Could Electricity Prices Become A Structural Inflation Problem

Most Americans are paying higher electricity prices, and the pressure is unlikely to ease anytime soon.

According to the Wall Street Journal, electricity prices have risen meaningfully across much of the country since 2022, and the drivers extend well beyond the frequently cited surge in data-center demand.

While electricity prices had historically tracked inflation, that relationship broke down after Russia’s invasion of Ukraine sent natural gas prices sharply higher.

Since then, utilities have faced rising fuel costs, storm damage from hurricanes and wildfires, and the need to replace aging grid infrastructure.

State-level renewable energy mandates have also driven up costs in regions where wind and solar resources are less efficient, particularly in the Northeast and Mid-Atlantic.

Looking ahead, the pressure is set to intensify.

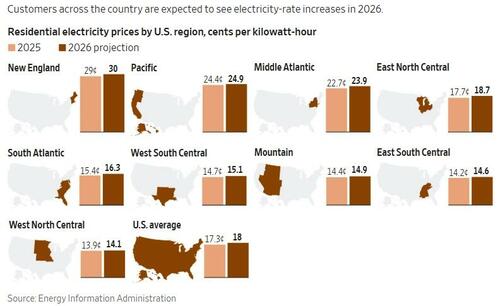

The Energy Department expects average residential electricity prices to rise another 4% in 2026, following a nearly 5% increase this year. Investor-owned utilities are projected to spend roughly $1.1 trillion between 2025 and 2029 on transmission, distribution, and generation. That’s double what they spent in the prior decade, and those costs are typically passed through to customers over time.

For consumers, electricity is already the second-largest energy expense after gasoline.

For investors, persistently rising power costs risk becoming a more durable source of inflation than policymakers anticipate.

Even if headline inflation cools, higher utility bills could continue to pressure household budgets, complicate the Fed’s disinflation narrative, and weigh on consumer-driven growth.