crypto

Ethereum Foundation’s move to stake its own ETH, using minority clients and distributed infrastructure, throws fresh focus on how Ethereum’s staking landscape is evolving...

"Jane Street abused market relationships to rig the market in its favor during one of the most consequential events in crypto history."

A person familiar with the project reportedly said the stablecoin...would be established as "a means to allow Gazans to transact digitally..."

OpenClaw creator Peter Steinberger confirmed that users can be removed for mentioning Bitcoin and crypto on Discord...

“Today marks an inflection in the Ethereum Foundation’s long-term quantum strategy...”

While sentiment for liquid cryptocurrencies is undeniably risk-off, it's crucial to recognize the underlying resilience and expansion of the broader digital assets ecosystem...

Magic internet money Bitcoin may be, but its positive spill-over effects on electricity grids around the world might be even more important than the asset itself...

...and prohibits the sale of bitcoins seized by Brazilian judicial authorities, ensuring that these assets remain within public control.

BIP 360 marks a new step in efforts to strengthen the network against emerging cryptographic and quantum computing risks...

...why mathematics, trauma, and human temperament matter more than ideology in modern money...

The EU plans to ban crypto transactions with Russia by shutting down all related channels, but analysts question whether the measure is fully enforceable...?

Dalio warns that CBDCs will eliminate financial privacy and enable governments to tax, seize funds and cut off political opponents...

The banking acquisition follows a trademark filing for “MrBeast Financial” in October, which specifically mentioned “cryptocurrency exchange services”...

Instead of raw acceleration, AI development should focus on systems that “foster human freedom and empowerment” and ensure “the world does not blow up"...

Wall Street–style liquidity is reportedly moving into prediction markets, signaling a shift toward deeper markets, higher volumes and greater institutional participation...

...market turmoil sparks rumors.

"Bitcoin is crashing so I have to say bye to the love of my life..."

The latest announcement from the People's Bank of China follows months of flip-flopping on privately issued yuan-pegged stablecoins.

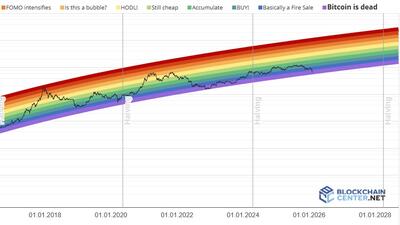

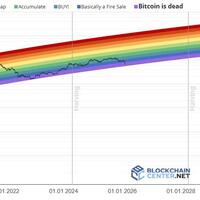

The recent market correction has pushed the bitcoin price further below the estimated production cost, which has historically served as a soft price floor...

Reports of Bitcoin’s death are once again trending, but for anyone who has lived through a halving cycle, this 50% haircut is just scheduled programming...