Epstein Files And A Stock Market On Thin Ice

From cracks forming beneath a major sector to fresh data that screams recession, the themes last week were consistent: fragility, distortion, and consequences that are no longer theoretical. If you’ve been feeling like something beneath the surface doesn’t add up, you’re not alone — and this week’s pieces dig directly into why.

In “Shit Is Getting Ugly In This One Sector I’d Avoid,” I break down an area of the market where the warning signs aren’t subtle anymore. If the dominoes start falling, it won’t stay contained.

Shit Is Getting Ugly In This One Sector I'd Avoid

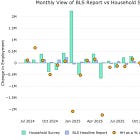

And in “Economy Is In Recession: Only 181k Jobs Gained For All Of 2025,” I note the labor data that most headlines glossed over — and why the slowdown may already be here.

"Economy Is In Recession": Only 181k Jobs Gained For All Of 2025

🔥 80% Off | Today: For the rest of the weekend take 80% off an annual subscription to my Substack — and keep the discount forever — using this coupon: Get 80% off forever

For those who want to zoom out, “Why Boom-Bust Cycles Validate Austrian Economics” connects the dots between policy distortions and inevitable corrections. The damage done during the boom doesn’t just disappear — it compounds.

Why Boom-Bust Cycles Validate Austrian Economics

Meanwhile, my conversation with Matt Taibbi in “‘Uniquely Destructive’: Matt Taibbi Talks Epstein Files” tackles transparency, power, and why this moment feels different — and stranger — than usual.

“Uniquely Destructive”: Matt Taibbi Talks Epstein Files

On the political front, “Zohran Mamdani’s Budgetary Buffoonery” dissects a fiscal strategy that somehow still manages to surprise in its simplicity.

Zohran Mamdani's Budgetary Buffoonery

And in “When Both Sides Go Quiet,” I explore what it means when political adversaries suddenly stop arguing about something. Silence in Washington is rarely accidental.

When Both Sides Go Quiet

We also looked at the culture and capital side of things: “Sports Betting And The Zero-Sum Trap” explains why the house almost always wins — and what that says about modern markets — while “Bitcoin Mining and the Electricity Grid: A Quiet Savior” makes the case that one of the most controversial industries today may be quietly strengthening infrastructure in ways few are talking about.

If you missed any of these, now’s the time to catch up. The through-line is simple: incentives matter, distortions accumulate, and reality eventually asserts itself. Click through, dive in, and decide for yourself what’s noise — and what’s signal.

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. If you see numbers and calculations of any sort, assume they are wrong and double check them. I failed Algebra in 8th grade and topped off my high school math accolades by getting a D- in remedial Calculus my senior year, before becoming an English major in college so I could bullshit my way through things easier. I am an investor in Mark’s fund.

The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.