NASDAQ On Edge, CTAs Lurking Below — And Fear Still Elevated

NASDAQ

NASDAQ remains range-bound since September. It’s trading well below the 100-day MA and approaching major must-hold support at the 200-day and the lower end of the range (24,400), with resistance stacked at 25,200, 25,600 and 26,000 (futures).

Source: LSEG Workspace

Must hold in MAG

The MAG index has fallen back to range lows and is trading just above the 200-day MA. The key line in the sand is 25k, with the 100-day now rolling over and turning negatively sloped. More index charts here.

Source: LSEG Workspace

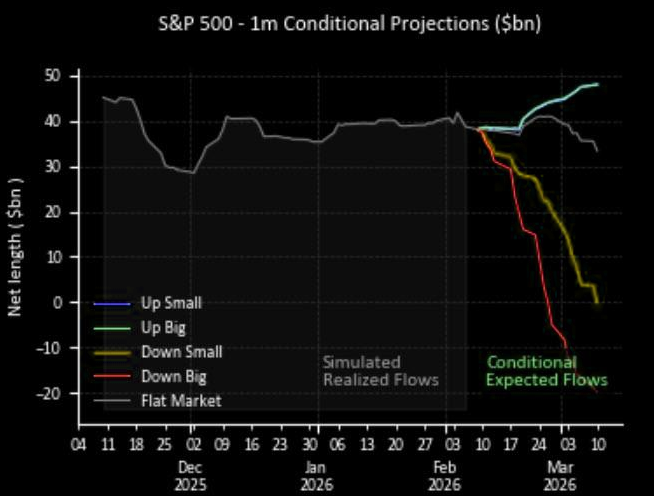

CTAs

GS estimates CTAs will sell $1.5–2bn of US equities over the next week. The S&P 500 is still above the key medium-term trigger at 6,723, a break below would likely accelerate systematic selling.

Source: GS

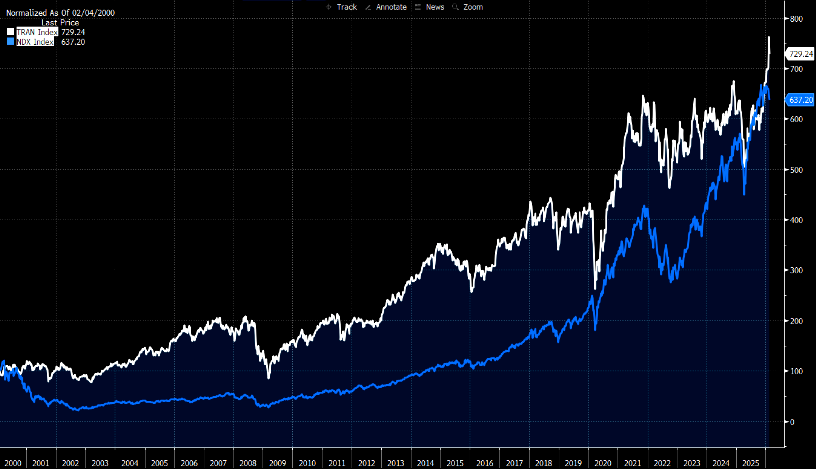

Not a typo

We had to check the charts ourselves, but yes it is accurate: "given what a headline grabber US tech has been for 15 years, its pretty staggering to consider the Dow Transport index has handily outstripped Nasdaq over the last 25 years." (GS).

Source: Bloomberg/GS

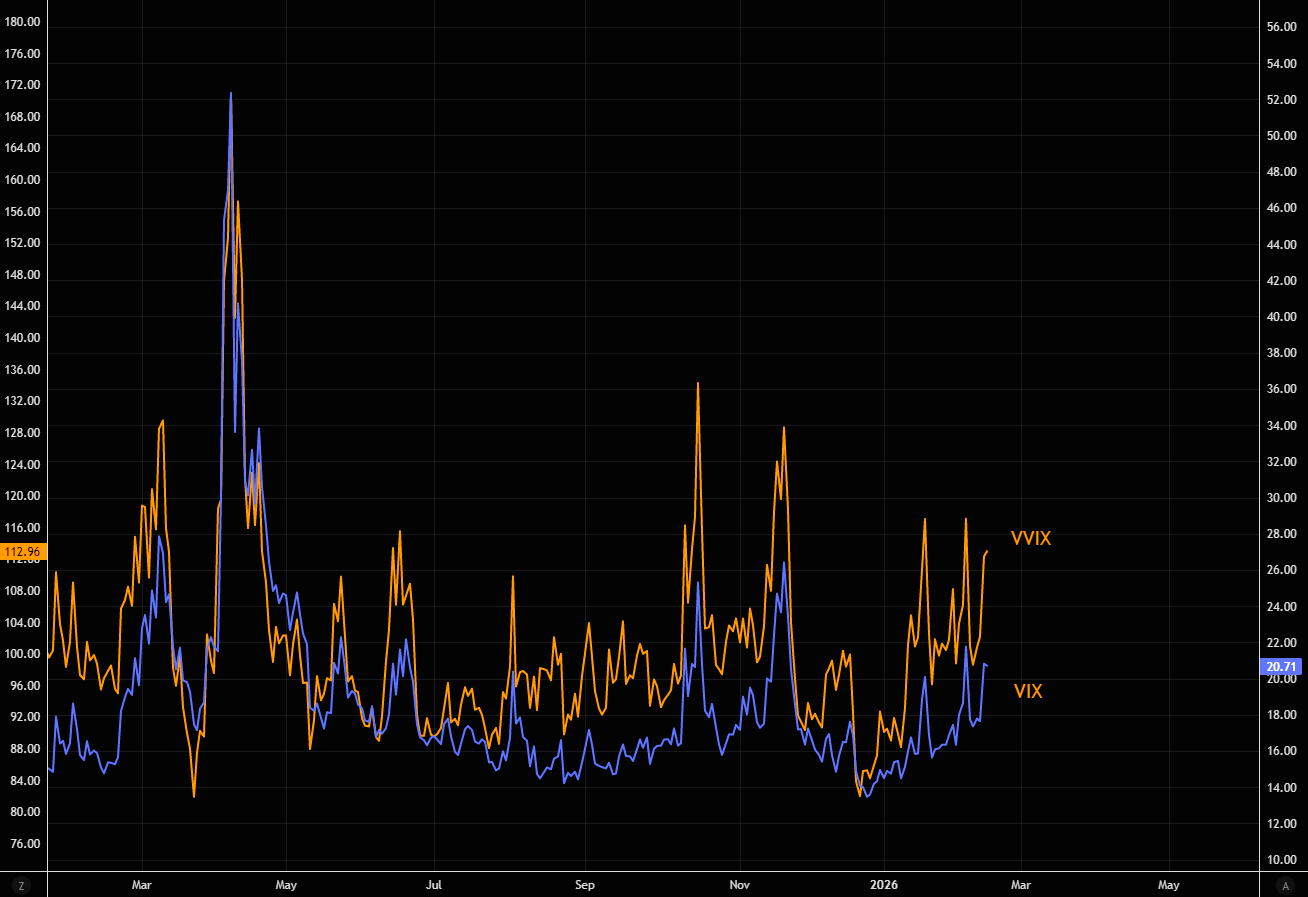

Fearful

With VVIX at 113, the market is still pricing elevated fear. The VVIX–VIX gap remains wide. Latest volatility observations here.

Source: LSEG Workspace

The SPX connection

SPX dislikes rising bond volatility, period. Chart shows SPX vs. MOVE (inverted).

Source: LSEG Workspace

Can AI replace AI software?

The debate is flawed and "illogical" according to HSBC. Main bullets:

1. Software vendors embed AI into enterprise applications for complementary value, expanding TAMs without displacement; AI augments rather than replaces core software functions.

2. Control of private client data, domain expertise, and optimized code creates decades-long barriers, making incumbents (e.g., SAP, Oracle) superior to AI-generated solutions for enterprise systems.

3. AI’s hallucinations and non-repeatability make it unsuitable for core enterprise systems requiring exactness, countering narratives of AI replacing software.

4. Persistent "AI vs. software" hype stems from media echo-chambers, but enterprise fundamentals ensure software resilience as AI focuses on augmentation.

5. AI integration with Global 2,000 firms drives rapid TAM growth, cost efficiency, and new revenue streams through embedded AI in legacy platforms.

IGV back to massive must hold area...

Source: LSEG Workspace

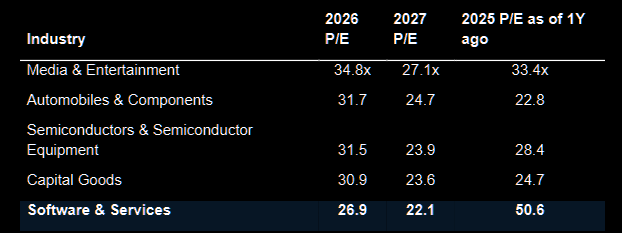

Fast market

"Exactly one year ago, software was trading at a P/E multiple of 51x, making it the most expensive industry in the equity market. Today, software trades at a P/E multiple of 27x and is not the most expensive industry. Media, autos, semis, and capital goods are trading at a higher multiple." Is the market wrong punishing this sector? Full read here.

Source: GS

Still no bid

Hartnett with a gentle reminder: "1 st AI-disrupted sector was India tech Q1’25 (INFO, TCS), and no bid yet; most obvious catalyst to reverse significantly the “AI-awe to AI-poor” rotation… an AI hyperscaler announcing a capex cut."

Source: LSEG Workspace

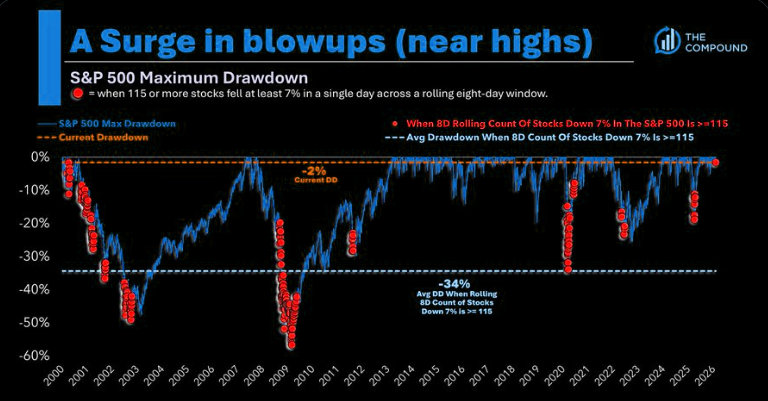

Wild volatile market

Michael Batnik: "Wild market. We haven't seen anything like this since the dotcom bubble burst. Over the last 8 sessions, 115 stocks in the S&P 500 have decline 7% or more in a single day. The average drawdown when that happens is 34%. Right now we're 1.5% below the all-time high." More here and here.