Run It Hot: Trump, The Fed, & The Coming Currency Debasement

Authored by Nick Giambruno via InternationalMan.com,

The Trump administration has made no secret of its desire to push the monetary easing pedal to the metal, even as the engine is already near the red line. They intend to push the system as hard as possible today and worry about the consequences later. One reason may be to inflate the stock market ahead of the 2026 midterm elections.

There are several indicators that the Trump administration intends to run it hot in 2026.

The first — and most important — is that Trump will likely succeed in consolidating control over the Federal Reserve.

Jerome Powell’s term as Chair of the Federal Reserve is scheduled to expire in May 2026, allowing Trump to appoint his replacement. Powell attempted — largely unsuccessfully — to resist Trump’s pressure for easier monetary conditions.

I expect Trump will get his way with the Fed in 2026, and that the central bank will bend to his demands. By replacing Powell, Trump will further stack the Fed with loyalists. The result will be money printing on a scale we’ve never seen before.

Further, Stephen Miran — another of Trump’s recent successful nominees to the Federal Reserve Board — has been pushing the idea of what he calls the Fed’s “third mandate.”

Traditionally, the Fed has two mandates: price stability and maximum employment. Miran’s proposed third mandate would be for the Fed to “moderate long-term interest rates.”

What that really means is that the Fed would openly finance the federal government by creating new dollars to buy long-term debt, keeping yields artificially low. In other words, the so-called third mandate is an explicit admission that the Fed is no longer independent. It would become a political tool used to fund government spending.

Without this support, massive federal spending would flood the market with Treasuries, pushing interest rates much higher. But with the Fed stepping in, Washington can keep borrowing while holding rates down — at least for a while. The catch is that this comes at the cost of debasing the dollar. Eventually, that debasement will force investors to demand higher yields anyway, only worsening the problem.

Remember, after Nixon severed the dollar’s last link to gold in 1971, the unspoken promise was that Washington would act as a responsible steward of its fiat currency. Central to that promise was the illusion that the Federal Reserve would remain independent of political pressure.

The idea was simple: without at least the appearance of independence, investors would see the Fed for what it is — a funding arm for spendthrift politicians — and confidence in the dollar would collapse.

That illusion is now shattering.

Let’s be clear: central banks were never truly independent. That’s why it was always an illusion — a societal myth. They exist to siphon wealth from the public through inflation and funnel it to the politically connected. The Fed’s independence was always a mirage — and now it’s disappearing fast.

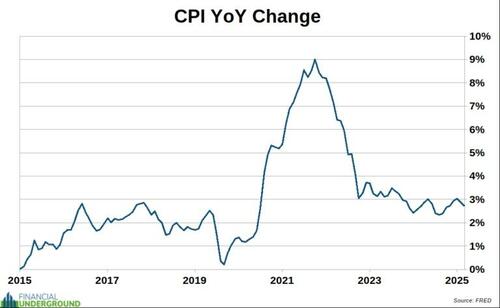

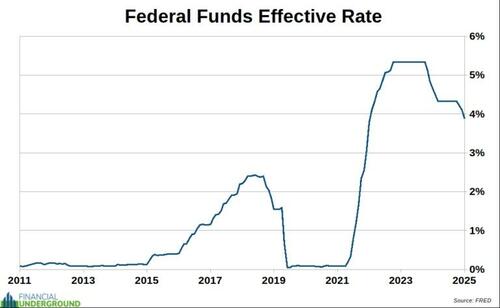

Further, late last year, the Fed embarked on a new interest rate cutting cycle, even though, according to their own rigged CPI metrics, prices are rising at 2.7%, well above their 2% target.

The Fed has already cut rates by around 50 basis points in 2025 and signaled that more rate cuts are coming in 2026.

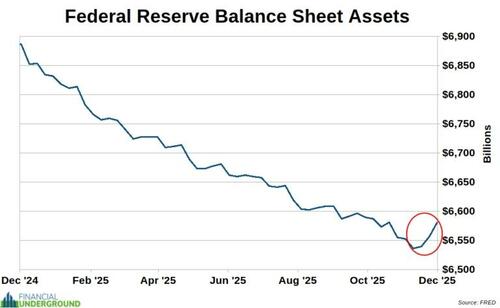

The Fed recently announced that it has ended the shrinking of its balance sheet and will now begin expanding it again, starting with the purchase of $40 billion in Treasuries in December.

The Fed insists this isn’t quantitative easing, calling it “reserve management” and pointing out that it isn’t explicitly targeting long-term Treasuries. That’s just wordplay. Buying Treasuries with newly created money is money printing, regardless of what label they attach to it. The Fed’s balance sheet is expanding again. A new printing cycle has begun.

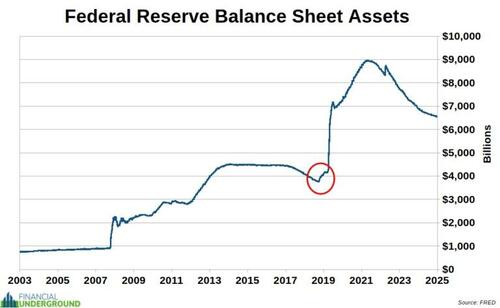

We’ve seen this pattern repeatedly. The Fed expands its balance sheet, then tries to shrink it. Something eventually breaks in the financial system, and the Fed pivots right back to easing and money creation. Each time this happens, the balance sheet never returns to its prior level. It ratchets permanently higher with every cycle of debasement.

What makes the current situation especially telling is that the Fed is entering another balance-sheet expansion phase even though the balance sheet is still more than 50% larger than it was before the Covid mass psychosis. Before 2020, the Fed’s balance sheet was roughly $4 trillion. It exploded to nearly $9 trillion during the Covid response. Even after so-called “quantitative tightening,” it remains around $6.5 trillion — nowhere near its pre-Covid level.

This completely contradicts the Fed’s long-standing claim that programs like QE are temporary.

Remember when former Fed Chair Ben Bernanke promised the balance sheet would eventually normalize after the 2008 financial crisis? That promise was made nearly 15 years ago, when the Fed’s balance sheet was around $2.5 trillion and was supposed to shrink back toward pre-crisis levels below $1 trillion. Instead, today the balance sheet is more than double what it was when Bernanke made that pledge — and now the Fed is entering yet another expansion cycle that threatens to push it even higher.

The long-term trend is obvious. The balance sheet only goes one direction: up. And the implication is unavoidable. Every time the Fed expands its balance sheet, it debases the currency. This isn’t an accident or a temporary policy error — it’s the core feature of the system.

If you’re wondering what comes next, look at the red circle on the chart below—and note what followed the last time the Fed shifted from shrinking its balance sheet to expanding it.

We are now in the top of the first inning of what may become the most aggressive balance sheet expansion cycle in the Fed’s history.

So let’s put it all together.

The midterms are coming in 2026, and Trump wants to boost the stock market.

Trump will get to replace Fed Chair Powell with a loyalist, consolidating control over the central bank.

The Fed has embarked on a new rate-cutting cycle, despite inflation still running well above its stated targets.

The Fed has ended the shrinking of its balance sheet and has begun expanding it again, buying tens of billions of dollars’ worth of Treasuries each month.

All signs point to a continued nominal melt-up in the stock market in 2026 — and ever-accelerating currency debasement.

The trajectory is clear. When monetary policy becomes a political tool and money printing turns permanent, the risks aren’t abstract — they’re personal. Currency debasement doesn’t just distort markets; it quietly erodes savings, purchasing power, and individual freedom.

The real question isn’t whether this process continues — it’s how prepared you are when it accelerates.

That’s why I’ve put together a free PDF report: The Most Dangerous Economic Crisis in 100 Years… the Top 3 Strategies You Need Right Now. Inside, you’ll learn: How the economic, political, and cultural forces now in motion are converging into a single systemic crisis, what the coming risks really mean for your money, your security, and your personal freedom, and the three concrete strategies you can use right now to position yourself ahead of what’s coming. This isn’t about fear. It’s about clarity — and taking action before the consequences become unavoidable. Click here to download the free PDF report and get prepared while you still can.