Boomers & Gen X Send Conference Board Consumer Confidence Tumbling In December

Amid a flurry of disappointing soft survey data since the government shutdown, The Conference Board's Consumer Confidence data for December was a mixed bag with the Present Situation tumbling (from 126.3 to 116.8) while Expectations were flat to a dramatically upward-revised November print (from 63.2 to 70.7), dragging the overall headline index down more than expected...

Source: Bloomberg

“Despite an upward revision in November related to the end of the shutdown, consumer confidence fell again in December and remained well below this year’s January peak. Four of five components of the overall index fell, while one was at a level signaling notable weakness,” said Dana M Peterson, Chief Economist, The Conference Board.

"The Present Situation Index declined as net views on current business conditions were negative for the first time since September 2024, a month that included a labor market scare and deadly hurricanes."

How do you 'revise' historical sentiment numbers?

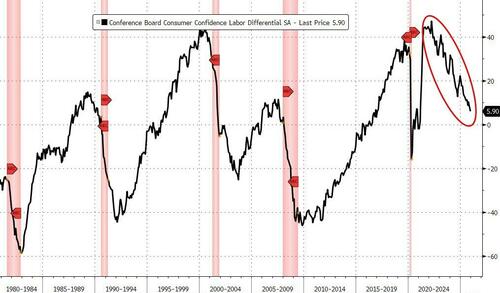

Under the hood, The Conference Board survey shows the trend of a weaker labor market continued to accelerate...

Source: Bloomberg

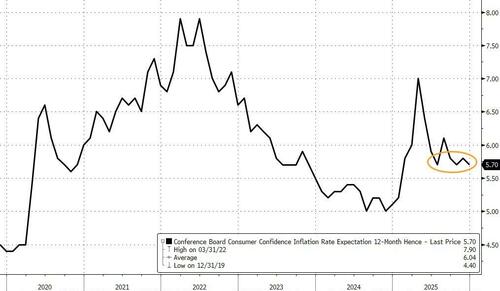

Inflation Expectations were flat (but remain elevated)...

Source: Bloomberg

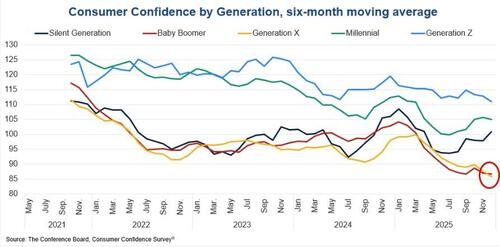

Among demographic groups, on a six-month moving average basis, confidence dipped among all age groups in December, although consumers under 35 continued to be more confident than consumers age 35 and older. There were few generational differences, as confidence among all generations trended downward in the month, with only the Silent Generation becoming more hopeful. Millennials and Gen Z remained the most optimistic of all generations surveyed. By income, confidence on a six-month moving average basis fell for nearly all brackets, except for those earning less than $15K and more than $125K. Still, consumers earning less than $15K remained the least optimistic among all income groups.

Confidence continued to fall in December among all political affiliations (Democrats, Republicans, and Independents).

Peterson added:

“Consumers’ write-in responses on factors affecting the economy continued to be led by references to prices and inflation, tariffs and trade, and politics. However, December saw increases in mentions of immigration, war, and topics related to personal finances—including interest rates, taxes and income, banks, and insurance.

The responses continued to skew pessimistic but less so than November, potentially due to fewer negative comments about prices and inflation, politics, as well as a rebound in positive responses about interest rates. Notably, the Federal Reserve Board cut monetary policy rates on December 10 for a third time in 2025, which landed in the second half of the survey sample interval.”

On net, consumers’ views of their Family’s Current Financial Situation collapsed into negative territory for the first time in nearly four years. However, expectations for their Family’s Future Financial Situation were the most positive since January of this year.

So, the stock market soars near record highs, GDP is ripping, but consumer sentiment is collapsing?