Jobs Data From Alternative Sources May Drive Feds Next Move

Authored by Lance Roberts via Real Investment Advice,

With the federal government shutdown delaying critical economic reports, the official jobs data remains incomplete. Last week, the Bureau of Labor Statistics (BLS) released the September jobs report. However, the October report, originally expected earlier this month, remains in limbo, potentially permanently. The reason is due to the shutdown, as the BLS was unable to conduct the household survey. As such, the Fed will have to rely on alternative data for perspective on the strength or weakness of the labor market.

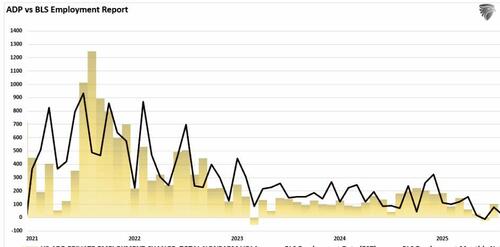

Therefore, in the absence of official jobs data, private-sector reports have become the best available gauge of labor market conditions. For example, the most recent ADP report showed only 42,000 private-sector jobs added in October. Crucially, it isn’t the “monthly number” that is crucial to consider, but the trend of the data. While there are undoubtedly many hopes for a resurgence of economic activity in 2026, the trend of employment data certainly doesn’t suggest that will be the case. At least not at the moment.

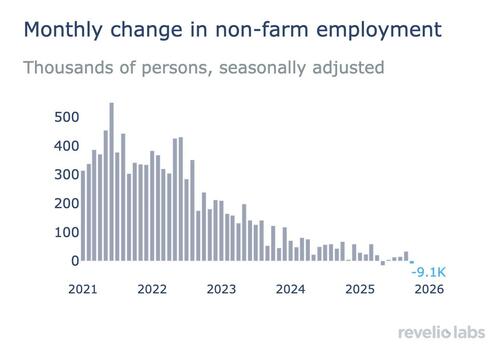

Another “real-time” source of jobs data is from Revelio Labs, which monitors job trends through company records and employee profiles. The most recent report from Revelio estimates a net decline of more than 9,000 jobs.

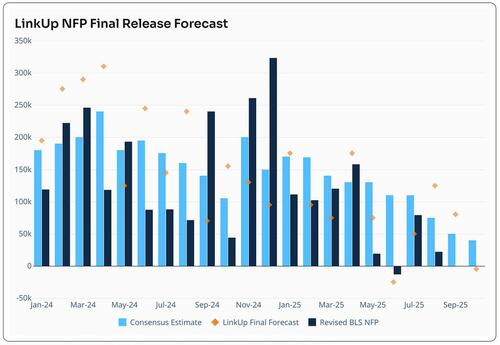

LinkUp, which tracks job listings, also reported a loss of 5,000 jobs in October.

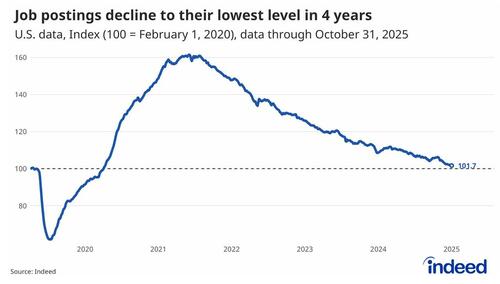

While that data is certainly concerning on its own, according to the job posting site Indeed, the number of jobs being posted is also rolling over, with listings now back to 2021 levels, and year-over-year declines in postings in almost every sector they track.

While the BLS employment report is heavily flawed, it remains the standard by which the markets and the Fed act. However, the alternative shows that the slowdown in employment is widespread and not just a function of the Government shutdown. There is evidence of both job losses and a retraction of job openings across the entire economy. This includes logistics to healthcare, retail, and professional services. The hiring freezes are not isolated events, but reflect a structural shift in demand.

None of this indicates a labor collapse. But the shift in momentum is significant, and job creation is stalling with openings shrinking and layoffs rising. This slowdown often precedes broader economic weakness, suggesting that the Federal Reserve’s next monetary policy moves may be more focused on job creation than on concerns about inflation.

The Fed Must Weigh Jobs Data Against Inflation Risks

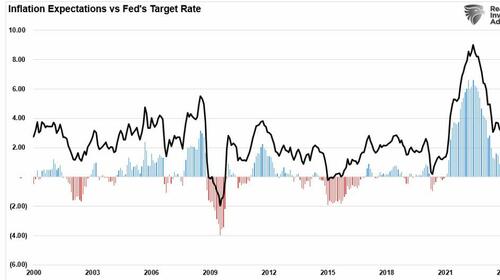

The Fed’s dual mandate, which is to achieve full employment and price stability, puts it in a difficult position right now. As noted above, there is clear evidence that economic weakness is increasing, with jobs data showing signs of weakening. On the other hand, inflation remains elevated, particularly in the services sector, with inflation expectations still above the Fed’s target.

For example, Fed Chair Jerome H. Powell recently said:

“In the near term, risks to inflation are tilted to the upside and risks to employment to the downside—a challenging situation…we remain committed to supporting maximum employment, bringing inflation sustainably to our 2 percent goal.”

At this juncture, the Fed must carefully assess the risks of its next policy moves. While softening jobs data suggests the employment objective is under threat, cutting rates and increasing monetary accommodation may spark a resurgence of inflation. However, if inflation remains high, the price-stability objective is under pressure; but higher inflation slows economic activity and employment. As President Mary C. Daly recently put it:

“At this point … the risks to the inflation side of our mandate and the risk to the employment side of our mandate are in better balance. And so, we have to be thoughtful about not loosening too early, but we have to be thoughtful about not holding too long.”

The Fed will likely place greater emphasis on alternative job data, wage trends, and inflation indicators in its next policy steps. Suppose these alternative signals continue to indicate a softening job market without wage inflation escalating. In that case, the Fed’s bias will likely tilt toward easing policy to prevent a sharper economic slowdown.

Looking back, the Fed has confronted similar scenarios when job growth weakened while inflation remained above target. In the minutes of a prior meeting, the Fed noted:

“A number of participants noted … although the labor market remained strong, … there was some risk that further cooling in labor market conditions could be associated with an increased pace of layoffs.”

In a more recent context, Powell said at the March 2025 Monetary Policy Forum:

“If the labor market were to weaken unexpectedly or inflation were to fall more quickly than anticipated, we can ease policy accordingly.”

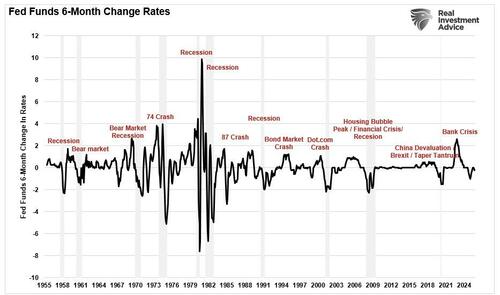

That statement highlighted conditionality—policy is not on a preset course but rather depends on the data. However, it is a balancing act between cutting too much and not enough. Unfortunately, the Fed has a long history of doing both at the wrong times.

The problem for the Fed, as noted above, is that two mandates of full employment and price stability work against one another. To achieve full employment, prices will rise as economic activity increases. To reduce inflation, economic activity must slow, which in turn leads to fewer jobs being created. This is why the Fed consistently gets itself trapped in providing increasing or reducing accommodation to solve one problem, but creates a problem with the other.

What the Fed Will Likely Do Next

The Federal Reserve is staring at a familiar dilemma with the jobs data cooling and inflation remaining above target. Furthermore, it appears, at least outside the stock market, that traditional policy tools are becoming less effective in their impact.

We expect that over the coming months, the Fed will likely continue easing monetary policy at a cautious pace while reassuring the markets that it is remaining “data-driven.” The reality is that they are cutting policy in the hopes of stimulating economic growth, which could spark an inflationary uptick. However, with the risks of a deflationary impact from the onset of AI, demographic trends, and rising non-productive debt levels, the Fed continues to “push on a string.” While the October rate cut was a clear sign that officials are willing to respond to weakening economic conditions, the bar for navigating the current environment without a policy misstep remains exceptionally high.

However, we expect that the most likely path forward includes:

- Cut rates in December, unless inflation readings rise meaningfully.

- A return of focus to the BLS Employment reports

- Consider a second 25 bps cut in early 2026 if wage growth continues to decelerate, quits remain low, and layoffs continue to rise.

- Avoid aggressive rate cuts unless recession risks rise sharply. As Fed Chair Powell emphasized, the Fed won’t act prematurely: “We have to be careful not to move too soon or too late.”

- Continue to balance downside risks with increased attention to credit conditions, consumer delinquencies, and business investment data.

The Fed will avoid rushing into a complete easing cycle unless both components of its mandate, employment and inflation, clearly support that move. Right now, the labor market is flashing yellow, but not red. Inflation is sticky, but no longer accelerating; therefore, we expect the Fed’s policy approach to reflect this.

How Investors Should Prepare

Investors should expect volatility. With conflicting economic signals, markets are vulnerable to sharp swings in response to Federal Reserve comments, inflation reports, and any new labor market indications. The path forward is not linear.

Here’s what to watch for and how to position:

- Watch yield curves: If short-term yields fall further while long-term yields stabilize, the bond market is pricing in slower growth with softer inflation. This benefits duration-sensitive assets.

- Favor high-quality fixed income: Slower job growth and lower inflation expectations improve the risk/reward profile of investment-grade credit and Treasuries.

- Avoid chasing speculative assets: If the Fed remains cautious, liquidity conditions will stay tight. High-beta equities, unprofitable tech companies, and cryptocurrencies remain vulnerable.

- Look for relative value in defensive sectors: Healthcare, consumer staples, and utilities offer protection if economic weakness deepens.

- Stay flexible on equity allocation: Earnings forecasts may still be too optimistic. Slower jobs data often precedes revenue and margin pressure. Valuations remain elevated in many areas.

- Watch small-business indicators: Job postings, wage plans, and hiring intentions in the NFIB and other surveys will be critical signals of broader labor market trends.

More broadly, investors should prepare for a period where monetary policy lacks a clear anchor. With a Fed that’s hesitant to act too aggressively, markets will likely overreact to soft guidance, regional inflation trends, and real-time labor indicators.

The economy is not falling off a cliff, but the momentum is clearly weakening, and the job market’s directional change is real. That weakness also suggests that inflation is no longer the problem. For the first time in nearly two years, the Fed’s focus is shifting, slowly, from restraining prices to protecting employment. Unfortunately, at least from a historical view, they have not managed such a shift without negative consequences.

While “this time could be different,” I wouldn’t make aggressive bets on that outcome.