ASML Shares Reverse Earlier Gains After Bookings Bonanza, Job Cuts

Update (0939ET): Aaaaaand, shares in ASML are now red to the tune of -1% despite the good news.

* * *

Shares in ASML, Europe's most valuable company which builds the 'printing presses' for modern microchips, exploded higher in Wednesday trade after Q4 orders blew past analyst estimates. The Dutch semiconductor company also announced job cuts to boost efficiency, and a share buyback of up to €12B by the end of 2028.

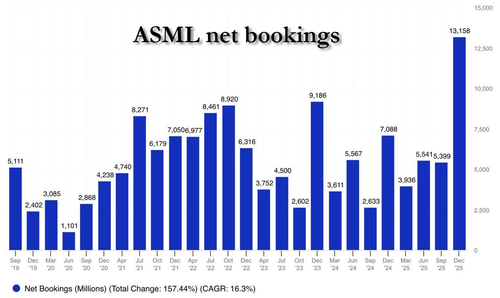

Fueled by demand for AI chips, bookings in the fourth quarter hit a record €13.2 billion ($15.8 billion), the Veldhoven, Netherlands-based company said in a Wednesday announcement reported by Bloomberg. Analysts estimated an average of €6.85 billion, according to the report. Sales were €9.72bln (exp. €6.95bln).

"In the last months, many of our customers have shared a notably more positive assessment of the medium-term market situation, primarily based on more robust expectations of the sustainability of AI-related demand. This is reflected in a marked step-up in their medium-term capacity plans and in our record order intake," the company said.

The company will cut around 1,700 jobs (around 4% of its workforce) - mostly in the Netherlands and some in the US, with the goal of streamlining the organization.

"The last three months have brought a lot of clarity" about what AI means for the semiconductor industry, CEO Christophe Fouquet told Bloomberg TV. "Our customers start to believe that this AI demand is sustainable, and therefore they are moving to building capacity, and they are moving very aggressively."

Shares in the company were up 6% to €1,291.20 in Amsterdam, pushing the stock beyond to YTD gains of 40%. Japanese suppliers also felt the love, with Lasertec Corp., Tokyo Electron Ltd. and Screen Holdings Co., benefiting from the success.

Overbought?

According to Bloomberg:

A key challenge for the sector is the stocks are already stretched from a technical perspective, limiting near-term upside. The 14-day Relative Strength Index for ASML, VAT, ASM International and BE Semiconductor were all above 70 at Tuesday’s close. And the stocks are all up by nearly 30% or more year-to-date.

At one point there will be debate about how much of the AI optimism is already reflected in price. Using ASML as an example, based on the most optimistic analyst earnings forecast for 2027, the stock is still trading at 27-times forward two-year earnings, above the 10-year average of 25 times.

Morningstar analyst Javier Correonero is advising investors to wait for a better entry point on the stock, as a lot of bullishness for this period and next year have already been priced in - making 'upside market movements more challenging.'

ASML makes lithography machines - tools used to etch microscopic circuit patterns onto silicon wafers during chip manufacturing. Without them, companies like TSMC, Intel, and Samsung couldn't make the most advanced chips used in AI accelerators, smartphones, GPUs, and defense systems.

Their crown jewel is Extreme Ultraviolet (EUV) lithography, which uses a 13.5nm wavelength light that allows them to print features only a few atoms wide, and enables the most advanced process nodes (7nm, 5nm, 3nm and beyond).

EUV machines require plasma-generated EUV light (created by blasting molten tin with lasers), mirrors polished to near-perfect atomic smoothness, vacuum systems (EUV is absorbed by air), and nanometer-precision alignment across thousands of components.

Each machine costs $150 - $200 million and weighs 180 tons.

As companies began pouring hundreds of billions of dollars into data centers, chipmakers have been driven to increase capacity - stoking demand for ASML's products.

Over half of last quarter's bookings were for EUV machines, totaling €7.4 billion, according to the company.

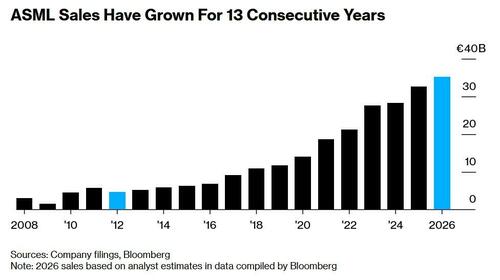

In 2025, net sales were €32.7 billion, while revenue is seen at between €34 billion and €39 billion, blowing past previous guidance.

"ASML has knocked it out of the park when it comes to order numbers," Ben Barringer, head of technology research at Quilter Cheviot, told Bloomberg. "Given the strength of the order book, we fully expect it to raise guidance throughout the year."

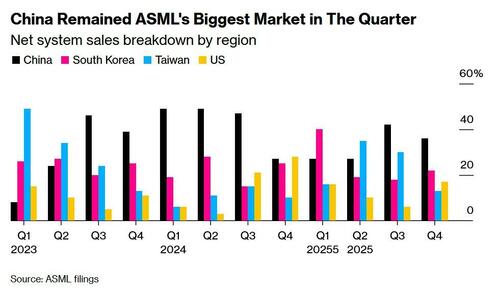

China was ASML's largest market in the fourth quarter - accounting for 36% of net system sales. That said, the Chinese market is expected to drop to around 20% of revs going forward, CFO Roger Dassen said in a call with reporters.

That said, China is restricted from buying the company's most advanced EUV machines, so ASML is selling them older-generation DUV (deep ultraviolet) systems that are roughly 8 generations behind the cutting edge, and are suitable for mature-node chips, not bleeding-edge AI chips (think cars, appliances, industrial equipment, etc.).