Gold’s Trend Snaps – Cheap Options and Looming CTA Liquidation

New in gold

Haven't seen gold trade below the trend line that has been in place so far in 2025... nor have we seen gold trade this much below the 50 day since late 2024.

Source: LSEG Workspace

Cheap options

Gold volatility usually trades with an upside skew, i.e gold up, gold volatility up. The consolidation/correction in gold has led to gold volatility, GVZ, resetting sharply lower. Playing gold direction via options makes a lot of sense here, both if you are looking at downside hedges, as well as if you are looking for upside exposure (call spreads are priced cheaply).

Source: LSEG Workspace

The dollar connection

Despite all the negative dollar takes, the DXY remains trading not far from late April levels. If gold can't catch bids with the DXY here, what happens should the dollar catch some bids eventually?

Source: LSEG Workspace

Specs

Gold net non commercials have been in denial for months, but decided to increase the gold long just in time for the latest move lower...

Source: LSEG Workspace

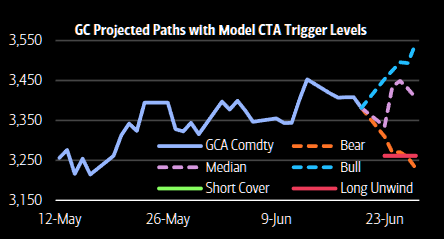

Momentum chasers

CTAs are getting very close to the long unwind trigger level...

Source: BofA

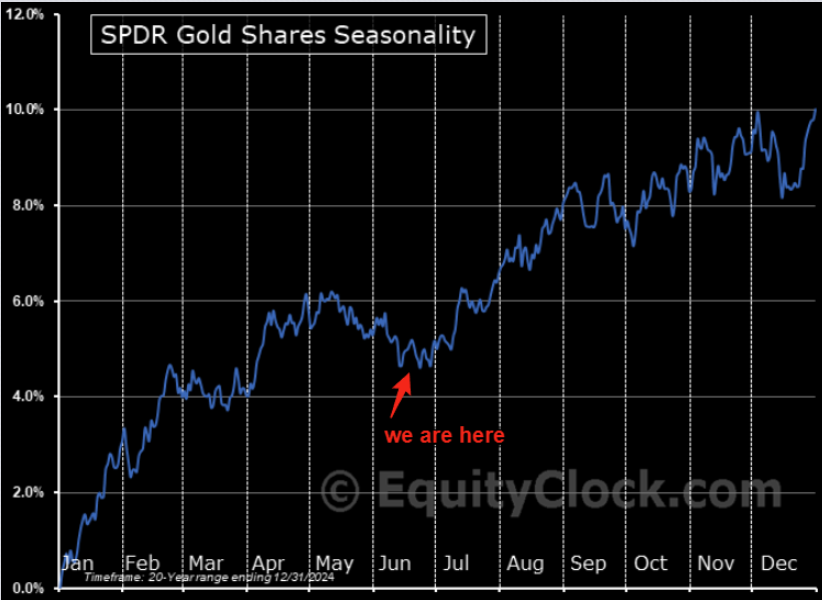

Seasonality

Before you get too bearish... Gold seasonality is rather strong from July.