Goldman's First Take On Safety Monitor-Free Robotaxis In Austin

On Monday, Goldman analyst Mark Delaney highlighted comments from Elon Musk and key Tesla executives touting robotaxi operations in Austin, Texas, with no safety monitors.

Testing is underway with no occupants in the car

— Elon Musk (@elonmusk) December 14, 2025

"We believe that removing the monitor for testing shows that Tesla is making progress with its autonomous technology," Delaney told clients.

The analysts provided more color on what this development means for scaling driverless operations:

We think the key focus from here will be how fast Tesla can scale driverless operations (including if Tesla's approach to software/hardware allows it to scale significantly faster than competitors, as the company has argued), and on profitability. As we have previously written, we believe how fast Tesla can scale its operating design domain or ODD (e.g. service area and the weather it works in) from a technical capability standpoint will be particularly important, and we think vehicle cost is a somewhat less important variable for profitability, given the potential ability for AV operators to amortize vehicle costs over many miles in a commercial business.

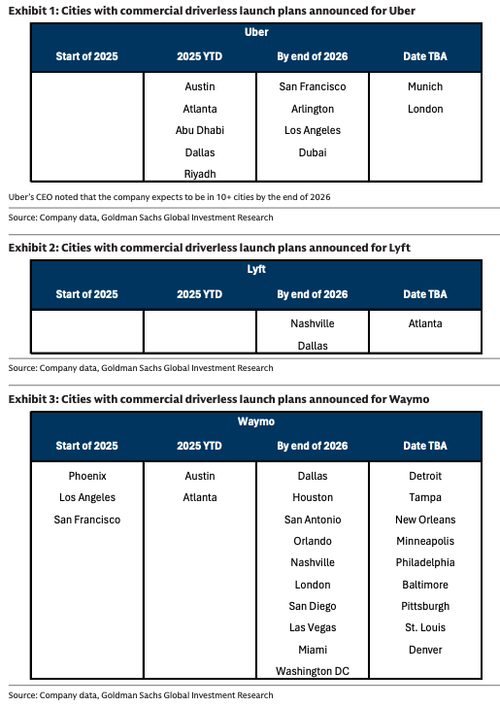

One key factor related to autonomous technology monetization is competition, given the competitive landscape both within the US and internationally for robotaxi operations (with Uber expecting to have AVs in at least 10 cities by the end of 2026 and Waymo already operating in several cities and with multiple additional planned deployments).

Specifically on the competitive landscape, we highlight several planned driverless deployments for Uber (covered by Eric Sheridan), Lyft (covered by Eric Sheridan), and Waymo robotaxis based on company announcements in the US and internationally (ex China) in Exhibits 1–3. Note that some of these overlap (e.g. in cities where Waymo and Uber partner), and we didn't include cities with testing/data collection that have a less clear commercial objective (e.g. NYC, where state law does not currently allow for commercial AV operations).

Recall we expect the US rideshare AV market to reach ~$7 bn in 2030.

Delaney also touched on over-the-air software updates that improved FSD:

We also believe Tesla is making progress with its autonomy software for consumer vehicles (which is FSD). Recall Tesla's CEO recently posted on X that the current v14.2.1 of FSD allows for texting while it is active in some cases depending on the context of surrounding traffic. We believe that the driver is still responsible for the vehicle in these situations (i.e. it is an L2 system). Additionally, the company had noted that v14.3 could be the version where customers could sleep while driving. Per crowdsourced data, v14.x currently can drive ~2,000–3,000 miles without a critical disengagement, though we acknowledge limitations may exist with this data, including controls on data collection and some disengagements not being classified by cause (e.g. lane issue, wrong speed, and other "non-critical" disengagements vs. safety issues, obstacles, or other "critical" disengagements). In addition, reviews, such as from Barron's, are showing good performance with FSD v14.

Robotaxis as a long-term profit driver for Tesla:

Recall that we previously estimated that Tesla's 2030 EPS could range from ~$2–3 to $20 (although we acknowledge there are outcomes beyond these ranges). This would assume:

automotive deliveries of 2–5 mn and automotive revenue ranging from approximately $75–$225 bn;

Services & Other revenue of $20–$40 bn (as the installed base grows);

Software revenue of $5–$45 bn, with the low end implying a competitive FSD market and the high end potentially driven by selling software to other OEMs;

Energy revenue of $35–$55 bn;

Robotics revenue of $3–$25 bn (based on the TAM analysis in the report led by Jacqueline Du linked here);

Robotaxi-related revenue of $2–$10 bn.

We assume EBIT margins ranging from the mid-to-high single digits to the low 20% range. We consider a middle-of-the-road scenario to be ~$7–$9 of EPS, which would imply what we view as balanced share in EVs and robotaxis, plus growth in its high-margin software/FSD business to a meaningful percentage of its own fleet as it begins providing eyes-off functionality for consumer vehicles (but not a meaningful software business for non-Tesla consumer vehicles).

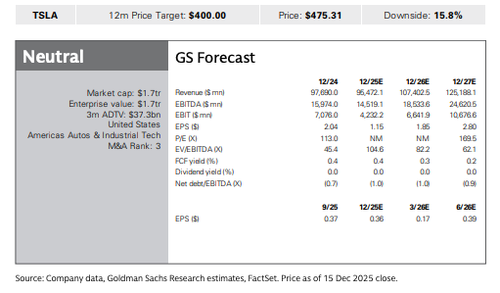

The analysts are Neutral-rated on Tesla with a 12-month price target of $400. ZeroHedge Pro subscribers can read the full note in the usual place.