Fast and Furious - Shorts Carried Out on Stretchers

Fast and furious

RSI across equity indexes has gone from extremely oversold to now hitting very overbought levels. RSI levels from the top: SPX, NDX and SOX.

Source: LSEG Workspace

Panic buying

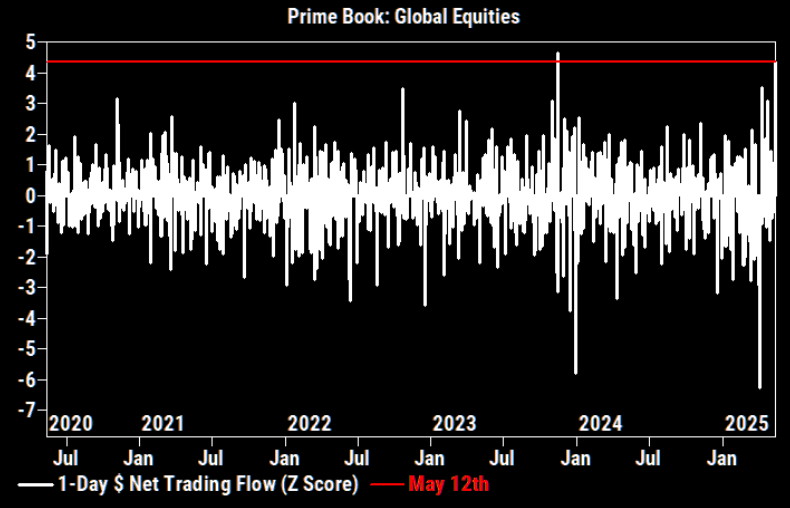

These are huge numbers. Forced chasing at its best. Goldman's prime data from yesterday:

1. Global equities, second largest net buying day in 5 years (3.7 sigma).

2. Buying significantly driven by short covers (1.6 to 1).

3. Net exposure +2.6 handles in a single session (73% net) from 65% net a month ago.

Source: GS PB

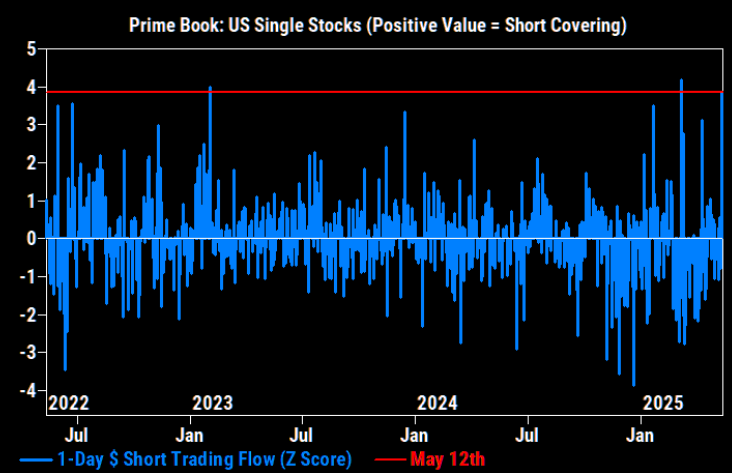

Short pain

Yesterday's notional short covering in US single stocks collectively was the largest since Mar 7th and ranks in the 99th percentile on a 5-year lookback.

Source: GS PB

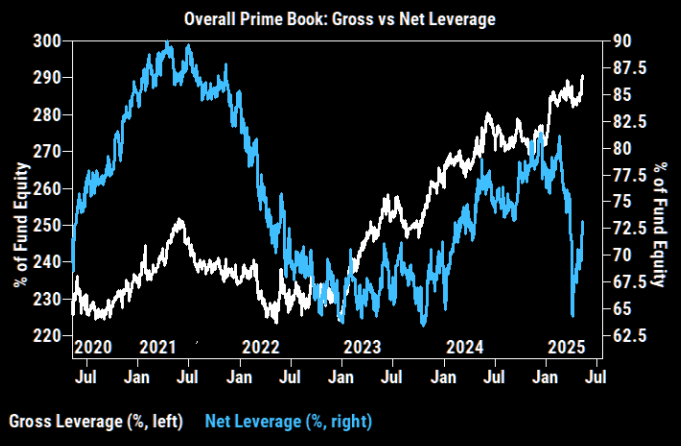

Gross and net

Gross leverage at new ATHs. Net exposure has picked up substantially, but still at relatively low levels...

Source: GS PB

Going to 7000

Flows are still almost entirely hedge fund-driven, with long-onlys absent and no urgency to redeploy—nets are low, shorts are high, and no one wants to buy back what they sold 30% lower. One trader today said, “We’re going to 7000,” and if he’s right, it’ll be painful unless positioning changes—quickly. (JPM's trader Matt Reiner)

Decoupling

SPX has left Citi US economic surprises index way behind...

Source: LSEG Workspace

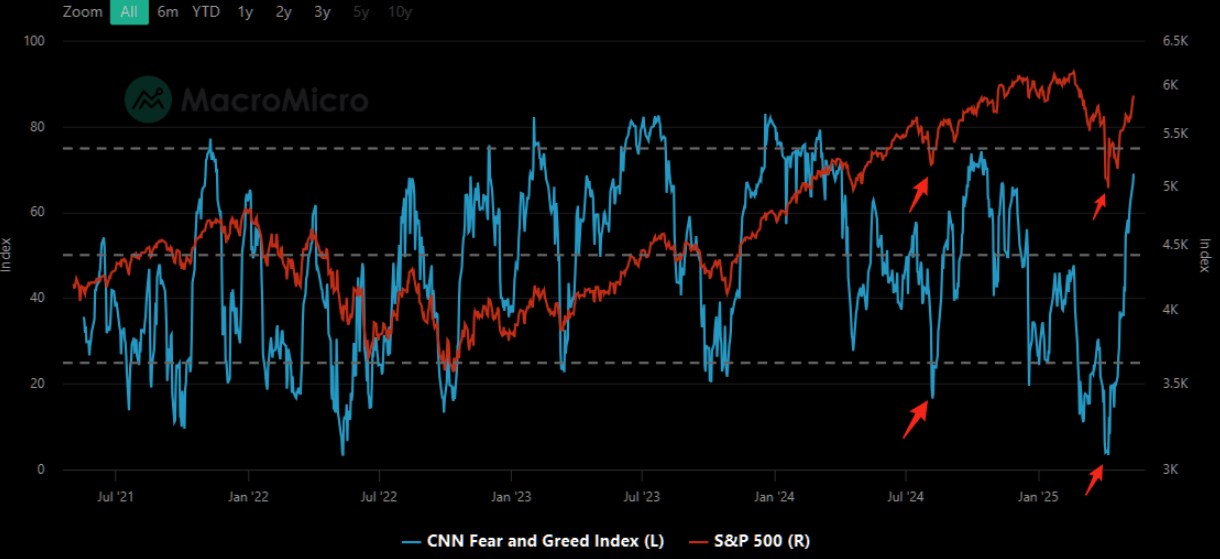

Keep it simple

The "easy" part of the bounce is over. Buying extreme fear worked once again. Sentiment has shifted and we are very close to extreme greed. Chasing here is for the "must cover" shorts crowd.

Source: Macromicro

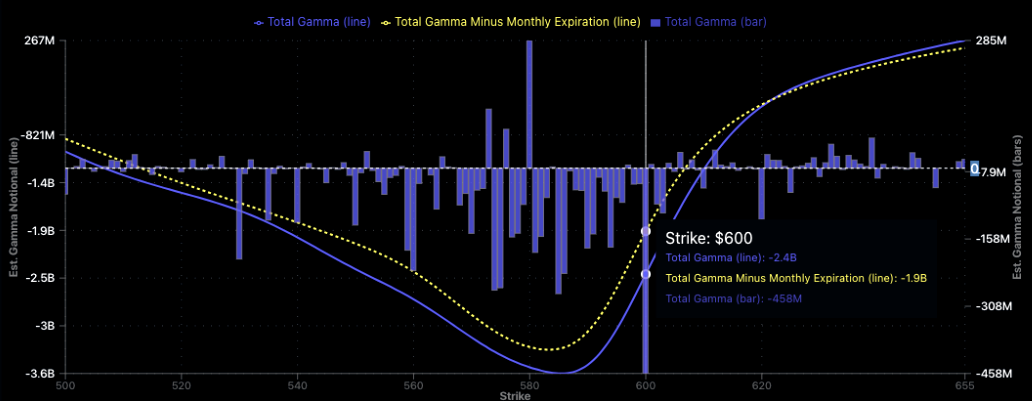

Diminishing short gamma buying

Earlier this month we pointed out the dealer short gamma "upside fragility" (here and here). This is now starting to fade. Spotgamma points out:

1. SPY negative gamma fades sharply above 590, meaning market makers have less to buy into strength

2. SPX positive gamma is starting to build between 5,900–6,000...which means dealers will shift from buying to selling into strength.

Source: Spotgamma

Remember the death cross?

It wasn't long ago people were talking about the death cross in SPX. Back then we pointed out that last time the death cross occurred (2022) markets decided reversing aggressively, and managed overshooting the 200 day by around 3.5%. A similar overshoot now would take us to around 6k...