The End of Cheap Silver

The US is Raising the Floor on Silver Price

Authored by GoldFix

Let’s spend a little bit of time talking about price floors and the implications for the markets in general, and silver specifically.

Price floors have a slightly deceptive name in that people think it implies a market cannot go below a certain price, and therefore, if the market drops, it will be supported. That is partly correct. But price floors can be used as a domestic policy to protect industry, and price floors can also be used as a geopolitical weapon to grow industry and make opponents pay higher prices for commodities that you have an advantage in.

Metal Price Floors: New Front in Minerals War

The United States has created a price floor framework for critical minerals aimed at cutting reliance on Chinese supply in materials tied to national security.

• According to Under Secretary of State for Economic Affairs Jacob Helberg, the framework was developed through interagency coordination and is now being discussed with allied governments.

• The proposed price supports are designed to protect non-Chinese producers from oversupply-driven margin compression and may be implemented through Pax Silica, a U.S.-led supply chain alliance.

In either situation, price floors are a subsidy to the targeted industry.

For example, if you are in Japan and you grow rice, and Japan feels that it is absolutely crucial that its rice supply be domestic for reasons of war risk and autonomy, then you put in a measure to make sure that rice is grown domestically. One of those measures could be to tax foreign rice coming in. In doing that, you make domestic rice more competitive, and people grow more of it because it becomes better and cheaper to eat your own rice.

Another way would be to say to the world that the price of rice is now 20% higher than it was last week, and then go out and buy all the rice in the world at that price, driving the price higher1. In doing that, you make everyone in the world pay a higher price for rice, while at the same time making it profitable for your own industry to grow more rice. So you increase supply and price at the same time. But you pay for it in a game of outpspending your competitor

The idea behind price floors, as opposed to straight subsidies of industry, is that price floors are an exporting weapon, meaning you export your pricing power. You essentially say to the world, “I can pay a higher price than you can, and I am going to do that and force you to keep up with me.”

This happens domestically all the time in grains. For years, soybeans were subsidized. Farmers were paid extra money for their soybean production. That was not a price floor, but it had the effect of putting a floor under soybean prices.

Now let’s turn to critical minerals, or more specifically, silver.

If it only costs $30 to bring silver out of the ground, then that becomes your natural organic price floor, because below $30 the price of silver is not worth producing. If market forces were free, that would drive the price of silver above $30 because of the lack of supply.

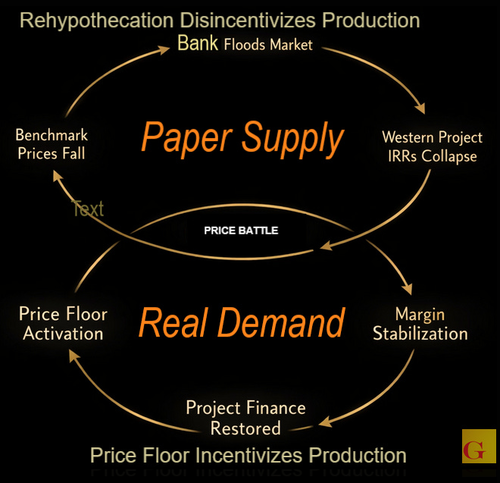

However, as silver investors know, that has not been the case. The rehypothecation and sale of futures in silver sent a global price signal that silver was only worth $16 or $17, and therefore not worthy of being pulled out of the ground. Slowly but surely, the U.S. lost much of its silver production while retaining pricing power.

The price of silver effectively had a ceiling on it, and below that ceiling, industry in the U.S. was disincentivized from opening refineries, smelters, or anything else involved in the silver value chain. We benefited from that because the price of silver stayed low and other countries were forced to sell it at a lower price to us. But in the process, the silver mining and value chain industry was damaged.

Now, in a turnabout, the U.S. realizes that it no longer has the ability to project a low price into the outside world. China has built its manufacturing power and is using that power to buy large amounts of silver at the low price environment that was created.

We can no longer afford that. Silver is now a critical mineral. We need it for weaponry, electronics, and other industries.

So what do you do?

Raising the price floor to $75 signals to domestic industry that this is now a profitable business to be in. Smelters get built, refineries get built, and businesses form around the silver value chain because there is now profit margin.

You also signal to the rest of the world that the price of silver will no longer be cheap. The higher the price of silver is, the harder it is for competitors to be profitable if their industry has been based on a lower pricing structure.

You do not say this directly. You signal it.

You create a price floor in several ways. One way would be to give an order to a bank such as JP Morgan or Bank of America and say: buy silver over the next six months and do not stop buying until the price reaches $75 an ounce. Do so carefully and without displaying intent.

Continues here