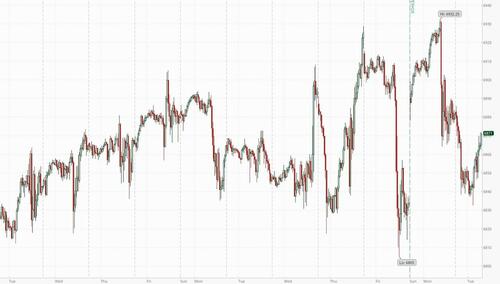

Futures Rebound From Session Lows Ahead Of Long Overdue Jobs Report

Stock futures are lower, but well off session lows, as traders await delayed jobs data that will shape the Fed’s next move. As of 7:15am, S&P 500 futures are 0.2% lower while Nasdaq 100 contracts are -0.3% with all Mag 7 names lower premarket; European equities are little changed.Treasuries are lower, pushing 10Y yields up 0.5bps to 4.175%. The Bloomberg dollar index is at session lows. Brent crude dropped 1.6% below $60 a barrel for the first time since May and gold pulled back after five days of gains. Bitcoin sank more than 1% before recovering above $87,000. The non-farm payrolls report, due at 8:30 a.m., will include more uncertainty and quirks than usual. Consensus among economists for November is at 50k, while the whisper number is 22k. On today' calendar, Non-farm payrolls, average hourly earnings and the unemployment rate for November are due at 8:30 a.m. ET. We also get the October retail sales data at that time. December US PMIs for the manufacturing and services industries are due at 9:45 a.m.

In premarket trading, all Mag 7 stocks are lower: Alphabet -0.1%, Apple -0.2%, Amazon -0.2%, Microsoft -0.4%, Nvidia -0.5%, Meta -0.6%, Tesla -1%

- Accenture (ACN) shares rise 1.9% after Morgan Stanley upgraded to overweight from equal-weight, saying the stock now trades at a compelling valuation following this year’s pullback.

- Cognex (CGNX) is up 3.7% after being raised to buy from sell at Goldman Sachs, with the broker noting organic growth is at an inflection point and margin recovery is underway after several years of underperformance.

- Organogenesis (ORGO) climbs 9.5% after the biotech said it plans to begin submitting ReNu, a product to treat knee osteoarthritis pain, to US regulators by the end of 2025.

The non-farm payrolls report, due at 8:30 a.m., will include more uncertainty and quirks than usual. Consensus among economists for November is at 50k,with a range of -20k to 130k, while the whisper number is 22k. The unemployment rate is expected to increase to 4.5%. Bloomberg Economics believes the US economy could have added as many as 130k jobs. The jobs report will also include an estimate of October payrolls — figures that were delayed by the federal shutdown. The stakes are high, but the huge range of estimates suggests no-one really knows what to expect (see our preview here). A print that reinforces the picture of a sluggish economy could put the stock rally back on track by supporting bets for further rate cuts, while a big miss may spook markets.

“The employment numbers would need to surprise materially — either significantly stronger or weaker than expected — to meaningfully shift market expectations,” said Mathieu Racheter, head of equity strategy at Julius Baer.

The setup is cautious going into the today' jobs. There’s rotation out of tech, dollar weakness and declines for oil and copper. Bitcoin dropped below $86,000 for the first time in two weeks, slipping deeper into bear market territory. Still, fund managers in Bank of America’s latest survey aren’t worried — going into the new year, they’re the most bullish they’ve been since 2021.

Rate reductions and robust growth have propelled the MSCI All-Country World Index to a gain of almost 20% in 2025, notching a third straight year of double-digit increases. According to a Bank of America' monthly Fund Managers Survey, money managers are confident about the outlook for 2026. Investor sentiment as measured by cash levels, stock allocation and global growth expectations rose to 7.4 in December on a scale capped at 10, the most bullish survey outcome in four-and-a-half years.

The improved prospects of a peace deal between Ukraine and Russia are showing up in the equity space, where European defense names underperform. Technology stocks are the worst performers in Europe, tracking a similar trend on Wall Street on Monday and Asia overnight. The Stoxx 600 falls 0.2%, with defense shares lagging while chemical stocks outperform. European defense stocks fell on the speculation around a possible ceasefire, with Germany’s Rheinmetall AG dropping as much as 4.6%, and Italy’s Leonardo SpA falling 4.5%. Here are some of the biggest movers on Tuesday:

- IG Group shares jump as much as 5.6% to an all-time high, after the trading platform said it will deliver its medium-term revenue growth targets ahead of schedule in 2026.

- UBS shares climb as much as 3%, touching their highest level since 2008, after Bank of America analysts said the Swiss lender is set to grow earnings per share at the fastest sequential pace of any bank globally.

- Raiffeisen Bank International shares rise as much as 2.9%, to the highest level since April 2011, as Oddo BHF starts coverage at outperform and says the Austrian lender’s scope to re-rate is still being overlooked.

- Aperam shares gain as much as 5.6% after Morgan Stanley says sentiment is turning more constructive on European stainless steel, with policy measures providing a floor.

- Abivax shares drop as much as 8.7% after the French biotechnology company reported third-quarter financial results that Van Lanschot Kempen analysts called “uneventful.”

- Saab shares sink as much as 6.6%, leading defense stocks lower, after President Donald Trump said a negotiated end to the war is “closer” than ever.

- Telefonica shares fall as much as 4.7% after newspaper El Economista reports the firm is set to replace CFO Laura Abasolo.

Earlier, Asian equities fell, with South Korea leading a broad selloff as traders awaited fresh signals on the sustainability of the tech-driven rally toward the end of the year. The MSCI Asia Pacific Index fell 1.4%, the most since Nov. 21, with AI beneficiaries TSMC and Alibaba among the biggest drags. Korea’s KOSPI fell more than 2%, with benchmarks also down more than 1% in Hong Kong, Japan and mainland China. The Hang Seng Index fell 1.5%. Optimism around AI-driven growth is giving way to concerns that valuations have baked in more than companies can deliver. Investors also awaited a report on the US labor market for clues on the health of the world’s largest economy and the outlook for Federal Reserve rate cuts that have provided a further tailwind for global stocks. Uncertainty over China’s economy is also weighing on sentiment, after a lack of strong stimulus measures emerging from recent government meetings. The MSCI China Index fell as much as 2.3% Tuesday, taking its declines from an Oct. 2 high to more than 10%.

In FX, the pound tops the G-10 pile, gaining 0.3% against the greenback which is trading near session lows.

In rates, treasuries hold small losses in early US trading amid a selloff in gilts after stronger-than-expected December UK PMI readings. US yields are less than 1bp higher on the day, the 10-year near 4.175% with UK counterpart cheaper by an additional 3bp. Treasury curve spreads also are within a basis point of Monday’s closing levels, with recent steepening trend intact The US session features delayed November jobs report as well as October retail sales and S&P Global US PMIs. WTI crude oil futures extend their slide, approaching year’s low as indications grow that supply is outpacing demand. Bunds edge up after euro-area PMI was less encouraging. Treasury auctions this week include $13 billion 20-year bond reopening Wednesday and $24 billion 5-year TIPS reopening Thursday.

In commodities, Brent crude futures fall 1.6% to $59.60 a barrel on oversupply concerns and signs that Russia and Ukraine are edging closer to a ceasefire. Spot gold drops $30 to around $4,275/oz. Bitcoin rises 1% to above $87,000.

Looking at today' calendar, US economic calendar includes November employment, October retail sales and December New York Fed services business activity (8:30am), S&P Global US manufacturing and services PMIs (9:45am) and September business inventories (10am). No Fed speakers are scheduled

Market Snapshot

- S&P 500 mini -0.2%

- Nasdaq 100 mini -0.3%

- Russell 2000 mini -0.3%

- Stoxx Europe 600 little changed

- DAX -0.3%

- CAC 40 little changed

- 10-year Treasury yield little changed at 4.17%

- VIX +0.5 points at 17.03

- Bloomberg Dollar Index little changed at 1205.25

- euro little changed at $1.1758

- WTI crude -1.9% at $55.75/barrel

Top Overnight News

- Traders are weighing the prospect of a possible end to Russia’s war in Ukraine, sending oil and defense stocks lower. US negotiators offered more significant security guarantees to Kyiv as part of Trump’s renewed push to end Russia’s war, but the effort still appeared part of a bid to pressure Zelenskiy on territory. BBG

- Senators in both parties are bracing for another government shutdown next year after Republicans blocked a proposal to extend expiring health insurance subsidies, the issue that triggered the 43-day closure that consumed much of the fall calendar. The Hill

- US suspended implementing a technology deal it struck with the UK amid growing frustrations in Washington over progress of trade talks with London: FT.

- Treasury Secretary Bessent reiterated that Congressional stock trading must end.

- Nasdaq is seeking SEC approval to extend trading to 23 hours during the work week by adding a new session from 9 p.m. to 4 a.m. ET. That would be in addition to existing premarket, regular and postmarket hours. BBG

- UK flash PMIs come in ahead of expectations, including services at 52.1 (up from 51.3 in Nov and above the consensus at 51.6) and manufacturing at 51.2 (up from 50.2 in Nov and above the consensus at 50.3). S&P

- Eurozone flash PMIs fall short of expectations, including manufacturing at 49.2 (down from 49.6 in Nov and below the consensus forecast of 49.9) and services at 52.6 (down from 53.6 in Nov and below the consensus forecast of 53.3) while inflationary pressures strengthened. S&P

- Two days of intense negotiations between Ukraine, the U.S. and European officials resulted in clear progress on security guarantees for Ukraine but left significant gaps on the issue of territory. Axios

- The U.S. is offering Ukraine security guarantees similar to those it would receive as part of NATO, American officials said Monday. The offer is the strongest and most explicit security pledge the Trump administration has put forward for Ukraine, but it comes with an implicit ultimatum: Take it now or the next iteration won’t be as generous. Politico

- Washington is preparing to seize more Venezuelan oil tankers as the White House ratchets up pressure on Maduro. Axios

- The yen outperformed all its major peers ahead of the BOJ’s widely anticipated move to lift its benchmark interest rate this week. BBG

- NFP Preview from Goldman: "We estimate nonfarm payrolls rose by 10k (70k private) in October and by 55k (50k private) in November, a touch above consensus of +50k in November but below the three-month average of +62k."

Trade/Tariffs

- US suspended implementing a technology deal it struck with the UK amid growing frustrations in Washington over progress of trade talks with London, according to FT.

- China's Commerce Ministry said China will charge tariffs of 19.8% on EU pork effective Dec 17th; Tariff range will be from 4.9-19.8%. Adds that investigation found pork products being dumped, harming Chinese producers.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly lower after the weak lead from Wall Street, as the tech-related pressure rolled over into the region. ASX 200 marginally declined amid underperformance in the tech, energy and resources sectors, while data showed consumer sentiment deteriorated. Nikkei 225 fell beneath the 50,000 level amid a firmer currency, BoJ rate hike expectations and underperformance in tech and electronics stocks. Hang Seng and Shanghai Comp were hit amid the tech woes, with the sector heavily represented in the list of worst-performing stocks in the Hong Kong benchmark.

Top Asian News

- China Securities Times commentary noted that China should set a positive yet 'pragmatic' 2026 GDP growth target with leeway, while researchers are said to be divided between an around 5% or 4.5%-5.0% growth target for 2026.

- XPeng (9868 HK) has obtained a Level 3 autonomous driving road test licence in Guangzhou, via Yicai.

- Japan's FY26 initial draft budget will be in excess of JPY 120tln, via Kyodo.

European bourses (STOXX 600 -0.1%) opened broadly lower, and then some indices gradually clambered into the green, to now display a mixed/mostly lower picture. Initial pressure followed on from a downbeat mood in Asia, which in turn was weighed on by tech-related downside in the US. European sectors opened mixed, but now hold a positive bias. Chemicals leads, followed closely by Autos, whilst Tech lags. For the autos sector, sentiment has been boosted following comments by an EU Lawmaker who suggested that the EU will have a 90% reduction in CO2 emissions for auto fleet targets from 2035.

Top European News

- UK financial regulator is considering a revamp of capital requirements for specialist trading firms and sees a real opportunity to make rules more proportionate and boost UK competitiveness, while options on the table include tweaking EU-aligned rules, aligning with the US approach, or allowing trading firms to use internal models.

- EU Lawmaker Weber said the EU will have a 90% reduction in CO2 emissions for auto fleet targets from 2035.

- EU Commission to propose extending the carbon border levy to downstream aluminium and steel products, according to Reuters detailing a draft document.

- The EU is to propose a new fund to support EU industries by using 25% of revenues collect from carbon border levy, according to Reuters citing a draft proposal

FX

- DXY is flat and trades within narrow 98.17 to 98.32 range, with price action incredibly lacklustre as traders count down their clocks into the US NFP Payrolls figure for October, and the full November jobs report. In brief, the November NFP is expected to show 35k jobs added, while the unemployment rate is seen at 4.4%. November's delayed employment report will incorporate October payrolls, though October's unemployment rate will be absent after the shutdown halted household survey collection. [Full preview in the Newsquawk Research Suite]

- GBP/USD is firmer against both the EUR and USD after hawkish PMI and LFS reports, the latter which saw wage figures above consensus and the priors subject to upward revisions. Employment figures signalled continued weakening in hiring, with the unemployment rate ticking up in line with expectations and payroll change across public and private sectors remaining in contraction. Currently trading at the upper end of a 1.3356 to 1.3415 range.

- JPY outperforms vs peers, in continuation of the strength seen in the prior session as markets look towards the BoJ at the end of the week where a 25bps hike is widely expected. Overnight, Japanese PMIs were mixed with surprising strength in manufacturing but weakness in services; metrics ultimately did little to move the yen. USD/JPY trades within a 154.69-155.26 range.

- EUR/USD is little changed, but did chop surrounding the release of differing PMI reports across the EZ. EUR initially saw marginal strength after French manufacturing PMI surprisingly rose into expansionary territory, with the report citing the robust aviation industry - but earlier strength was then reversed on the weak German report which showed manufacturing slip further into contraction. EUR is flat against the USD in narrow 1.1745-1.1763 parameters. The next level to the upside is Monday's high at 1.1769.

Fixed Income

- USTs are trading within a narrow sub-5 tick range (112-10+ to 112-14), with price action incredibly lacklustre this morning as traders wait for the US NFP Payrolls figure for October, and the full November jobs report [Full preview in the Newsquawk Research Suite]. In brief, the November NFP is expected to show 35k jobs added, while the unemployment rate is seen at 4.4%. November's delayed employment report will incorporate October payrolls, though October's unemployment rate will be absent after the shutdown halted household survey collection.

- Bunds have chopped and changed within a 127.49 to 127.65 range, but currently trading just off best levels. Initial action was slightly bearish, following Gilt pressure after the UK’s jobs report (see below). Thereafter, French PMI figures (which were mixed, but Manufacturing surprisingly climbed in expansionary territory), sparked modest pressure in the benchmark to a session low. This then entirely reversed on a poor German report, which missed expectations across the board, taking Bund Mar’26 to a session high. EZ PMI figures also printed below expectations, putting the blame on Germany; the inner report highlighted that “it is clear that price pressure, driven in part by wage increases, is still noticeable”.

- Gilts opened near enough unchanged from the close yesterday, but then tumbled lower as markets digested the UK’s jobs report. In essence, the unemployment rate ticked higher, in-line with expectations, whilst Employment Chance was a better than feared. Focus is also on the Wages components, which topped expectations. Overall, metrics should not change much for policymakers at the BoE, with something for both the doves (cooling labour market), and the hawks (rising wages); a view also shared by analysts at Pantheon Macro, writing that “today’s data will keep the balance of views on the MPC little changed”. Money markets continue to assign a 91% chance of a 25bps reduction this Thursday. Thereafter, UK paper took another leg lower on the region’s PMI figures, which topped expectations – taking the benchmark below the 91.00 mark to a fresh tough of 90.83 vs current 90.90.

- UK sells GBP 4.25bln 4.125% 2031 Gilt: b/c 3.23x (prev. 3.01x), average yield 4.093% (prev. 4.088%), tail 0.2bps (prev. 0.6bps)

Commodities

- Crude benchmarks have continued to sell off with Brent dipping below USD 60/bbl for the first time since May 2025. WTI and Brent traded rangebound in a USD 56.19-56.54/bbl and USD 60.08-60.39/bbl band throughout the APAC session as the markets consolidated following Monday’s selloff. As the European traders entered, benchmarks extended lower, aided by comments from Russia’s Ryabkov stating that a resolution on the Ukraine war is near. WTI and Brent dipped to a trough of USD 55.69/bbl and USD 59.42/bbl before slightly paring back earlier losses. However, Brent continues to trade below USD 60/bbl.

- Spot XAU has continued to grind lower, dipping below USD 4.3k/oz, but losses remain relatively contained compared to silver and copper. XAU peaked to a high of USD 4318/oz during the APAC session before selling off, with losses accelerating as the yellow metal broke USD 4300/oz to the downside, before buyers stepped in at USD 4272/oz. Thus far, XAU trades in a tight USD 4276-4292/oz band near lows as the European session gets underway.

- 3M LME Copper fell as the APAC session commenced, and as the stateside risk-off mood rolled over into Asia-Pac equities. The red metal opened at USD 11.64k/t and initially saw slight upside to peak at USD 11.68k/t before falling to a trough of USD 11.53k/t. In the European morning, 3M LME copper continues to trade near USD 11.6k/t as markets await a flurry of US data.

Geopolitics

- Ukrainian President Zelensky later said there was still no ideal peace plan as of now, and the current draft is a working version, while he added the US wants to proceed quickly to peace and that Ukraine needs to ensure the quality of this peace. Zelensky said there is agreement that security guarantees should be put to a vote in Congress and said they are really close to strong security guarantees, while he hopes to meet with US President Trump when the final framework for peace is ready. He also stated that there will be no free economic zone in Donbas under Russian control and that Ukraine will not recognise Donbas as Russian either de jure or de facto, as well as noted that Ukraine will ask the US for more weapons if Russia rejects the peace plan. Furthermore, he said Ukraine and US negotiators could meet this weekend in the US, and that Ukraine and the US support German Chancellor Merz's idea of a Christmas ceasefire, with an energy ceasefire an option.

- Russia's Deputy Foreign Minister Ryabkov said certain Ukraine war resolution is near, according to TASS. Ryabkov also said Russia has no understanding of Berlin talks outcome so far, via RIA. They are ready to make efforts to overcome disagreements relating to the Ukraine crisis, via Ria. Not willing to make any concessions re. Crimea, Donbas and Novorossiya. Russia will not agree to the deployment of NATO troops in Ukraine under any circumstances, via RIA.

- Russia's Kremlin said do not want a ceasefire which will provide a pause for Ukraine to better prepare for continuation of war. On the Ukrainian proposal for Christmas truce, said "depends whether we reach a deal or not.". Did not see the details of the proposals on security guarantees for Ukraine yet.

- Al Jazeera correspondent reports Israeli airstrikes in areas east of Gaza City.

- US is preparing to seize more sanctioned oil-filled tankers off Venezuela, according to Axios citing officials. The president has many tools in the toolbox, and "this is a big one". So far, Trump doesn't want to move into Venezuelan waters to seize ships. "But if they make us wait too long, we might get a warrant to get them there," in Venezuelan waters.

- US military said it carried out strikes on free vessels in international waters, which killed eight people.

- China's Foreign Ministry on Japan's comments about Chinese defence spending said Japan 'groundlessly accused' China and maliciously smearing China's legitimate national defence building

US Event Calendar

- 8:30 am: Nov Change in Nonfarm Payrolls, est. 50k

- 8:30 am: Nov Change in Private Payrolls, est. 50k

- 8:30 am: Nov Change in Manufact. Payrolls, est. -5k

- 8:30 am: Nov Average Hourly Earnings MoM, est. 0.3%

- 8:30 am: Nov Average Hourly Earnings YoY, est. 3.6%

- 8:30 am: Nov Unemployment Rate, est. 4.5%

- 8:30 am: Oct Retail Sales Advance MoM, est. 0.1%, prior 0.2%

- 8:30 am: Oct Retail Sales Ex Auto MoM, est. 0.2%, prior 0.3%

- 8:30 am: Oct Retail Sales Ex Auto and Gas, est. 0.36%, prior 0.1%

- 9:45 am: Dec P S&P Global U.S. Manufacturing PMI, est. 52.05, prior 52.2

- 9:45 am: Dec P S&P Global U.S. Services PMI, est. 54, prior 54.1

- 9:45 am: Dec P S&P Global U.S. Composite PMI, est. 53.9, prior 54.2

- 10:00 am: Sep Business Inventories, est. 0.1%, prior 0%

DB's Jim Reid concludes the overnight wrap

Markets have struggled at the start of this week so far ahead of a busy few days. Weak data yesterday led to a bit more concern about the 2026 outlook. So that meant the S&P 500 (-0.16%) fell back for a second day, Treasury yields generally dipped (-1.1bps for 10yr), Brent crude oil closed at a 7-month low of $60.56/bbl, whilst the US 2yr inflation swap (-5.6bps) hit a fresh one-year low. There were more headlines that may ultimately inch us towards a compromise on the war in Ukraine that likely helped oil dip. However, on the other side, Kevin Warsh has emerged as favourite for the Fed Chair for the first time on Polymarket, with Hassett losing this position after being in the lead for virtually all of the last couple of months. S&P (-0.50%) and Nasdaq (-0.74%) futures are extending declines this morning with Asian equities generally down -1.5 to -2%.

The narrative is all subject to change though, as today marks the start of a series of top-tier data releases and central bank decisions. That begins with the US jobs report for November, along with a partial report for October, which is out at 13:30 London time. For context, the shutdown meant that data stopped being collected, so even though we’ll get the payrolls numbers for both October and November, there’s only going to be an unemployment rate for November. When it comes to the data itself, these numbers are likely to be very choppy because of the shutdown, but our US economists expect that payrolls will be down -60k in October, due to early year government buy-outs all coming through this month, followed by a bounce back of +50k in November. By contrast, they think that private payrolls will have a much smoother path of +50k for both months. Meanwhile for unemployment, they see the rate ticking up to a 4-year high of 4.5% in November.

From a market perspective, the most important question is whether the report opens the door for more rate cuts in the early part of next year. As it stands, the Fed have only signalled one further cut for 2026 in the dot plot, but we’ve repeatedly seen in this cycle how a softer labour market has pushed them back in a dovish direction. Indeed, Powell had said in late-October that a December cut was “not a foregone conclusion”, but after the unemployment rate ticked up again, the cut was priced back in, which they delivered last week.

US Treasuries initially rallied ahead of the jobs report, and the move got further momentum because of the latest Empire State manufacturing survey. That fell by more than expected to -3.9 in December (vs. 10.0 expected), which was beneath every economist’s estimate on Bloomberg. So investors priced in more rate cuts for the next few months, with the likelihood of a rate cut by March ticking up to 60%, having been at 54% on Friday. However yields turned back higher late in the European session, with the 10yr (-1.1bps to 4.17%) closing nearly 3bps above the session lows, while 2yr yields were -2.0bps lower on the day to 3.50%.

The partial reversal in yields came after headlines on the next Fed Chair, as CNBC reported that Kevin Hassett’s candidacy had received some pushback from people close to Trump. The article said this was based more around promoting former Fed Governor Kevin Warsh, rather than criticising Hassett. So that article was seen as confirming the recent momentum behind Warsh, particularly after Trump recently said in a WSJ interview that “I think the two Kevins are great”. Indeed, yesterday marked the first time in nearly 3 weeks that Hassett was no longer the favourite on Polymarket, and as we go to press this morning, Warsh is pulling ahead on 48%, with Hassett behind on 40%. Meanwhile, the latest Fed commentary saw NY Fed President Williams echo Powell’s tone that policy is well positioned into next year, while Boston Fed President Collins said last week’s rate cut was a “close call” given lingering inflation risks.

The backdrop proved to be a headwind for US equities, as the weak data meant investors became more doubtful on the near-term outlook. So after futures were strong before the open, the S&P 500 (-0.16%) ended up building on its losses from last Friday, with tech stocks in the NASDAQ (-0.59%) seeing even bigger declines. That said, it was a mixed story within tech, with Broadcom (-5.59%) and Oracle (-2.66%) extending their declines from last week, but the Magnificent 7 (+0.13%) narrowly advancing, led by a +3.56% gain for Tesla. The challenging tech mood saw Bitcoin fall -2.55% to $86,204, its lowest in three weeks. It wasn’t all bad news however, with most S&P 500 constituents higher on the day, led by defensive sectors such as health care (+1.27%) and utilities (+0.88%).

As discussed at the top, Asian markets are weak this morning. Tech-heavy exchanges are seeing the biggest drops, with the Hang Seng down -2.09%, followed by the KOSPI at -1.85%, and the Nikkei at -1.47%. Chinese markets, including the CSI (-1.41%) and Shanghai Composite (-1.25%), are also falling for a second day after yesterday's weak November activity and real estate data. That's offsetting hopes of fresh stimulus for now. Australia's S&P/ASX 200 is outperforming but still down -0.42%. US Treasuries have dipped down a basis point.

In earlier economic news, Japan's manufacturing sector showed improvement in December, with the S&P Global flash manufacturing PMI rising to 49.7 from 48.7. This indicates a move closer to expansion, supported by better domestic and international demand for industrial goods and automobiles. Japan's services sector remains strong, with the flash Services PMI at 52.5, slightly down from 53.2 but still showing solid growth driven by domestic consumption and resilient demand in service industries. Elsewhere, Australia's private sector also continued to expand in December, albeit at a slower pace. The S&P Global flash services PMI decreased to 51.0 from 52.8, impacted by increased competition and a more moderate rise in new export business. However, the manufacturing sector proved more resilient, with its preliminary PMI increasing to 52.2 from 51.6, thanks to stronger goods demand and improved export orders.

Earlier in Europe, markets had been more consistently positive, with both equities and bonds advancing. In part, that was supported by headlines on the Ukraine peace talks. Ukrainian officials touted “real progress” from talks in Berlin with US officials reportedly offering “Article-5 like” security guarantees and Trump saying later that “we are closer now than we have been ever” to peace. Further talks are expected in the US this weekend, while the EU leaders’ summit this Thursday will discuss “reparations loans” to fund Ukraine. Peter Sidorov reviews the latest proposals and their implications for European policy in a note this morning.

Those Ukraine headlines put more downward pressure on oil prices and yields on 10yr bunds (-0.4bps), OATs (-1.2bps) and BTPs (-1.5bps) all moved lower. Meanwhile, equities advanced across Europe, with the STOXX 600 (+0.74%) closing just shy of its record high last month, and Spain’s IBEX 35 (+1.22%) hit a fresh record. The euro (+0.11%) posted a fourth consecutive advance against the US dollar to reach its strongest level since September at 1.1753. European equity futures are back down around half a percent this morning given the global overnight sell-off.

Over in Canada, sovereign bonds outperformed after their latest CPI report was beneath expectations. Specifically, headline inflation was at +2.2% in November (vs. +2.3% expected), and both measures of core CPI followed by the Bank of Canada were at +2.8% (vs +2.9% expected). That meant Canadian bonds outperformed, with 10yr yields down -2.9bps on the day.

To the day ahead now, and data releases include the US jobs report for November, retail sales for October, and the December flash PMIs from the US and Europe. Otherwise from central banks, we’ll hear from the ECB’s Villeroy.