Centrus Energy Soars After DOE Awards $2.7 Billion For Uranium Enrichment

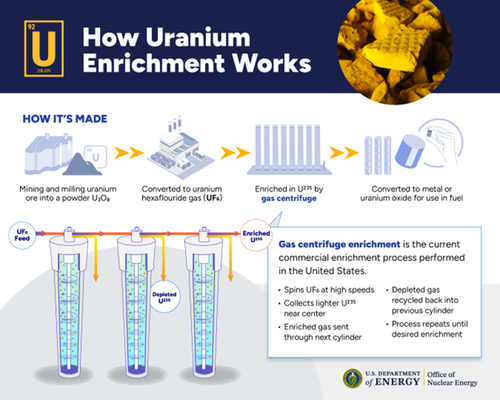

The Department of Energy (DOE) has finally awarded the billions of dollars for uranium enrichment announced back in 2024. The contracts span the full range of uranium enrichment from low-enriched uranium (LEU) used by the current global reactor fleet, through high-assay LEU (HALEU) which is planned to be used by multiple advanced reactor designs. Yet while three companies were chosen for huge awards, peaking at almost 900 million each, a few were notably left out.

— U.S. Department of Energy (@ENERGY) January 5, 2026

Centers Energy was awarded $900 million to support the expansion of their currently-operating 900 kg/yr HALEU production capacity and toward the development of next-generation reactor fuel. We covered their recent announcement about finally starting the production of new centrifuge units for LEU production. Centrus now has US government supply on the HALEU side and Korean government support on the LEU side.

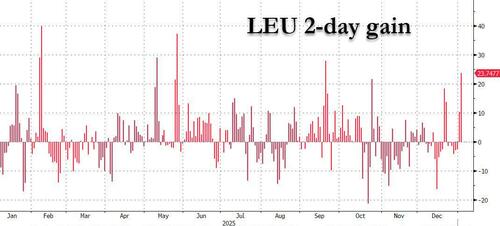

Centrus shares rose as much as 9.2% in New York, and closed up almost 25% in the past two days, one of its biggest gains in the past year.

“President Trump is catalyzing a resurgence in the nation’s nuclear energy sector to strengthen American security and prosperity,” said Secretary of Energy Chris Wright. “Today’s awards show that this Administration is committed to restoring a secure domestic nuclear fuel supply chain capable of producing the nuclear fuels needed to power the reactors of today and the advanced reactors of tomorrow.”

General Matter, started by Founders Fund’s Scott Nolan, was awarded $900 million for HALEU capacity development at their future facility in Kentucky. General Matter has been tight-lipped about the enrichment technology they plan to utilize at their new facility, but will submit an application to the US Nuclear Regulatory Commission (NRC) for the facility planned at Paducah this calendar year.

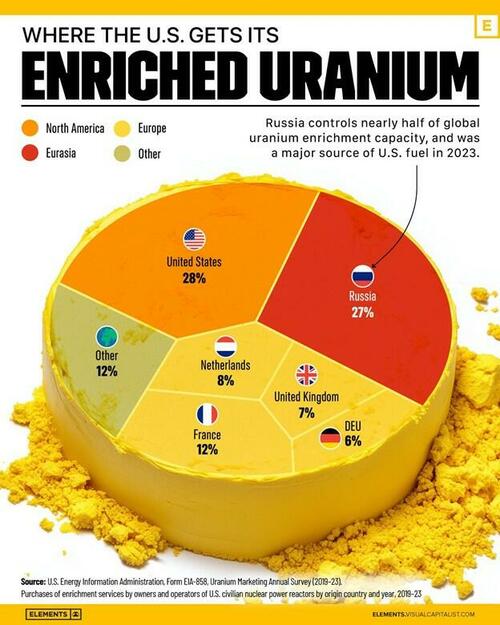

Orano, a French enrichment company majority owned by the French government, was awarded $900 million for developing and constructing their planned LEU enrichment facility in Tennessee. They have vaguely discussed their intended plant size, but have remarked it will have a capacity in the “millions of SWU”. Separate Work Unit (SWU) is the measurement of uranium enrichment production capacity, with Russian imports currently clocking in at roughly 3-4 million SWU/yr.

Senator Tom Cotton last month argued that companies, such as Orano, which coordinate with China’s nuclear program should be barred from receiving US taxpayer dollars.

Global Laser Enrichment (GLE), a company co-owned by Silex and Cameco, was awarded $28 million to continue the advancement of their novel laser enrichment technology. They currently have an enrichment facility application under review with the NRC for their Kentucky facility, and are currently producing hundreds of kg of LEU at their North Carolina test center.

Notably left out of the list of award recipients was Nano Nuclear’s partner LIS Technologies, a company also developing a novel uranium laser enrichment method. While they have been busy pounding the table for months that their laser technology is the only US-origin technology, so far the US government seems to be uninterested.

Also left off the list is the only enrichment company producing commercial quantities of product in the US, Urenco. Their facility in New Mexico has been operating for years, and recently received permission from the NRC to increase their enrichment levels. Owned by a combination of UK, Dutch, and German government and private entities, the company failed to secure an award for this round.

This is likely only the first of many awards and contracts to come with companies in the domestic nuclear fuel chain, as we discussed at length last week. Many more such announcements are likely over the coming weeks.