NQ rebounding following another tech-led selloff; DXY firmer aided by weaker Yen following BoJ hike - Newsquawk US Market Open

- US President Trump’s administration initiated a multi-agency review of NVIDIA (NVDA) H200 licenses for sales to China, according to sources cited by Reuters.

- US President Trump is scheduled to make an announcement at 13:00EST/18:00GMT on Friday and will deliver remarks on the economy at 21:00EST/02:00GMT.

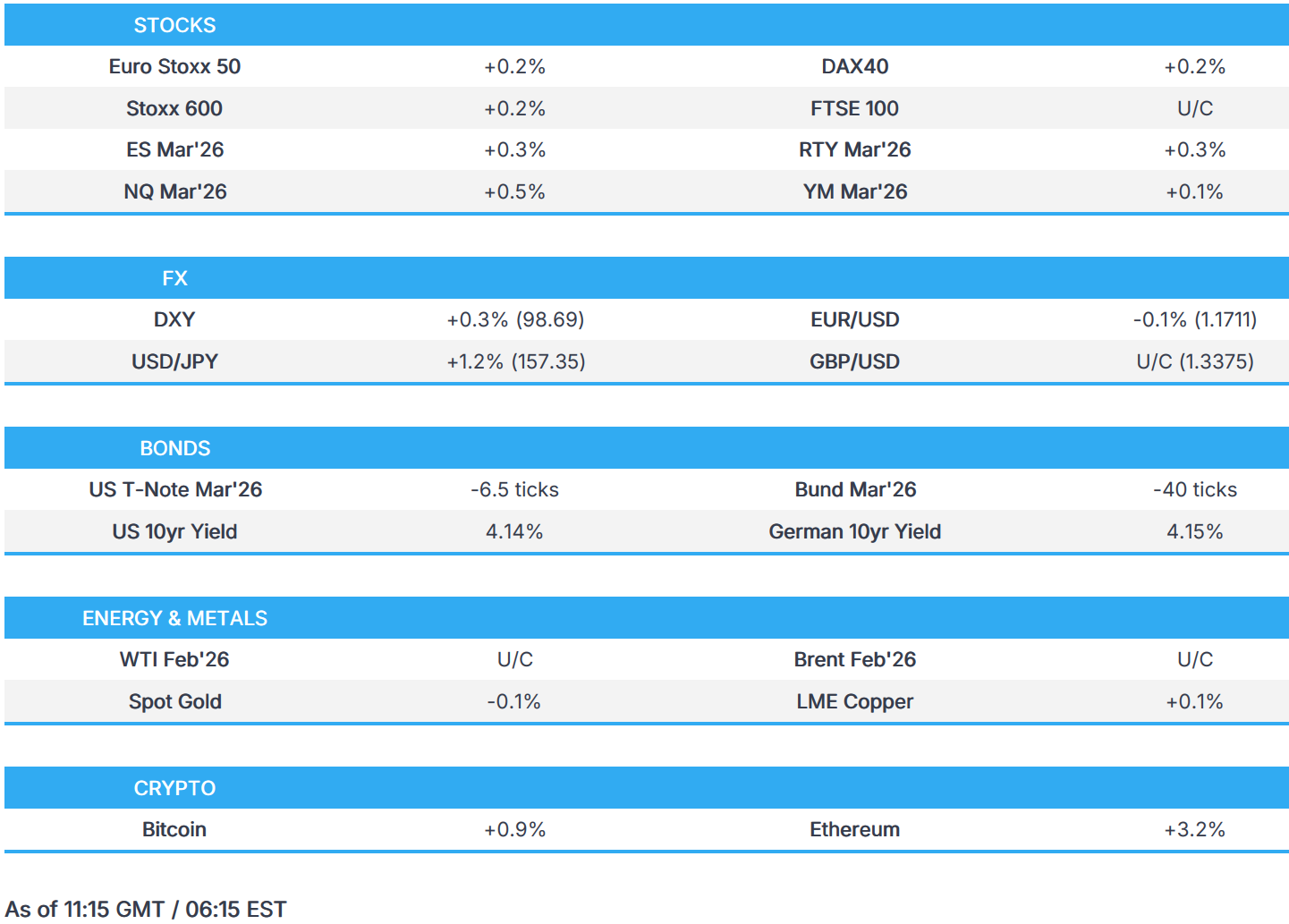

- European bourses are mixed whilst US equity futures are broadly firmer, with outperformance in the NQ.

- DXY is firmer, whilst the JPY underperforms; the BoJ hiked rates by 25bps as expected, though Governor Ueda avoided explicitly guiding future policy.

- Global fixed benchmarks generally pressured but with price action fairly muted.

- Crude benchmarks trade muted as EU agree on Ukraine loans; XAU trades rangebound after failing to break above USD 4350/oz.

- Looking ahead, highlights include Canadian Retail Sales (Oct), EZ Consumer Confidence (Dec), US Employment Trends (Nov). Speakers include ECB's Lane & Fed's Williams.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TRADE/TARIFFS

- US President Trump told NBC "We're making so much money with tariffs", people would start getting the payments "very soon". "Within the next few days, it’ll all be out".

- US President Trump administration initiated multi-agency review of NVIDIA (NVDA) H200 licenses for sales to China, according to sources cited by Reuters.

- China's Commerce Ministry urges India to correct wrong practice on Telecom tariffs. China files WTO case against India over ICT tariffs and Photovoltaic subsidies.

- China's Commerce Ministry has launched an investigation into some rubber products from the US, South Korea and the EU. Adds to keep anti-dumping duty rate of up to 222%. Will terminate anti-dumping measures against UK rubber imports from December 20th.

- EU's von der Leyen said "we have reached out to our Mercosur partners and agreed to postpone slightly the signature", adds she is confident EU has sufficient majority to approve the Mercosur trade deal.

- French President Macron said work must continue on EU-Mercosur deal after delay, adds safeguards clause must be adopted by EU Parliament and accepted by Mercosur nations. He said, with new safeguard and mirror clauses to be implemented in January, it would be a "new" Mercosur-EU deal. France asked for CAP budget to be maintained.

- Chinese auto parts company Wangxiang agrees to pay USD 53mln to resolve US Justice Department lawsuit over imported components.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 U/C) opened around the unchanged mark, and have remained on either side of the mark since.

- European sectors hold a slight positive bias. Autos leads, followed by Insurance whilst Consumer Products lags; the latter pressured in tandem with post-earning losses in Nike (-10.5%).

- US equity futures are trading with a mild upward bias, with the NQ marginally leading as Oracle (+5.7%) gains in the pre-market after TikTok US reaches an agreement on an Oracle-led US ownership plan.

- TikTok has signed a deal to sell its US entity to a joint venture controlled by American investors, according to Axios. The TikTok agreement is set to close on January 22. Oracle (ORCL), Silver Lake and Abu Dhabi-based MGX will collectively own 45% of TikTok's US entity. Nearly one-third of the TikTok US will be held by affiliates of existing ByteDance investors, and nearly 20% will be retained by ByteDance.

- Capital One (COF) reportedly concerned about AI costs rising via cloud computing relationship with AWS (AMZN) and may be looking for alternatives, via Business Insider citing an internal Nvidia (NVDA) memo.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- DXY is mildly firmer and trades at the upper end of a 98.41 to 98.70 range. Really not much driving things for the USD this morning, and with the upside largely facilitated by the JPY weakness. On that note, the BoJ raised rates by 25bps to 0.75% as expected. The decision was unanimous, and it stated that interest rates are expected to remain at significantly low levels, and the bank will continue to raise the policy rate if the economy and prices move in line with forecasts. The presser thereafter, spurred another bout of pressure in the JPY where Ueda avoided explicitly guiding markets towards another rate hike. Though he did highlight that the BoJ will conduct market operations swiftly, under exceptional circumstances in market. Interesting comments from the Governor came as he stated that several BoJ members mentioned that recent JPY weakness may affect prices going forward, adding that this warrants attention, given some believe that it could be affecting inflation. This spurred some very slight strength in the JPY at the time, which later pared.

- EUR is essentially flat and trades within a 1.1704 to 1.1728 range. Markets have had a slew of ECB speakers to digest this morning, but really not adding much to the agenda. ECB's Kocher suggested that they are where they want to be on rates, a comment reiterated by Sleijpen.

- GBP is also flat, within a 1.3364 to 1.3387 range. Traders seemingly taking breather following the upside seen in the prior session, following a hawkish cut at the BoE. Since, Governor Bailey has provided some commentary. On Thursday he said that he is "very" encouraged by the process in returning inflation to target; comments which were largely reiterated once again earlier this morning.

FIXED INCOME

- JGBs began the overnight session on a slightly firmer footing, but then came under marked pressure after the BoJ policy decision, where the Bank hiked rates by 25bps as expected. The decision was unanimous, with the accompanying commentary reiterating that it will continue to raise the policy rate if the economy and prices move in line with forecasts. Bond traders appear to be focused on the BoJ’s comments related to higher wages heading into the new year – and ultimately on remarks that the Bank will continue to raise rates in line with expectations. Perhaps focus for JGBs focus on the fiscal side of things, with the BoJ seemingly waiting for economic developments, which will be subject to volatility under PM Takachi’s cabinet.

- USTs traded rangebound throughout the overnight session and have continued to trade sideways throughout the European morning. Currently lower by a handful of ticks and within a 112-17+ to 112-23 range. Ahead, US President Trump is scheduled to make an announcement at 13:00EST/18:00GMT on Friday and will deliver remarks on the economy at 21:00EST/02:00GMT.

- Bunds and Gilt action has also been exceptionally lacklustre; currently holding a slight downward bias, within a 127.16 to 127.52 and 90.94 to 91.20 range, respectively. A few ECB speakers this morning, but not really any pertinent commentary thus far; Kocher reiterated that interest rates are at a good place. Back to the UK, Gilts mildly underperform – continuing the post-BoE hawkish move seen in the prior session. Some remarks from BoE Governor Bailey earlier who suggested that he is confident that inflation will be close to target by late spring, giving a good reason to expect a bit more downward path on rates. Ultimately, no move in Gilts on the remarks.

COMMODITIES

- Crude benchmarks remain contained in tight ranges as the European session gets underway amid a lack of crude-specific newsflow. WTI oscillates in a USD 55.67-55.99/bbl range while Brent holds below USD 60/bbl comfortably as European trade continues. Recent comments via US President Trump, who said that "I do not rule out a war with Venezuela", according to NBC, had little impact on the complex.

- Spot XAU saw initial downside at the start of the APAC session, continuing the reversal lower after failing to hold beyond USD 4350/oz during Thursday’s US session. XAU fell to a trough of USD 4310/oz and since, remains in a c.USD 40/oz band throughout the European morning.

- 3M LME Copper lead the gains across the metals complex as the risk tone stateside rebounded, which boosted Asia-Pac equities. The red metal opened unchanged but gradually rose, in line with APAC equities. This helped 3M LME Copper break Thursday’s high of USD 11.79k/t and continue to a peak of USD 11.83k/t as the European session gets underway.

- Phillips 66 (PSX) reported emissions event at Sweeney refinery and petrochemical complex in Texas on December 17th.

NOTABLE EUROPEAN HEADLINES

- Bundesbank cuts growth forecast for 2026 to 0.6% (prev. 0.7%) and raises 2026 inflation forecast for Germany to 2.2% (prev. 1.5%). Nagel: "Starting in the second quarter of 2026, economic growth will strengthen markedly, driven mainly by government spending and a resurgence in exports." and adds that "....while progress will be subdued initially, it will then slowly pick up.".

- French Prime Minister Lecornu said parliament will be unable to vote on a budget for France before the end of the year. Starting on Monday, he will meet with key political leaders to consult with them on the steps to be taken.

- Joint Committee from French National Assembly and Senate cannot reach compromise text on 2026 budget, according to a Committee member.

- Swedish Think Tank NIER sees 2025 GDP at 1.6% (sept. fcst. +0.9%), 2026 GDP 2.9% (sept. fcst. 2.6%).

- UK Trade Minister Bryant confirms a hack of Government data.

NOTABLE EUROPEAN DATA RECAP

- UK Retail Sales MM (Nov) -0.1% vs. Exp. 0.4% (Prev. -1.1%, Rev. -0.9%).

- UK Retail Sales YY (Nov) 0.6% vs. Exp. 0.9% (Prev. 0.2%, Rev. 0.6%).

- UK Retail Sales Ex-Fuel YY (Nov) 1.2% vs. Exp. 1.6% (Prev. 1.2%, Rev. 1.6%).

- UK PSNB Ex Banks GBP (Nov) 11.653B GB vs. Exp. 10.0B GB (Prev. 17.434B GB, Rev. 21.189B GB).

- UK PSNCR, GBP (Nov) 10.293B GB (Prev. 20.825B GB, Rev. 20.460B GB).

- UK Retail Sales Ex-Fuel MM (Nov) -0.2% vs. Exp. 0.2% (Prev. -1.0%, Rev. -0.8%).

- UK GfK Consumer Confidence (Dec) -17.0 vs. Exp. -18.0 (Prev. -19.0).

- Italian Industrial Sales YY WDA (Oct) 1.7% (Prev. 3.4%).

- Italian Industrial Sales MM SA (Oct) -0.5% (Prev. 2.1%).

- Italian Consumer Confidence (Dec) 96.6 vs. Exp. 96.0 (Prev. 95.0).

- Italian Mfg Business Confidence (Dec) 88.4 vs. Exp. 89.3 (Prev. 89.6, Rev. 89.5).

- French Producer Prices MM (Nov) 1.1%.

- German GfK Consumer Sentiment (Jan) -26.9 vs. Exp. -23.2 (Prev. -23.2, Rev. -23.4).

- German Producer Prices YY (Nov) -2.3% vs. Exp. -2.2% (Prev. -1.8%).

CENTRAL BANKS

BoJ

- BoJ raised rates by 25bps to 0.75%, as expected, with the decision unanimous, while it stated interest rates are expected to remain at significantly low levels and will continue to raise policy rate if the economy and prices move in line with forecasts.

- BoJ Governor Ueda (post-policy press conference) said Japan's economy is recovering moderately, albeit with some weakness. Will make a decision on rate hike after checking the impact on the economy. Will conduct market operations swiftly, under exceptional circumstances in market. Delaying a rate hike could force a significant hike later. There is still some distance to lower the limit of neutral rate estimate. Several BoJ members mentioned that recent JPY weakness may affect prices going forward, and warrants attention. Members suggested that the weak JPY is possibly affecting underlying inflation.

- Japanese Economy Minister Kiuchi said they respect the BoJ's decision but they need to be mindful of economic outlook.

- Japanese Economy Minister Kiuchi said FX is affected by various factors, determined at markets. Important for currencies to move in stable manner reflecting fundamentals. Closely watching market moves with a high sense of urgency, including long-term yields.

Other

- BoE Governor Bailey said he is confident that inflation will be close to target by late spring, giving a good reason to expect a bit more downward path on rates.

- ECB's Escriva says there are no reasons for any change in interest rates in any direction.

- ECB's Sleijpen says policy is in a good place but we must maintain a data-dependent and meeting-by-meeting approach.

- ECB's Muller said it is too early to speculate what will happen in six months, imagines a scenario that weaker growth and further disinflation could justify more easing but the opposite could also be imagined, via Econostream.

- ECB's Kocher said they have not decided what course to take on rates, when asked if there are no more rate cuts coming. Rates could be cut or raised, depending on developments.

- ECB's Rehn said outlook for growth and inflation remains highly uncertain due to trade war and geopolitical tensions. Reiterates meeting-by-meeting approach and ECB maintains full freedom of action and optionality.

- ECB's Kocher said there are many risks to growth and inflation to the up and downside. said they want to keep all options open to be able to react to the volatile situation. They are where they want to be on rates.

- ECB Wage tracker suggests lower wage growth and gradual normalisation of negotiated wage pressures in 2026. ECB wage tracker with unsmoothed one-off payments at 3.0% in 2025 and 2.7% in 2026.

NOTABLE US HEADLINES

- US Homeland Security Secretary Noem said at President Trump's direction, she is immediately directing the USCIS to pause the DV1 program.

- US President Trump to make an announcement at 13:00EST/18:00GMT on Friday and deliver remarks on the economy at 21:00EST/02:00GMT.

GEOPOLITICS

RUSSIA-UKRAINE

- Russian President Putin said we do not see Ukraine being ready for talks, ready and want to end the conflict via peaceful means. Continue to create a safe zone on the border with Ukraine.

- Belarus said "We are preparing to start the combat shift of the Russian Oryshnik missile system", via Al Arabiya.

- Russia's Dmitriev said regarding EU summit decision that it was a 'major blow to EU warmongers led by failed Ursula' and voices of reason in the EU blocked the illegal use of Russian reserves to fund Ukraine.

- EU's Costa said leaders agreed to roll over sanctions against Russia, adds Ukraine will only repay EU loan once Russia pays reparations and the EU reserves its right to make use of the immobilized assets to repay loan.

- German Chancellor Merz said Ukraine will receive an interest-free loan of EUR 90bln with these funds sufficient to cover military and budgetary needs for the next two years, and the EU will keep Russian assets frozen until Russia has compensated Ukraine. said: We expressly reserve the right to use Russian assets for repayment if Russia fails to pay compensation in full compliance with international law.

- EU's Costa said we have a deal to finance Ukraine, and the decision to provide EUR 90bln of support to Ukraine for 2026-2027 was approved.

- EU official said it seems there is the possibility of unanimity to use headroom of EU budgets to provide funding for Ukraine. EU leaders want work to continue on the technical and legal aspects of the instruments establishing a reparations loan.

- EU considers using joint debt to loan up to USD 106bln dollars to Ukraine, according to Bloomberg.

- European Council President Costa proposed to EU leaders to address Ukraine's immediate pressing financial needs through an EU borrowing solution, according to two EU diplomats.

- Russia's President Putin says US President Trump is making frank efforts to end the conflict in Ukraine. Says Russia has been asked to make compromise on Ukraine, in which Russia agreed to. The ball is on the West and Ukraine's court.

- Ukraine has hit Russian shadow fleet tanker in the Mediterranean sea for the first time, according to Reuters citing SBU source. SBU's aerial drones hit the Qendil vessel, causing critical damage. However, vessel was empty at the time of the attack.

MIDDLE EAST

- Contacts between Israel and Syria have not made much progress, according to Al Arabiya quoting US sources.

- Germany's Competition Authority approves the merger of Palo Alto (PANW) and Israel's Cyberark software.

- US ambassador to Israel said the US is not considering supplying Turkey with F-35 jets (LMT), which is not on the table under current US laws, via Sky News Arabia.

CRYPTO

- Bitcoin is a little firmer this morning and trades just shy of the USD 88k mark, whilst Ethereum outperforms, but still below USD 3k.

APAC TRADE

- APAC stocks were mostly higher as the region took impetus from the positive handover from Wall Street, where the major indices gained following softer CPI data and strong Micron earnings, while the attention overnight turned to the BoJ, which unsurprisingly hiked rates for the first time since January.

- ASX 200 was underpinned by outperformance in tech and financials, but with gains capped as mining, resources and materials sat at the other end of the spectrum.

- Nikkei 225 rallied amid tech strength and with some banks supported as yields gained amid the widely-expected BoJ rate hike, in which the central bank raised its key rate by 25bps to 0.75%, which is the highest in 30 years.

- Hang Seng and Shanghai Comp conformed to the upbeat mood amid tech strength, and after the PBoC continued to opt for a double-pronged liquidity operation, while it was also reported that TikTok signed a deal to sell its US entity to a joint venture controlled by American investors.

NOTABLE ASIA-PAC HEADLINES

- Japanese Finance Minister Katayama said will consider fiscal sustainability to some extent in compiling next fiscal year's budget, adds aim to boost market confidence by lowering debt to GDP ratio.

NOTABLE APAC DATA RECAP

- Chinese FDI (YTD) (Nov) -7.5% (Prev. -10.3%).

- Australian Housing Credit (Nov) 0.6% (Prev. 0.6%).

- Australian Private Sector Credit (Nov) 0.6% (Prev. 0.7%).

- New Zealand ANZ Business Outlook (Dec) 73.6% (Prev. 67.1%).

- New Zealand ANZ Own Activity (Dec) 60.9% (Prev. 53.1%).

- Japanese CPI, Core Nationwide YY (Nov) 3.0% vs. Exp. 3.0% (Prev. 3.0%).

- Japanese CPI Index Ex Fresh Food (Nov) 112.5 (Prev. 112.1).

- Japanese National CPI Ex. Fresh Food & Energy YY (Nov) 3.0% vs Exp. 3.0% (Prev. 3.1%).

- Japanese National CPI Ex. Fresh Food YY (Nov) 3.0% vs Exp. 3.0% (Prev. 3.0%).

- Japanese National CPI YY (Nov) 2.9% vs Exp. 2.9% (Prev. 3.0%).

- Japanese CPI, Overall Nationwide (Nov) 2.9% (Prev. 3.0%).

- New Zealand Exports (Nov) 6.99B (Prev. 6.5B, Rev. 6.44B).

- New Zealand Annual Trade Balance (Nov) -2.06B (Prev. -2.28B, Rev. -2.35B).

- New Zealand Trade Balance (Nov) -163.0M (Prev. -1542.0M, Rev. -1598M).

- New Zealand Imports (Nov) 7.15B (Prev. 8.04B, Rev. 8.03B).