Gold Euphoria, Bond Mayhem, Dollar Disgrace

Powerful

The move higher in the 10 year and bond volatility, MOVE, has been rather extreme. Watch closely how bond volatility behaves going forward.

Source: Refinitiv

Keeps on giving

Unstoppable gold managed printing anther new ATH. The bounce on the 50 day a few sessions ago was just perfect. Note RSI is becoming rather overbought, but things can stay overbought for longer than most think possible...

Source: Refinitiv

Crowd grabbing gold upside

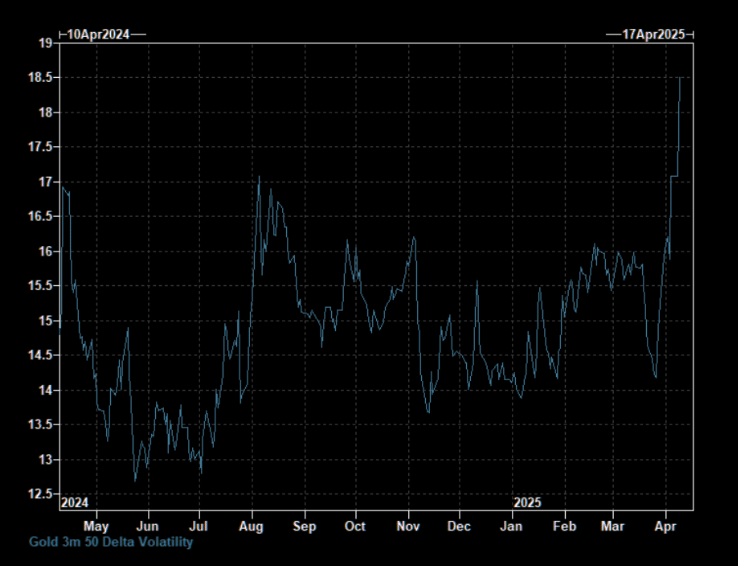

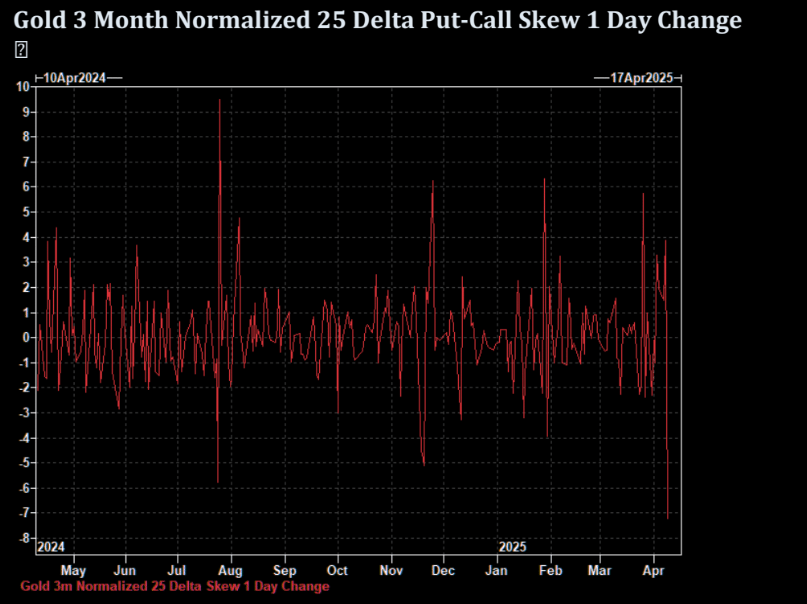

Finally that upside gold convexity kicked in. GS writes:

Aggregate call volumes were >60% above average. Gold 3month implied volatility richened significantly. And normalized 25 delta put-call skew registered its largest 1 day fall for at least the past year (chart 2).

Chasing gold options given current vol levels is expensive in our view. Overwriting relatively expensive gold vol screens attractive (especially if using for directional strategical views).

Source: GS

Source: GS

DXY at huge levels

DXY trading right around the massive 100 level. Pushing DXY momentum break outs, both ways, has been a costly strategy for years. Is this time different? Why not a hammer candle soon, just to frustrate the crowd...

Source: Refinitiv

Overshoot?

Euro momentum is huge. We are trading above the range highs as of writing. Note we have not traded this much above the 200 day in a long time. Is this the moment when people are forced to get sucked in, and we see another failed break out (overshoot) move? Chart 2 shows the Euro vs net non commercial positioning.

Source: Refinitiv

Source: Refinitiv

Front running?

Soc Gen on the dollar here: "...what the FX market has done is sell the dollar ahead of expected bad news, even ahead of what the rates market is pricing in. This would tend to suggest that a period of consolidation is likely, though illiquid markets leave themselves open to major overshoots."

Source: Soc Gen

The loss

A lot of people have lost a lot of money...

Source: BofA

Getting close

On Monday 76% of MSCI ACWI country indices traded below both 50-day & 200-day moving averages…close but not quite triggering a buy signal from BofA Global Breadth Rule (triggered at 88%); note 10 buy signals since 2011, after which MSCI ACWI rallied 4-5% following 4 weeks writes Hartnett. On the other hand, we are getting 4-5% moves on a daily basis these days...

Smelling blood

Foreigners puking US equity funds.

Source: BofA

Looking forward to the weekend

The majority of the crowd is in desperate need for the weekend chill post the extreme volatility. Average daily band for SPX is ~780bps over the last 4 days.

Source: GS