The Inevitable Reversal: When Speculative Narratives Don't Hold

Authored by Lance Roberts via RealInvestmentAdvice.com,

For nearly two years, markets were driven by the same speculative narrative that “this time is different.” Bitcoin, precious metals, and AI-linked equities rose not only because of robust fundamentals, but also because investors clung to powerful narratives about inflation, disruption, and monetary collapse. Those speculative narratives are not only seductive but also contribute to investment behaviors that obscure reality.

Bitcoin was cast as “digital gold,” a hedge against a largely false tale of a weakening dollar and fiscal instability. Gold and silver were likewise falsely elevated as defensive stores of value in a monetary regime supposedly at risk of losing purchasing power. AI stocks became shorthand for a new productivity supercycle where profits would follow indefinitely rising valuations. These speculative narratives are fine and drive bull markets in the near term. As John Maynard Keynes once quipped: “Markets can remain irrational longer than you can remain solvent,” and those narratives are potent as they frame expectations and justify positions.

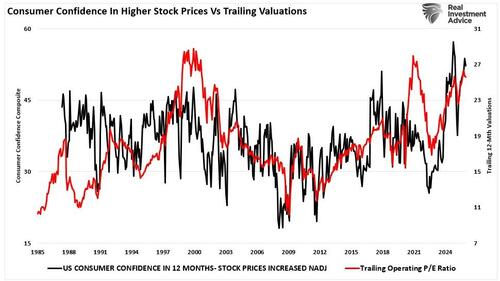

However, these speculative narratives have little to do with economic or fundamental realities that will ultimately drive outcomes. In markets, stories don’t replace valuation. As I noted previously, when “valuation metrics are excessive… it is a better measure of investor psychology than fundamentals.” That means price becomes more about sentiment than business results, and we see that in the relationship between consumer sentiment about stock prices over the next 12 months and valuations.

“This broad wave of bullish behavior isn’t isolated to sentiment surveys. Positioning data, equity fund inflows, and trading behavior confirm the lack of bears in the market. Markets are rising not because of strong earnings or economic acceleration, but because of optimism about future prices. In this environment, price momentum drives buying, not fundamentals. We see that in the overlay of consumer sentiment about higher prices versus valuations. Simply, investors are willing to overpay on expectations that things will continue to improve.”

This shift from fundamentals to “belief-based investing” creates a market lubricated by emotion, especially in risk assets with no tangible earnings or cash flow drivers. In AI equities, some names traded on lofty price-to-sales ratios divorced from earnings prospects. In crypto, price discovery was often based on sentiment momentum rather than adoption metrics or utility. Even the spike in gold and silver prices did not reflect changes in industrial demand or monetary policy fundamentals, but the false narrative of a coming “currency collapse.”

These speculative narratives are classic hallmarks of a mania: the story, not the data, becomes the primary driver of price.

Leverage: The Hidden Engine of Mania

Of course, it is not just faulty speculative narratives that move markets. The narratives only motivate investor behavior, but for that behavior to have an impact, investors must have the capital to invest. Notably, as the narratives take hold, investors put their capital to work. However, as the narratives gain momentum, leverage accelerates those behaviors into extremes. As we noted recently:

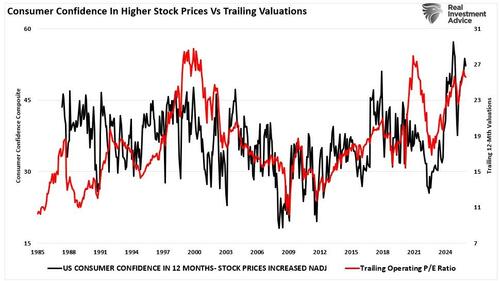

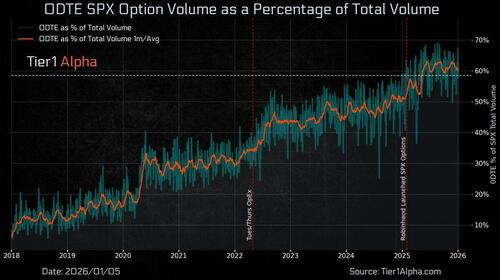

“However, this surge in allocations has also been accompanied by a massive expansion in leverage. Currently, margin debt as a percentage of real DPI has been reported at around 6.23 %, the highest on record. This ratio also suggests that for every $100 of real DPI, roughly $6 of margin debt is outstanding, a substantial amount. But that number doesn’t include the additional leverage taken on by investors through speculative option trading and 2x and 3x leveraged ETFs, which are also being bought on margin.”

However, it is crucial to remember that “margin debt is not a technical indicator… it represents the amount of speculation in the market.” When speculative narratives take hold, margin buying gives investors more purchasing power, driving prices higher, amplifying gains, and leading to further leverage. Unfortunately, the eventual and inevitable unwind also works in reverse, amplifying losses when prices decline.

But leverage did not stop at margin balances. Investors embraced:

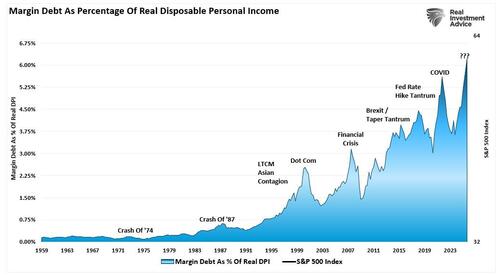

Ultra‑short dated options strategies that carry outsized leverage.

Leveraged ETFs offering 2x or 3x exposure to narrow segments of the market.

Futures and crypto margin accounts that magnified directional bets.

All these instruments enabled investors, particularly vastly inexperienced and unwitting retail traders, to assume exposures far beyond what cash capital would normally permit. The result was, and is always, an increasingly unstable structure in which valuations rose not because of business performance, but because leverage and sentiment chased headlines higher.

Unfortunately, in the end, fundamental and economic realities take hold, and speculative narratives fail to hold.

The Inevitable Reversal: When Narratives Don’t Hold

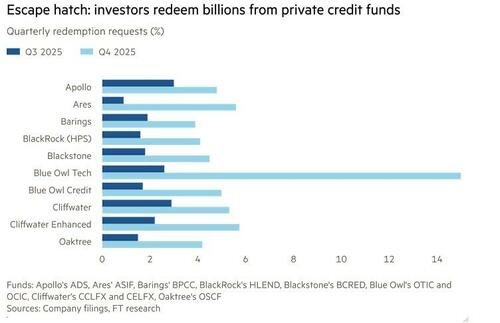

There is an old saying that “Markets don’t die of old age—they die of excess.” That statement doesn’t only apply to the stock market; it applies to every market, asset class, and investment. For example, over the last few years, there has been a mad rush by high-net-worth investors to enter private credit markets. As the assets under management for these funds rose, the managers increasingly invested in weaker deals, pushed credit risk limits, and overlooked fundamentals. As we warned last year, the redemptions of private credit are now accelerating as concerns over stability and illiquidity rise.

What triggered the reversal last week was not some dramatic policy shift, economic upheaval, or credit-related event, but a gradual shift in conditions that exposed the overextension. Softening economic signals, slowing earnings growth in tech sectors, and fading headline narratives removed the justification for trend extrapolation.

As we often discuss with our readers, when speculation is the driver, these reversals are a feature, not a bug, of the system.

What we saw last week started in Bitcoin, spread to precious metals, and then jumped into the equities market. As prices fall, margin calls force deleveraging, requiring liquidations to cover positions. Crucially, margin calls force the liquidation of positions regardless of investors’ desire to hold. That’s why downturns in highly leveraged markets tend to be sharp and fast.

“When lenders fear they may not recoup their credit lines, they force the borrower to sell assets to cover the debt … margin calls generally happen simultaneously, as falling asset prices impact all lenders at once.”

This sequence flips the entire narrative-driven rally. What was once perceived as a hedge or growth trend becomes a crowded trade that unwinds in chaos. Prices can and often do detach from valuation pressures as forced selling begets further selling.

The investor lesson is that speculative behavior always rewards the buyer on the way up, but punishes brutally on the way down.

The Real Lessons for Investors—Especially Younger Ones

What happened should wake up investors, but especially younger ones who have known only bull markets or narrative-driven rallies.

Narratives are not strategies.

Leverage is not risk management.

Volatility is not optional.

Valuation matters. Yes, markets move on liquidity and leverage in the short term, but in the long term, prices must align with earnings, cash flows, and economic reality. Investing based on stories of doom, disruption, or currency collapse, without a grounding in fundamentals, eventually leads to capital destruction.

Speculation disguised as investing is a losing proposition. Excessive trading, especially in leveraged instruments, turns portfolio management into a directional bet rather than a systematic allocation. When speculative bets in the markets via options, leveraged assets, and margin surge, that is a warning, not a reassurance.

For younger investors watching this unfold, there are several enduring principles:

Don’t confuse confidence with experience. High conviction during a rally is a natural byproduct. But that conviction often precedes drawdowns, particularly when leverage and risk tolerance are high.

Diversification is real only when exposures are uncorrelated. Owning Bitcoin, gold, and AI stocks doesn’t diversify if they all behave like leveraged growth bets driven by the same sentiment.

Manage risk first. Heavy allocation to speculative positions without defensive hedges is not investing—it’s gambling.

Leverage amplifies outcomes in both directions. You may win big for a time, but the downside can be catastrophic.

Accept corrections as necessary. Pullbacks purify excesses and restore market health. Markets that seem like they will never correct often suffer the worst crashes later, think dot‑com and housing bubbles.

The lure of quick gains is powerful. However, real wealth accumulates through disciplined risk management, valuation awareness, and systematic portfolio construction. If you are a younger investor, market speculation is a powerful drug when you are successful. However, if you can limit your urges and transition from short‑term performance chasing to a long‑term mindset that prioritizes capital preservation, your ability to accumulate and maintain vast wealth expands.

This isn’t bearishness for its own sake. It’s an empirical recognition that markets are cyclical and leverage is structural.

The most successful investors are those who prepare for both runs and reversals, not just the runs. Therefore, the next time you scoff at those not “chasing the latest speculative fad,” maybe ask yourself, “Why aren’t they chasing it?”

It might just save you from heartache.