China's Central Bank Keeps Buying Gold... And Dumping US Debt

Authored by Andrew Moran via The Epoch Times,

China’s ferocious appetite for gold is influencing the global metals market, and that demand is what will keep driving up metal prices, according to Michael Howell, founder of CrossBorder Capital.

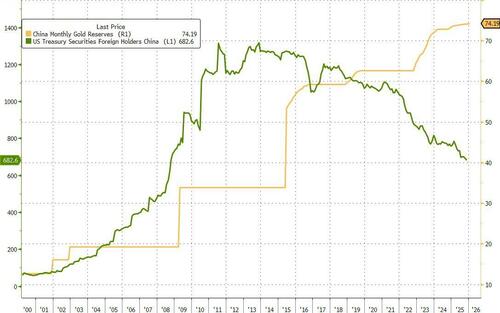

The People’s Bank of China’s gold holdings totaled 74.19 million fine troy ounces by the end of January, up from 74.15 million in the previous month, according to recent central bank data.

Beijing’s value of gold reserves also surged to $369.58 billion, from $319.45 billion in December 2025.

Gold accounts for almost 9 percent of China’s total reserves, the World Gold Council estimates.

The metals market has been on a roller coaster ride over the past few months.

Gold prices are currently trading at about $5,000 per ounce—up by 17 percent this year—on the COMEX division of the New York Mercantile Exchange.

Silver, the sister commodity to gold, is hovering at about $80 per ounce. The white metal has fallen sharply since reaching an all-time high of $121.

The commodities boom will continue, with a focus on oil and gold, Howell said in a recent interview with Siyamak Khorrami, host of EpochTV’s “California Insider.”

Global financial markets are experiencing a commodities boom, particularly in industrials, which coincides with the buildout of artificial intelligence infrastructure. At the same time, Howell said, energy is also witnessing a dramatic increase.

“Stronger economic activity worldwide will elevate oil prices from their current subdued levels,” he said. “Gold has had a tremendous rally over the last 18 months. It’s defied most predictions, but it continues to go up.”

China is playing an outsized role in its meteoric ascent.

Although retail traders are fueling sizable inflows into gold investments, China has been on a gold-buying spree for years as part of the country’s de-dollarization efforts.

For more than a decade, Beijing has been diversifying its foreign exchange reserves to reduce its exposure to the U.S. dollar and American assets, particularly Treasury securities.

In October, China’s holdings of U.S. debt fell to $688.7 billion, down by nearly 10 percent from the previous year, according to Treasury Department data.

Reports have surfaced that Chinese regulators have advised banks to trim their holdings of U.S. government bonds because of market volatility. Whether this shows up in the data over the coming months could further cement China’s long-term plans to ditch the dollar and remain in gold.

Influential Force in Gold Markets

As China remains one of the world’s largest buyers, it will also maintain an immense influence in global gold markets, according to Howell.

“The reason gold is going up is because of what’s happening in China,” he said.

It is no secret that China has largely shaped the global metals market through physical demand, whether through industrial consumption or retail use.

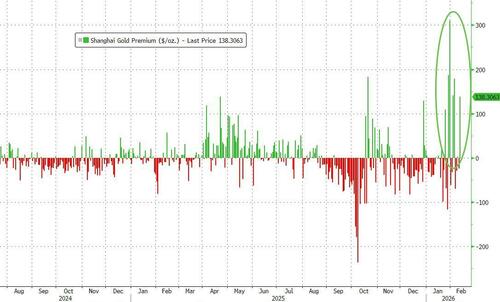

But recent activity on the Shanghai Futures Exchange indicates that Beijing is also influencing prices, said Ewa Manthey, commodities strategist at ING.

“Rising turnover and open interest signal a greater role for speculative positioning in driving momentum, and notably, key price breaks in gold and silver have increasingly occurred during Asian hours, with Europe and the US following rather than leading,” Manthey said in a Feb. 6 research note.

Domestic investors are increasingly turning to commodity futures to express macro views and hedge risks, as property markets are weak, equities are uneven, and capital outflows face tighter controls, according to Manthey.

In this environment of economic and geopolitical uncertainty, metals—across the base and precious spectrum—have become a more prominent alternative investment channel.

Gold trading at a premium in China sends various signals to global markets, mainly the sign that domestic stockpiling is underway. This, Manthey said, sends the message that supplies are tightening and worldwide availability could be tightening.

Although fundamentals trump short-term speculative forces in precious metals, influential noise can trigger greater volatility and abrupt, sharper price corrections.

The Great Debasement

One long-term factor supporting the bullish case for gold is money printing.

Over the years, China has frequently engaged in monetary debasement through aggressive stimulus programs.

Howell estimates that officials have injected more than $1 trillion in liquidity into the financial system to prop up the world’s second-largest economy amid diminished household demand, trade strife, and slowing factory activity. At the same time, China is grappling with enormous debt.

“China’s probably got the biggest problem of the lot, because it’s still sitting on that huge real estate debt which has been saddling the economy,” Howell said.

Although Evergrande and Country Garden have not captured international attention lately, the fallout of China’s real estate bubble burst persists, featuring a mountain of red ink.

Today, China’s general government debt accounts for more than 100 percent of gross domestic product, reflecting the years-long dependence on credit-fueled growth.

The only solution for the authorities to prevent a debt-fueled crisis is to print money, according to Howell. Although defaults are one strategy, they would inevitably destroy the credit system.

“So what happens is central banks come in, and they print money, and that is the solution to every financial crisis you can think of going backwards, and that will be the solution to future financial crises,” Howell said.

“Given the fact that the debt levels are rising remorselessly year after year after year, politicians are kicking the can down the road,” he said. “They’ve got no appetite to control spending, and they just think the easy way out is either take on more debt or print money.”

At a time when assets have become the go-to investment for institutional investors and armchair traders, one of the most important strategies is to refrain from selling gold.

“You don’t want to be selling gold right now,” he said. “Strategically, you’ve got to hold gold.”

Good as Gold

In 10 years, gold could reach $10,000 per ounce, according to Howell—and he is not the only one presenting a bullish prognostication.

Yardeni Research forecasts $10,000 by the end of the decade.

“This is all happening because rising geopolitical tensions are driving a military arms race, and defense companies need metals to increase their output,” Yardeni Research said in a Jan. 25 research note.

“Also boosting metals prices is the geopolitical AI arms race, which is escalating capital spending on technology.”

Meanwhile, “deep currents” are supporting gold’s rally, such as U.S. deficit spending and central bank buying, said David Miller, senior portfolio manager at Catalyst Funds.

“These are very powerful forces and will likely drive gold significantly higher over the next three, five, or even [10] years,” Miller said in a note emailed to The Epoch Times.