Software At The Edge: $80 Or Air Pocket

If this is the bounce...

IGV bounced earlier this month, but we’re once again trading near the recent panic lows. The $80 level is the clear make-or-break to watch.

If this is how price behaves after a bounce, the real question is: what does a decisive break below that critical $80 support look like?

Source: LSEG Workspace

Gone

Decades of almost perfect correlation is now gone. Can we dismiss the gap between IGV and QQQ?

Source: LSEG Workspace

Must hold in MSFT

The biggest component of IGV, MSFT, is now trading right on its major trendline. The death cross has been in place for some time, keeping the broader technical backdrop fragile.

The ~$400 area is the clear make-or-break level for MSFT.

Source: LSEG Workspace

PLTR as well

PLTR, the second-largest component of IGV, has pulled back to its major long-term trendline. The stock is trading well below the 200-day moving average, and the 50-day is now approaching a potential cross below the 200-day.

The $130 area is the clear line in the sand for PLTR.

Source: LSEG Workspace

ORCL

ORCL, the third-largest IGV component, is trading right on its descending trendline. The stock hasn’t reclaimed that trendline since the implosion began, nor has it been able to sustain any meaningful move above the 21-day moving average.

Source: LSEG Workspace

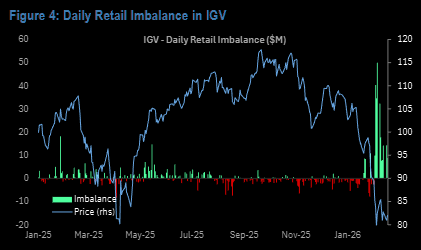

Busy buying

Retail continues to buy imploded IGV.

Source: JPM

Let the trend be your friend

OWL printing new lows...More on the OWL redemption halt here.

Source: LSEG Workspace

Spillover effects?

New OWL lows telling us something about software?

Source: LSEG Workspace

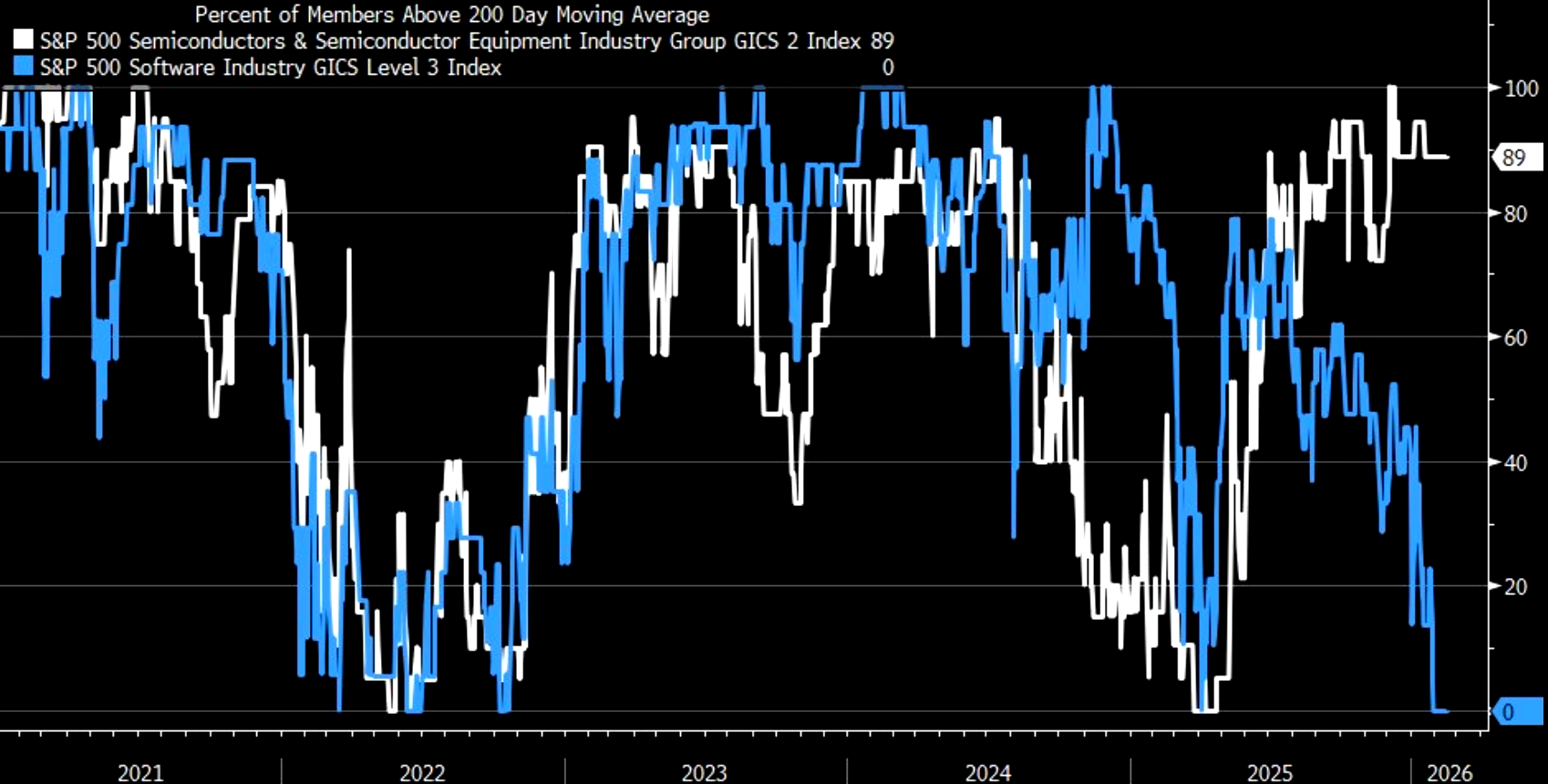

89% vs 0%

Semis: 89% above the 200-day. Software: 0%.

Source: Bloomberg/Kevin Gordon

FOMO momos

IGV and BTC continue to move in pretty much perfect tandem. Momentum in both is extremely poor.