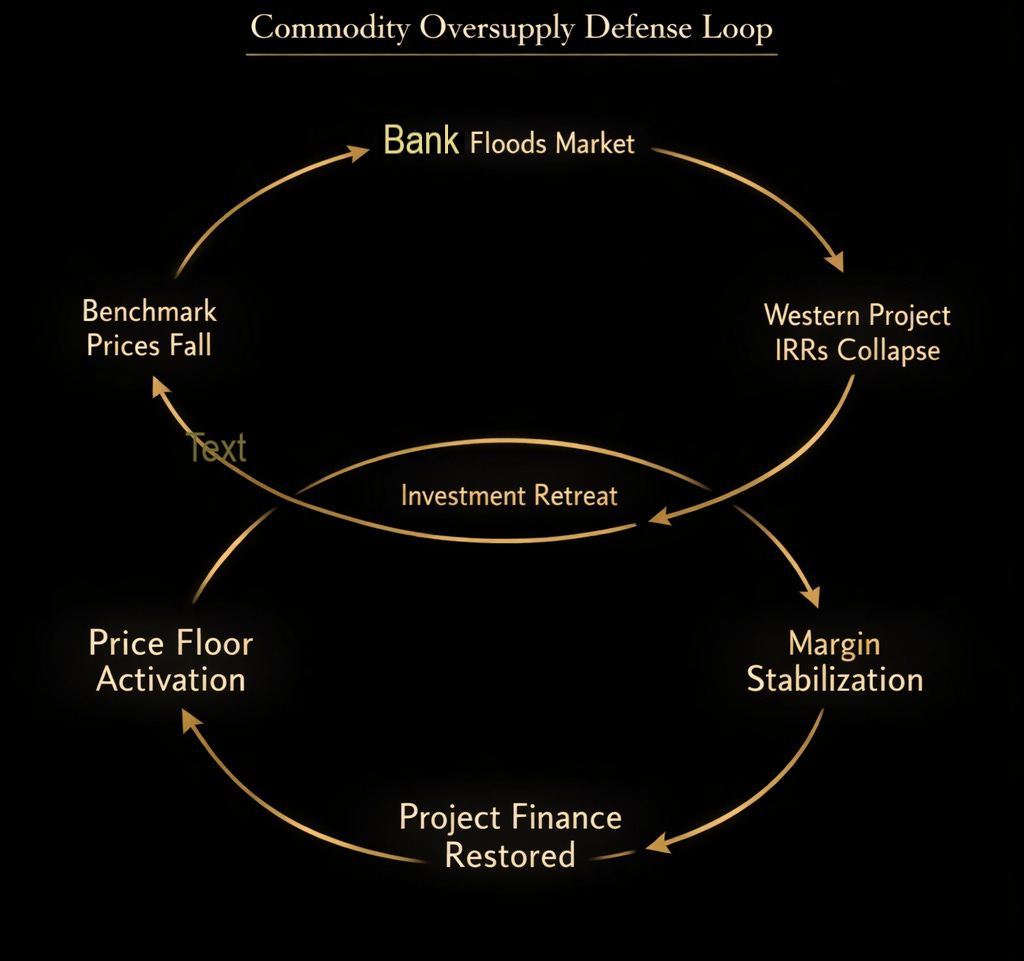

Policy shifts of this kind reduce downside risk for producers. A guaranteed floor price ensures that mines continue to operate during downturns, insulating supply chains from cyclical weakness. For investors, this translates into a structural repricing of silver.

Its dual role as both a monetary hedge and an industrial input means that supply interventions could create tighter markets, particularly if stockpiles or joint-purchasing agreements emerge. The practical effect is to skew prices higher while compressing downside volatility.

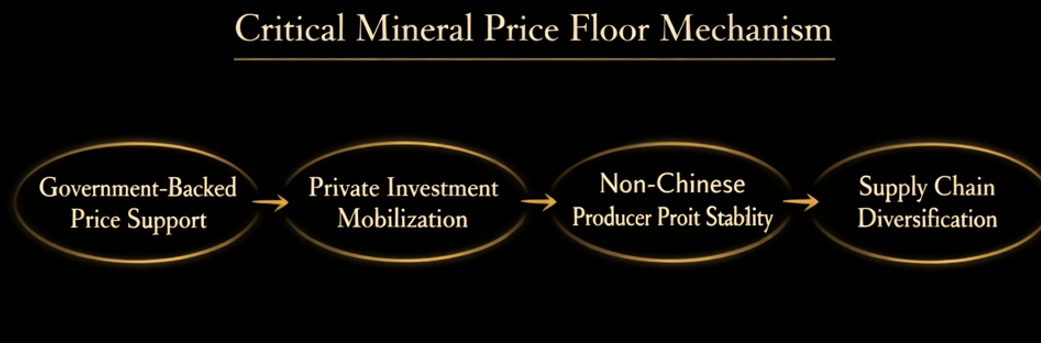

According to Bloomberg reporting by Joe Deaux and Annmarie Hordern, Under Secretary of State for Economic Affairs Jacob Helberg confirmed that multiple U.S. agencies have collaborated to develop what he described as a “very, very sophisticated price floor system” now under discussion with allied governments. In comments delivered at the Defense Tech Leadership Summit in West Palm Beach, Helberg emphasized the centrality of pricing mechanisms in mobilizing private capital toward domestic and partner-aligned extraction and processing capacity.

“We have had multiple agencies take a close look at this. They’ve developed a very, very sophisticated price floor system that we are having conversations with our allies and partners about.”

“We’re very excited about it because pricing is the key to unlocking private investment.”

The proposal follows a U.S.-hosted critical minerals summit earlier this month attended by 55 nations, where officials outlined the concept of coordinated price supports and expanded private-equity participation as components of a wider supply-chain realignment strategy. While the policy objective appears to be insulating Western producers from market-share erosion via Chinese oversupply tactics, limited operational detail has thus far been provided regarding pricing formulation, implementation pathways, or rollout timelines.

Price floors have been intermittently discussed within the mining and processing industry as a defensive tool to prevent external actors from suppressing benchmark prices through excess output. Helberg indicated that any eventual deployment would likely proceed through Pax Silica, a U.S.-led alliance intended to coordinate investment and strengthen non-Chinese sourcing and refining networks.

Continues here