CBO Director Warns US Fiscal Path Is 'Not Sustainable' ; Projects Additional $1.4T Deficit Swell Under Trump Agenda

The Congressional Budget Office raised its 10-year deficit estimate by $1.4 trillion, citing Trump's 2025 reconciliation act, higher tariffs and lower immigration.

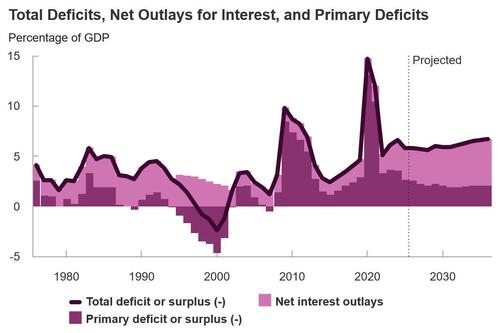

Annual deficits are projected to remain historically large, totaling $23.1 trillion from 2026 to 2035 and reaching 6.7% of GDP by 2036.

The 2025 tax law is the single largest driver, adding $4.7 trillion to deficits over the decade, partially offset by roughly $3 trillion in tariff revenue.

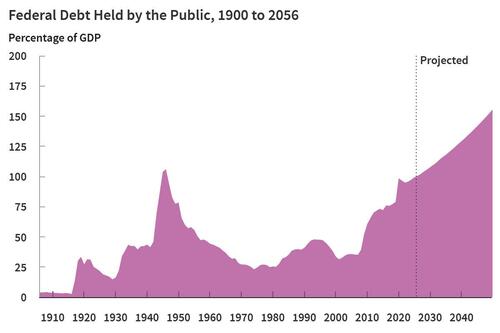

Federal debt held by the public is projected to rise to 120% of GDP by 2036, surpassing the post-World War II record by 2030.

Interest costs are expected to double over the next decade, climbing from $1 trillion in 2026 to $2.1 trillion in 2036 as debt and rates rise.

Economic growth is projected to strengthen in 2026 but slow to 1.8% thereafter, falling short of the administration’s 3% growth target despite productivity gains from artificial intelligence.

The federal government is barreling toward a decade of historically large budget deficits, according to a new report from the (arguably partisan) Congressional Budget Office (CBO), which said on Wednesday in a new report that recent tax and immigration policies have sharply worsened the long-term outlook.

The CBO increased its estimate of cumulative deficits for the 2026-35 period by $1.4 trillion, citing President Donald Trump’s 2025 tax law and the cost of stepped-up immigration enforcement. The agency now projects total deficits of $23.1 trillion over the decade, underscoring what it called an “unsustainable fiscal path.”

At the center of the revision is last summer’s tax package, which extended the 2017 tax cuts and added new breaks. The CBO estimates the law will increase deficits by $4.7 trillion over 10 years. Immigration enforcement actions are expected to add another $500 billion. Those costs, the agency said, will more than offset revenue gains from higher tariffs, even as import duties rise to levels not seen since the mid-20th century. The CBO estimates tariff revenue will reduce deficits by about $3 trillion over the period.

Since its last long-term outlook in January 2025, the agency said three developments have materially altered its baseline projections: enactment of the 2025 reconciliation act, a sharp rise in tariffs, and lower immigration. Together, those changes have pushed projected deficits for the coming decade $1.4 trillion higher, to a cumulative $23.1 trillion from 2026 through 2035.

“The budget projections continue to indicate that the fiscal trajectory is not sustainable,” CBO Director Phillip Swagel said in prepared remarks accompanying the report.

For fiscal 2026, the deficit is projected at $1.9 trillion, or 5.8% of gross domestic product, roughly unchanged as a share of the economy from 2025. By 2036, the annual deficit is expected to widen to $3.1 trillion, or 6.7% of GDP - levels the agency described as “historically unusual,” particularly with unemployment projected to remain below 5%.

The latest outlook reflects the effects of President Donald Trump’s 2025 tax law, which extended the 2017 tax cuts and added new provisions. The CBO estimates the reconciliation act will raise deficits by $4.7 trillion over the 2026–35 period, once higher debt-service costs and macroeconomic effects are included. Higher tariffs are projected to reduce deficits by about $3 trillion, while lower immigration adds roughly $500 billion.

Revenues are projected to remain broadly stable as a share of the economy, rising modestly from 17.5% of GDP in 2026 to 17.8% in 2036. Outlays, however, are expected to climb from 23.3% to 24.4% of GDP as spending on Social Security, Medicare and interest costs grows faster than economic output.

Debt held by the public is projected to rise from 99% of GDP at the end of 2025 to 120% by 2036. Under current law, the CBO expects debt to surpass the previous postwar record of 106% of GDP—set in 1946—by 2030. Over a 30-year horizon, debt climbs to an estimated 175% of GDP. The Social Security Old-Age and Survivors Insurance Trust Fund is now projected to be exhausted in 2032, a year earlier than previously forecast.

Rising debt feeds directly into higher interest costs. Net interest outlays are projected to double over the next decade, increasing from $1 trillion in 2026 to $2.1 trillion in 2036 and rising from 3.3% to 4.6% of GDP.

Those projections undercut the administration’s stated goal of reducing the deficit toward 3% of GDP by the end of Mr. Trump’s term, a target repeatedly cited by Treasury Secretary Scott Bessent. The CBO now expects deficits of 5.8% of GDP in 2026 and about 6% in 2028.

On the economic front, the agency projects stronger real GDP growth in 2026, as the pro-growth elements of the tax law outweigh the drag from tariffs and reduced immigration. Growth is then expected to slow to 1.8% from 2027 onward, reflecting offsetting forces: stronger incentives to work and invest on one hand, and larger deficits and slower labor-force growth on the other.

The outlook also incorporates a modest boost from generative artificial intelligence, which the CBO estimates will add roughly 10 basis points a year to productivity growth, raising nonfarm business output by about 1% by 2036.

Even so, the growth dividend is not enough to materially improve the fiscal picture. While stronger growth lifts revenues, it also pushes up interest rates, and the latter effect dominates. “That result highlights how the nation’s large stock of debt influences the way that changes in the economy stemming from legislation affect the federal budget,” Mr. Swagel said.

The forecast also assumes the Federal Reserve cuts its benchmark rate by 25 basis points in 2026, with the yield on 10-year Treasury bonds rising gradually to about 4.3% by late 2027 and then stabilizing. Upward pressure from growing federal debt is expected to be offset by slower labor-force growth.

Federal Reserve Chair Jerome Powell has echoed the CBO’s warning in recent remarks, saying that while today’s debt level is manageable, the long-term path is not. “We’re running a very large deficit at essentially full employment,” Mr. Powell said last month. “The fiscal picture needs to be addressed - and it’s not really being addressed.”

On the other hand...

Perhaps CBO is just talking shit because they're #resistance?

According to some economists, CBO might be understating the deficit-reducing potential of tariffs by assuming sharper declines in import volumes than recent experience suggests. Economist Andrew Rechenberg and analyses by the Coalition for a Prosperous America point to tariff revenues collected since 2018 that remained resilient even as trade patterns shifted. In many cases, imports were rerouted through alternative supply chains rather than eliminated, while demand proved more inelastic than expected in categories such as intermediate goods and energy inputs. Under those conditions, sustained tariff enforcement - particularly with limited exemptions - could generate revenues above baseline projections.

Other analysts contend that the CBO’s long-term outlook may be overly cautious in its assessment of how tax certainty and trade policy interact with domestic investment. Permanent tax provisions and trade barriers that favor domestic production, they argue, can reinforce incentives for reshoring and capital formation in ways that are difficult to fully capture in baseline projections. Former CBO Director Douglas Elmendorf has previously acknowledged that long-run investment and productivity responses to permanent policy changes are inherently uncertain and may unfold gradually, suggesting that modest but persistent gains in domestic output could meaningfully improve fiscal outcomes over time.

Meanwhile, some economists question whether higher projected deficits will translate as directly into rising interest costs as the CBO assumes. They point to continued global demand for U.S. Treasurys, demographic forces that suppress real interest rates, and the dollar’s role as the world’s primary reserve currency as factors that weaken the link between debt levels and borrowing costs. From this perspective, fiscal sustainability is less about historical deficit benchmarks and more about market tolerance - specifically whether rising debt triggers inflation expectations or capital flight - conditions that, thus far, have not materialized.