UBS: SpaceX-xAI Merger Signals Rise Of "Orbital AI"

In September 2024, we penned a note that Elon Musk was on track to become the world's first trillionaire by 2027, driven by what we described as "space race bets." That call looks increasingly correct following the merger of Musk's SpaceX and xAI earlier this week, a transaction that has lifted his net worth to $850 billion.

By contrast, former WeWork CEO Adam Neumann, who once famously said in 2019 that he wanted to live forever and be the first trillionaire, must be watching Musk's empire soar to new heights in disgust. Musk's decision to fold xAI into SpaceX is already being framed by UBS as an "orbital AI" investment angle, positioning Musk at the center of low-Earth orbit dominance and next-generation AI compute (read more here).

UBS trader Jephine Wong provided clients on Wednesday with what has caught her eye with the xAI-SpaceX deal:

X" marks the spot as Elon Musk moved swiftly to fold xAI into SpaceX — an all‑stock deal valuing the combined entity at ~$1.25T (~$1T for SpaceX; ~$250B for xAI). The signal is clear: SpaceX is planting a flag in orbital AI, betting that a meaningful share of compute — essentially data centers in space — will be operating within 2–3 years. It's a bold storyline to take into a potential summer/fall ~$50B IPO, but it also introduces new complexity for investors: SpaceX is generating ~$8B in EBITDA, while xAI is burning approximately $1B per month. The roadshow narrative shifts from a pure‑play space champion to a space‑plus‑AI hybrid — asking investors to balance operating strength against AI‑scale capex. EchoStar, a holder of SpaceX‑linked assets, slipped on the news — a sign that not everyone is converted just yet.

Chart of The Week

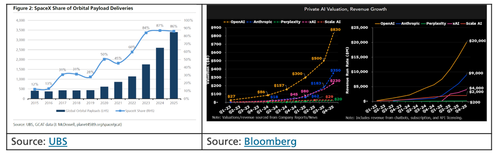

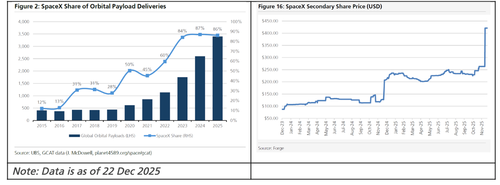

Spaced Out: SpaceX's merger with xAI broke this week — just as SpaceX has become the undisputed heavyweight of the orbital payload market. The company is now so dominant it effectively is the global launch cadence (see UBS's John Hodulik chart below, report here). But pulling xAI into the fold adds a new twist. What had been a clean space‑infrastructure story now becomes a space × AI narrative, pairing orbital payload dominance with an AI business burning nearly $1B a month. The question for investors is whether this move expands the opportunity or complicates the story right before a historic IPO comes into view. What do you think? Who are you backing for orbital AI? And does xAI have an edge the rest of the market hasn't spotted yet? We'd love to hear your thoughts!

What caught our eye this week?

SpaceX merges with xAI: the "Orbital AI" pitch

Musk entities merging: Musk folded xAI into SpaceX (website memo here) at a combined ~$1.25T valuation (SpaceX at ~$1T; xAI at ~$250B) via an all‑stock deal, arguing that "within 2–3 years" the lowest‑cost AI compute will be in space, supported by a jaw dropping FCC filing seeking approval for up to 1 million compute‑oriented satellites. The company still plans to go public this year, and had already begun lining up anchors for what could be a $50B raise. Investors got the message…. and some new nerves: EchoStar, a holder of SpaceX‑linked assets, slipped on the merger chatter, reflecting the sudden shift from a pure‑play space IPO to a space‑plus‑AI conglomerate. UBS John Hodulik (see here) covers Ecostar for us and has done a handy analysis of Echostar's ~3% stake in SpaceX and a one-pager on the company in late December.

Follow the numbers – to explain timing: xAI burned $8–$9.5B in 9M 2025 on only ~$210M of revenue… even after $20B+ raised (incl. $2B from Tesla). SpaceX, by contrast, is printing cash: roughly $8B 2025 EBITDA on $15–$16B revenue, powered by Starlink's ~9M subs and a launch cadence supporting a $1T+ IPO case. The merger brings together SpaceX's operating muscle with xAI's capex appetite, and gives the roadshow a unified "orbital AI" arc. Mgmt says the deal won't derail a 2026 listing timeline, and internal docs indicate a stock for stock structure (SpaceX shares at $526.59).

Professional subscribers can read much more from UBS about the 2026 IPO market here at our new Marketdesk.ai portal.