Core Consumer Price Inflation Slowest In 4 Years As Energy & Airfare Costs Tumble

With four times as many data points skewing towards higher February consumer prices than lower ones, whisper numbers into this morning's CPI print (expected to rise 0.3% MoM) were to the upside (but we note that for the 4th month in a row we were contrarian to that, suggesting prices cool off this month).

4th month in a row subs knew the CPI ahead of the report, and vs wrong consensus expectations pic.twitter.com/dYYXOUSyyo

— zerohedge (@zerohedge) March 12, 2025

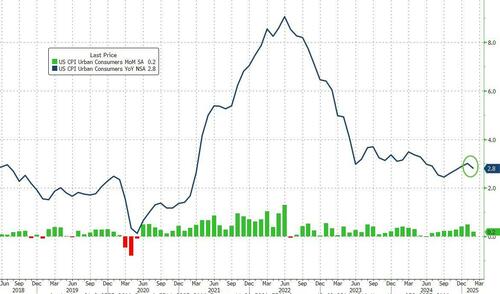

However, headline and core CPI both printed below expectations (+0.2% MoM) which dragged the headline CPI down to +2.8% YoY...

Source: Bloomberg

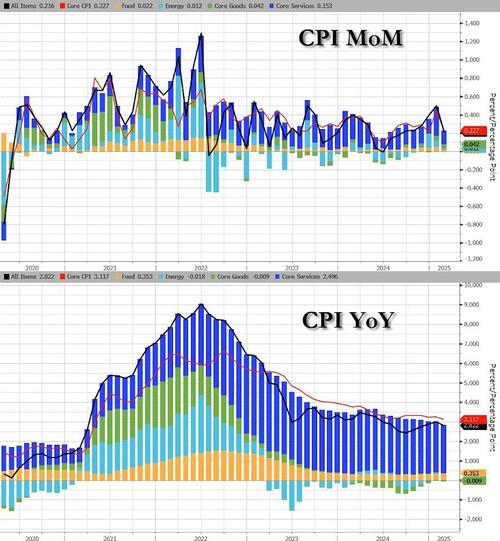

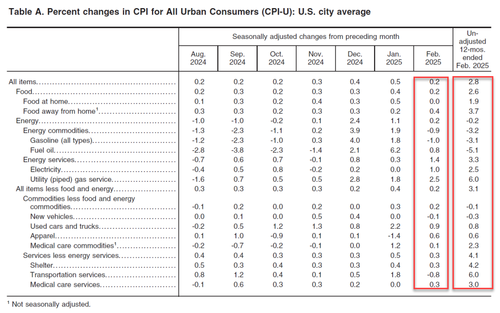

CPI Highlights:

The index for shelter rose 0.3 percent in February, accounting for nearly half of the monthly all items increase. The shelter increase was partially offset by a 4.0-percent decrease in the index for airline fares and a 1.0-percent decline in the index for gasoline.

Despite the decrease in the gasoline index, the energy index rose 0.2 percent over the month as the indexes for electricity and natural gas increased. The index for food also increased in February, rising 0.2 percent as the index for food away from home increased 0.4 percent. The food at home index was unchanged over the month.

The index for all items less food and energy rose 0.2% in February, following a 0.4% increase in January. Indexes that increased over the month include medical care, used cars and trucks, household furnishings and operations, recreation, apparel, and personal care. The indexes for airline fares and new vehicles were among the few major indexes that decreased in February.

The miss also pulled Core CPI YoY down to +3.1% - its lowest since April 2021

Source: Bloomberg

Core CPI Details:

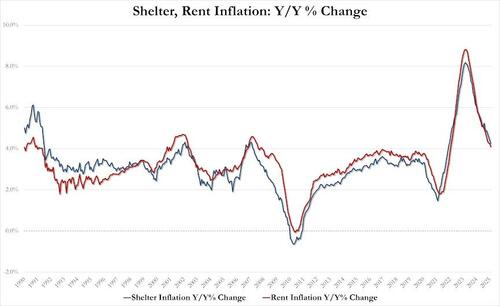

The shelter index increased 0.3 percent over the month.

The index for owners’ equivalent rent rose 0.3 percent in February, as did the index for rent.

The lodging away from home index increased 0.2 percent in February.

Shelter inflation up 0.36% MoM, up 4.247% YoY, lowest since Dec 2021

Rent inflation up 0.26% MoM, up 4.09% YoY, lowest since Jan 2022

The medical care index increased 0.3 percent over the month. The index for physicians’ services increased 0.4 percent in February and the index for hospital services rose 0.1 percent over the month.

The prescription drugs index was unchanged in February

The used cars and trucks index rose 0.9 percent in February.

The index for new vehicles also declined over the month, falling 0.1 percent.

The index for household furnishings and operations rose 0.4 percent over the month and the index for recreation increased 0.3 percent.

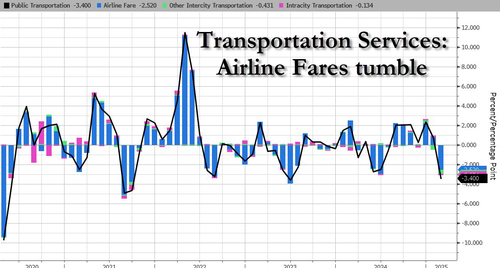

Other indexes that increased in February include apparel, personal care, and motor vehicle insurance. In contrast, the index for airline fares fell 4.0 percent in February, after rising 1.2 percent in January.

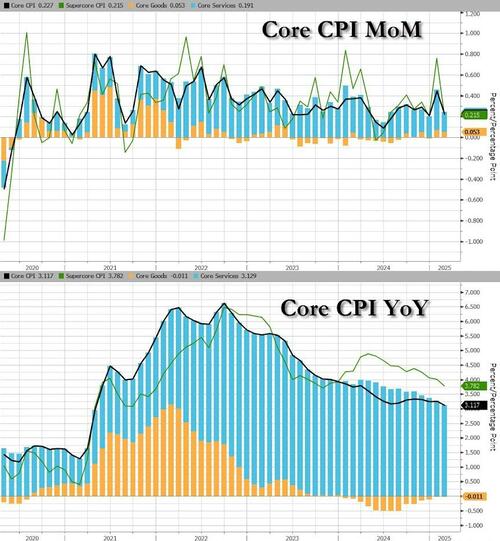

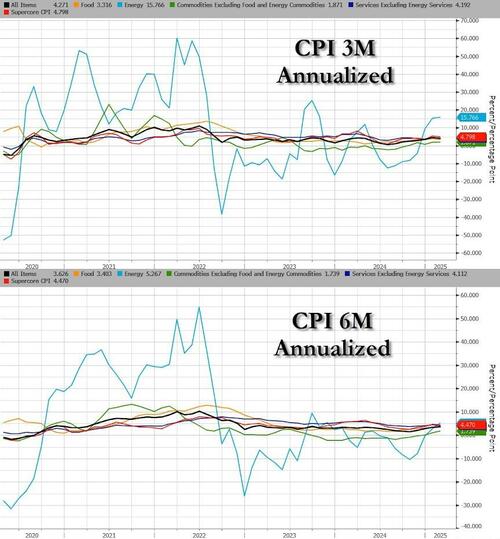

Goods 'inflation' is basically negligible currently while Services cost inflation is continuing to fall rapidly...

Source: Bloomberg

Energy and Transportation costs are tumbling (Drill baby drill?)

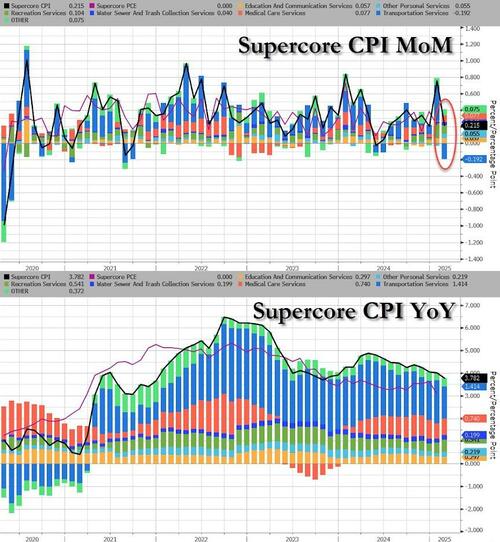

The so-called SuperCore CPI (Services ex-Shelter) also fell to its slowest rate since Oct 2023...

Source: Bloomberg

Tranportation costs' tumble led SuperCore lower...

And drilling down further, it was airfares that led that the disinflationary impulse...

On a 3m and 6m annualized basis, energy costs are still driving CPI higher...

...But traders should expected both CPI and PPI Energy to keep tumbling as oil prices have fallen...

Source: Bloomberg

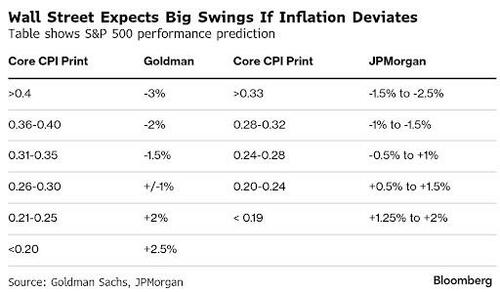

So what happens next?

Is this just the ammo needed to spark a huge short squeeze higher?