Apple Prioritizes Premium iPhone Rollout As 'Great Memory Crunch' Tightens Global Supply

We have repeatedly warned about the "Great Memory Crunch," driven by AI data center buildouts absorbing a growing share of global memory supply, and industry insiders now telling consumers and enterprises (read here) should accelerate purchases of electronics that use high-bandwidth memory before prices accelerate further, as supply shortages are expected through 2027.

One key signal that the memory shortage is worsening is that Apple, one of the world's most valuable companies, is having to prioritize the production and shipment of its three most premium new iPhone models due to the memory crunch, according to a new report by Nikkei Asia.

Not even Apple can mitigate the threat of the HBM shortage.

Here's more from the report based on industry insiders:

The U.S. tech giant will focus on delivering its first-ever foldable iPhone as well as two non-folding models with higher-end cameras and larger displays for its flagship launch in the second half of the year, said four people with knowledge of the matter. The standard iPhone 18 model will be scheduled for shipment in the first half of 2027, they said.

The move is intended to optimize resources and maximize revenue and profits from premium models amid surging prices for memory chips and other materials, multiple sources told Nikkei Asia. It is also critical for Apple to minimize any potential production hiccups while mass producing its first-ever foldable iPhone, which requires more complicated industrial techniques and new materials that could require more time to reach required levels of production quality, according to the people.

Choosing to focus on premium models in the second half of this year and targeting sales for its relatively standard models in the first half of 2027 could help the company better manage supply chain resources and develop a better and clear marketing strategy, one of the people said.

. . .

Apple has at least five new iPhone models in the pipeline: a revamped iPhone Air, its thinnest-ever model; the standard new iPhone; and three premium models. It is not yet clear when shipments of the Air will start, but they are not expected this year.

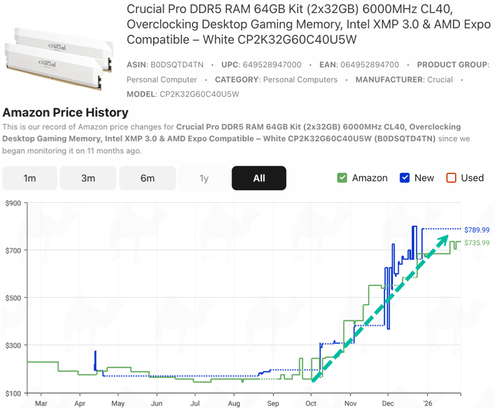

To visualize the HBM memory crunch, Amazon price-tracking website CamelCamelCamel shows a parabolic surge in the price of Crucial Pro DDR5 64GB RAM, rising from $145 to $790 in just six months.

More than one month ago, we cited Goldman analyst Maho Kamiya, who told clients that concerns about rising memory prices and the absence of top-down tailwinds had sent Nintendo shares spiraling.

TrendForce expects 70% of HBM chips produced this year will be consumed by data centers.

The list of memory-crunch victims has continued to grow.

Last week, we noted that smartphones, PCs, and other consumer electronics dependent on HBM were set to come under pressure. Goldman then followed with another note, warning that it had slashed global PC shipment forecasts due to soaring memory prices. That list continues to expand:

In addition to the Nikkei Asia report, Apple CEO Tim Cook told investors during an earnings call this past week that "We do continue to see market pricing for memory increasing significantly. As always, we’ll look at a range of options to deal with that."

If even one of the world’s largest and most powerful companies is struggling to secure enough memory supply, the warning signs are flashing red: the Great Memory Crunch is rapidly accelerating and could impact product availability, while sending prices for popular electronics soaring.