Trump's team reportedly working on plan to control Venezuelan oil for years to come; European equity futures lower - Newsquawk European Opening News

- APAC stocks eventually traded mostly negative following a similar handover from Wall Street, where the S&P 500 and DJIA pulled back from record highs.

- USD/JPY saw two-way trade with early upside as Japanese yields ticked lower following softer-than-expected wage data from Japan, but then reversed course as the negative risk tone in Japan spurred some mild haven currency flows.

- US President Trump's team is working up a sweeping plan to control Venezuelan oil for years to come, according to WSJ.

- US President Trump posted that Venezuela is going to be purchasing only American-made products with the money received from the new oil deal with the US.

- European equity futures indicate a softer cash market open with Euro Stoxx 50 futures -0.4% after the cash market closed with losses of 0.1% on Wednesday.

- Looking ahead, highlights include Swedish CPI (Dec), Swiss CPI (Dec), US Initial Jobless Claims, RevelioLabs Total US Nonfarm Employment Data, Chinese Inflation (Dec), SNB Minutes, ECB SCE, BoE DMP, Comments from ECB's de Guindos, Supply from Spain & France.

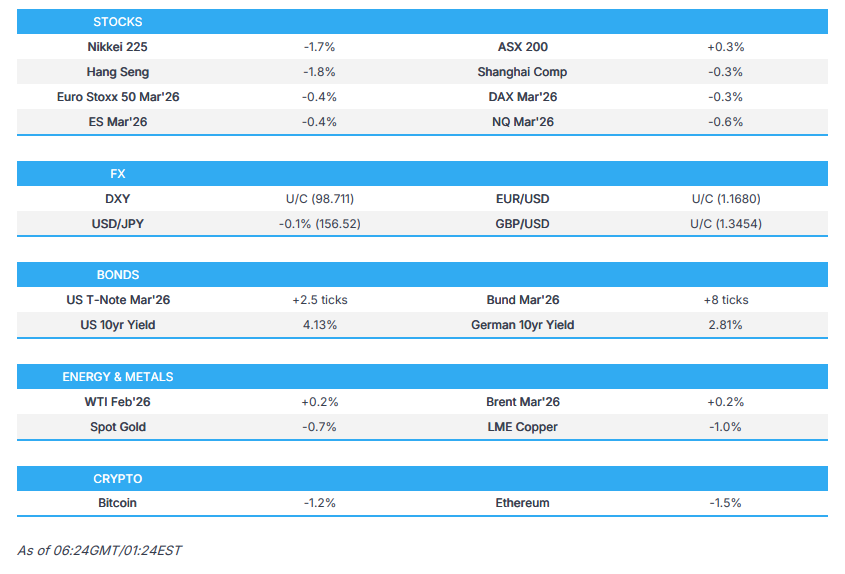

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks saw two-way trade with upside in stocks seen throughout most of the US session before selling off in the afternoon into the closing bell to see indices close predominantly in the red, albeit Nasdaq was flat. The downside extended with US President Trump taking aim at two sectors in the US, housing and defence. The President announced he will ban large institutional investors from buying more single-family homes, weighing on the real estate sector and Blackstone (BX). Meanwhile, for Defence, Trump said he will not permit buybacks or dividends until problems, like slow production and maintenance, are fixed, which pressured defence stocks, although they were supported after the closing bell as Trump commented that he wants the 2027 defence budget boosted to USD 1.5tln from USD 1tln.

- SPX -0.34% at 6,921, NDX +0.06% at 25,654, DJI -0.94% at 28,996, RUT -0.29% at 2,575.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump posted "I have just been informed that Venezuela is going to be purchasing ONLY American Made Products, with the money they receive from our new Oil Deal. These purchases will include, among other things, American Agricultural Products, and American Made Medicines, Medical Devices, and Equipment to improve Venezuela’s Electric Grid and Energy Facilities. In other words, Venezuela is committing to doing business with the United States of America as their principal partner – A wise choice, and a very good thing for the people of Venezuela, and the United States."

- EU trade chief said the European Commission will propose most-favoured-nation tariffs on ammonia, urea and, where necessary, other fertilisers, while they will issue guidance to allow temporary suspension of carbon border tax on certain goods, such as fertilisers.

NOTABLE HEADLINES

- US President Trump said he is immediately taking steps to ban large institutional investors from buying more single-family homes, and will be calling on Congress to codify it.

- US President Trump posted on Truth Social that they will no longer tolerate defence contractors issuing massive dividends to their shareholders and massive stock buybacks, at the expense and detriment of investing in plants and equipment. It was later announced that President Trump signed an executive order "PRIORITIZING THE WARFIGHTER IN DEFENSE CONTRACTING" which bans defence stock buybacks.

- US President Trump said their military budget for the year 2027 should not be USD 1tln, but rather USD 1.5tln.

- US President Trump signed a Presidential Memorandum directing the withdrawal of the US from participation in 66 international organisations.

- US Treasury is implementing President Trump's no tax on American car loan interest, according to Treasury Secretary Bessent on X.

- White House is withdrawing its nomination of Ryan Baasch to be FTC commissioner, with Baasch to become the Deputy Director of the White House NEC instead.

- US Q4 GDP data has been rescheduled for February 20th, while October and November Personal Income and PCE are to be released January 22nd. Furthermore, the December Personal Income and PCE is due on February 20th at 08:30EST, alongside the Q4 advance estimate for GDP.

- US House voted 221-205 to clear the Democrats' bill to extend expired healthcare subsidies for three years, through the procedural hurdle and with the House expected to vote on the underlying measure to extend the ACA enhanced tax credits on Thursday, but was seen to likely fail in the Senate, according to CNBC. However, it was separately reported by WSJ that Senate Republicans said a deal to extend federal health-insurance subsidies for two years is within reach.

- NVIDIA (NVDA) is said to be requiring full upfront payment from Chinese customers seeking H200 chips, hedging it against ongoing uncertainty over China's approval of the shipments.

APAC TRADE

EQUITIES

- APAC stocks eventually traded mostly negative following a similar handover from Wall Street, where the S&P 500 and DJIA pulled back from record highs.

- ASX 200 traded marginally higher as strength in health care, tech, consumer stocks, energy and financials, offset the losses in mining and materials, with mild tailwinds seen amid a softer yield environment in Australia.

- Nikkei 225 extended its decline beneath the 52,000 level amid soft wages data from Japan and further frictions with China after MOFCOM yesterday announced an anti-dumping probe into Japan's dichlorosilane imports, which is a key chipmaking chemical, while Japan protested China's operation of mobile drilling rigs in waters on the Chinese side of the Japan-China median line in the East China Sea.

- Hang Seng and Shanghai Comp eventually traded negative with the Hong Kong benchmark pressured amid tech-related weakness and with some early pressure seen in China’s OpenAI rival Knowledge Atlas Technology a.k.a. Zhipu, during its Hong Kong debut. The mainland eventually gave up the modest gains that were seen as the PBoC conducted a CNY 1.1tln outright reverse repo operation to maintain ample liquidity in the banking system.

- US equity futures were lacklustre after the prior day's losses although further downside was limited, and defence stocks found some reprieve after-hours following comments from US President Trump that he wants the 2027 defence budget boosted to USD 1.5tln from USD 1tln.

- European equity futures indicate a softer cash market open with Euro Stoxx 50 futures -0.4% after the cash market closed with losses of 0.1% on Wednesday.

FX

- DXY traded little changed overnight after marginally gaining yesterday to track higher US yields in the short end after ISM Services topped estimates and pointed to the strongest growth in the services sector since October 2024. Conversely, job openings unexpectedly deteriorated, and the ADP December report also disappointed, although markets had brushed that aside, with some more labour market proxies scheduled for release later today, ahead of Friday's NFP report.

- EUR/USD rebounded off the prior day's trough, but with upside limited in the absence of any fresh pertinent catalysts and with the recent EU flash inflation data unlikely to change the ECB's narrative.

- GBP/USD lacked demand with price action stuck around 1.3450 after having suffered alongside cyclical peers during US trading hours.

- USD/JPY saw two-way trade with early upside as Japanese yields ticked lower following softer-than-expected wage data from Japan, but then reversed course as the negative risk tone in Japan spurred some mild haven currency flows.

- Antipodeans remained subdued after ultimately trickling lower on Wednesday, and with yields in Australia declining following recent softer-than-expected inflation data and a contraction in exports, while comments from RBA Deputy Governor Hauser failed to spur a rebound despite noting that they have likely seen the last rate cut in the cycle and the chance of near-term rate cuts is very low.

- PBoC set USD/CNY mid-point at 7.0197 vs exp. 6.9926 (Prev. 7.0187).

FIXED INCOME

- 10yr UST futures remained indecisive after recent mixed data in which ISM Services PMI topped estimates, but ADP Employment and JOLTS Job Openings disappointed, while attention turns to more jobs-related releases scheduled later, including Initial Jobless Claims and RevelioLabs Total US Nonfarm Employment Data.

- Bund futures traded rangebound after gaining yesterday in a choppy environment following German data and supply.

- 10yr JGB futures extended on the prior day's advances with participants digesting softer-than-expected wages data, including a further deterioration in real wages, while prices ultimately weathered the choppy reaction seen in the aftermath of the mostly softer results from the 30yr JGB auction.

COMMODITIES

- Crude futures mildly rebounded after the prior day's choppy performance amid a slew of Venezuela-related headlines and reports that the US seized a Russian-flagged tanker in the North Atlantic, as well as a second tanker in the Caribbean. It was also reported that President Trump's team is working up a sweeping plan to control Venezuelan oil for years to come, and that President Trump believes his efforts could help lower oil prices to his favoured level of USD 50/bbl.

- US President Trump's team is working up a sweeping plan to control Venezuelan oil for years to come, while President Trump told aides that his efforts could help lower oil prices to his favoured level of USD 50/bbl, according to WSJ.

- US Vice President Vance said Venezuela can only sell its oil if it serves US national interests, and the way they will control Venezuela is to control the purse strings.

- White House said the Trump administration is in close correspondence with interim Venezuelan authorities, and their decisions will continue to be dictated by the US, while the US is working with Venezuela and the oil industry on a deal, and they have already begun marketing the oil. Furthermore, it stated that the deal involves sanctioned oil that was just sitting on ships and will arrive very soon.

- US DoE provided details on the Venezuela fact sheet, and will allow the sale of oilfield equipment and services to Venezuela.

- Chevron is in talks with the US government to expand its Venezuela license and seeks authorisation to supply Venezuelan oil to other buyers, while the US government also wants other US companies involved in oil exports from Venezuela, according to industry sources.

- US oil companies warn they will need guarantees to invest in Venezuela, according to FT

- Spot gold gradually retreated following the prior day's choppy performance and mixed US data releases.

- Copper futures initially rebounded from yesterday's trough but then faltered alongside the mixed risk sentiment.

CRYPTO

- Bitcoin was indecisive with price action choppy on both sides of the USD 91,000 level.

NOTABLE ASIA-PAC HEADLINES

- PBoC announced on Wednesday it will conduct a CNY 1.1tln outright reverse repo operation on Thursday to maintain ample liquidity in the banking system.

- China's MIIT held a meeting with the power and storage battery industry on regulating competition and said it is to enhance the inspection of battery prices, while it added it is necessary to strengthen market supervision.

- RBA Deputy Governor Hauser said they have likely seen the last rate cut in the cycle and the likelihood of near-term rate cuts is very low, while he also noted that the November CPI data was helpful, but was largely as expected, according to an ABC interview.

DATA RECAP

- Japanese Average Cash Earnings YoY (Nov) Y/Y 0.5% vs. Exp. 2.3% (Prev. 2.5%, Rev. 2.6%)

- Japanese Real Cash Earnings YY (Nov) -2.8% vs Exp. -1.2% (Prev. -0.7%, Rev. -0.8%)

- Australian Balance of Trade (Nov) 2.936B vs. Exp. 4.9B (Prev. 4.385B )

- Australian Exports MoM (Nov) M/M -2.9% (Prev. 3.4%)

- Australian Imports MoM (Nov) M/M 0.2% (Prev. 2.0% )

GEOPOLITICS

VENEZUELA/LATIN AMERICA

- US President Trump posted that it was a great honour to speak with Colombia's President, who called to explain the situation of drugs and other disagreements that they have had, while Trump said he appreciates his call and tone and looks forward to meeting him in the near future. Furthermore, arrangements are being made between Secretary of State Marco Rubio and the Foreign Minister of Colombia, with the meeting to take place in the White House.

- US President Trump's administration reportedly draws up new legal justification for the Maduro operation, with the DoJ's opinion expected to say that it was lawful because it was part of a law enforcement action, according to WSJ.

- US VP Vance said the recently seized oil tanker by the US was a fake Russian tanker, while he stated the US had a legitimate indictment for Maduro and that President Trump will make a determination on Greenland.

- US Energy Secretary Wright said they're going to see very significant pressure on Cuba, according to a CNBC interview.

RUSSIA-UKRAINE

- Ukrainian President Zelenskiy said he expects no further demands on Ukraine in peace negotiations.

- US Republican Senator Graham said after a meeting on Wednesday with US President Trump, that he has greenlit the bipartisan Russia sanctions bill, while Graham added that he looks forward to a vote as early as next week.

OTHER

- White House said regarding Russia and China that President Trump has good personal relationships which will continue. It also stated regarding Greenland that it is being actively discussed by President Trump and the National Security team, and that they are talking about what a potential purchase would look like.

- China reportedly hacked the email systems of US Congressional Committee staff, with Beijing intelligence said to have used Salt Typhoon to access communications used by top panels in US Congress, while the intrusions were detected in December, according to FT.

EU/UK

NOTABLE HEADLINES

- EU plans to pursue a special rulebook for corporates outside national law, which would create a voluntary ‘28th regime’ for companies to operate across the EU, according to FT.