'Out Of Stock': As Lunar New Year Looms, AsiaPac Dip-Buyers Emerge In Gold

"I came to buy because the price of gold dropped today," said Ng Beng Choo, a 70-something retiree who arrived early in the morning at the headquarters of Singapore's United Overseas Bank (UOB), the city-state's only bank offering physical gold products to retail investors.

Bloomberg reports that clients and walk-in buyers crowded into a dedicated lounge for bullion transactions.

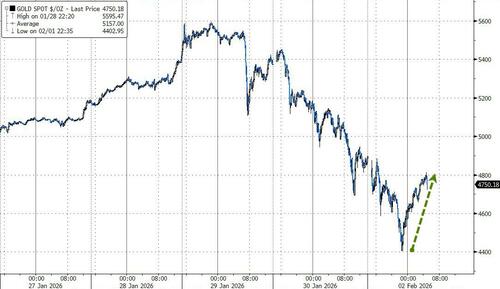

Overnight, after an initial puke (catch-down) in precious metals, gold prices are bouncing back, as it appears retail investors are 'buying the dip' across AsiaPac.

The extent to which Asian investors buy the dips will play a key role in determining the direction of the market from here.

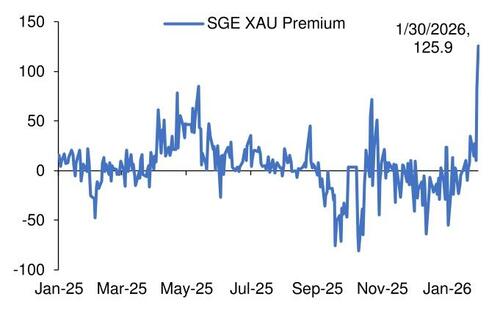

While the Shanghai benchmark price extended losses after the market opened, it was still trading at a premium over the international price.

Over the weekend, buyers flocked to the country’s biggest bullion marketplace in Shenzhen to stock up on gold jewelry and bars ahead of the Chinese New Year.

“The combination of heightened volatility and the proximity of the Lunar New Year will prompt traders to trim positions and reduce risk,” said Zijie Wu, an analyst at Jinrui Futures Co.

At the same time - particularly in peak buying season - the pullback in prices is likely to support retail demand in China, he said.

Rather than seek to sell, many retail investors appeared to be trying to buy the dip in gold, which fell to near $4,400 an ounce on Monday after Friday's seemingly more technical (ands spectacular) liquidation.

“In my career it’s definitely the wildest that I have seen,” said Dominik Sperzel, the head of trading at Heraeus Precious Metals, a leading bullion refiner.

“Parabolic,” “frenzied” and “untradeable” were all descriptions of the market on Friday, wrote Nicky Shiels, head of metals strategy at MKS PAMP SA.

January 2026, she said, would go down as “the most volatile month in precious metals history.”

But, "fundamental changes played only a minor role in the recent developments,” said Dominik Sperzel, head of trading at Heraeus Precious Metals.

In silver, “limited market liquidity and high leverage significantly amplified the downward momentum,” he said.

“The bottom line is that the trade was way too crowded,” said Robert Gottlieb, a former precious metals trader at JPMorgan Chase & Co. and now an independent market commentator, adding that a reluctance to take further risks would constrain market liquidity.

Bloomberg also reports that in central Sydney, a queue of people snaked out into the street from an ABC Bullion outlet near Martin Place.

“I lost a lot of money” on Friday, but “tomorrow’s a new day,” said Alex, a man in his 20s who was lined up outside the Sydney store to buy bullion, declining to give his full name.

In Thailand, where gold bars and jewelry are popular, people keep their holdings rather than selling off, Thanapisal Koohapremkit, Chief Executive Officer at Thai brokerage Globlex Securities Co. said.

“It’s still a buying trend in here in Thailand,” said Kuhapremkit.

“ They’re holding the old position and then just hold and see.”

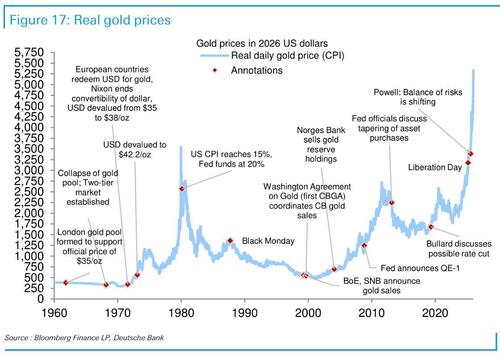

Retail buyers may be betting that the main drivers of gold’s ascent - an increasingly unpredictable Trump and the debasement trade where investors avoid currencies and sovereign bonds - are still intact.

That optimism was shared by Michael Hsueh, an analyst at Deutsche Bank AG,, which said in a note on Monday it was sticking with its forecast for gold to get to $6,000 an ounce.

(1) We argue that the adjustment in precious metal prices overshot the significance of its ostensible catalysts. Moreover, investor intentions in precious (official, institutional, individual) have not likely changed for the worse as of yet.

(2) Gold's thematic drivers remain positive and we believe investors' rationale for gold (and precious) allocations will not have changed. The conditions do not appear primed for a sustained reversal in gold prices, and we draw some contrasts between today's circumstance and the context for gold's weakness in the 1980s and 2013.

(3) We see signs that China has been a prominent driver of precious metal investment flows. Thus, the rise in SGE premiums late last week is an important sign of amplified buying interest in gold. Together these suggest the rationale for a positive outlook has not changed from that described last week (see chart above)

Finally, returning to where we started, Bloomberg reports that at UOB, many customers who hadn’t pre-ordered were disappointed.

All products from MKS PAMP SA, one of the world’s most recognized bullion brands, were sold out, while people who arrived late were out of luck.

“Due to overwhelming response, the buy queue tickets have all been fully issued for the day,” according to notices posted around the UOB headquarters. “Your patience is appreciated.”