Lenders & Homebuilders Jump After Trump Unveils QE-Style $200B Mortgage Bond Buying Plan To Unfreeze Housing Market

Upate (0710ET):

Shares of LoanDepot, Rocket Companies, and Opendoor Technologies surged in premarket trading after President Trump signaled plans to push Freddie Mac and Fannie Mae to purchase $200 billion in mortgage-backed securities, a move aimed at driving down mortgage rates and improving affordability ahead of the midterm election cycle.

If the QE-style program is implemented, it would represent a direct government intervention to lower lending costs, providing near-term relief to a housing market effectively paralyzed by years of high prices and elevated borrowing costs, producing some of the worst affordability conditions in a generation.

The prospect of lower rates could act as a positive tailwind for mortgage originators, realtors, and adjacent real estate services that have endured several years of depressed transaction volumes, with some realtors forced to return to their previous bartending jobs.

Wall Street analysts view MBS purchases as a mechanism to tighten mortgage spreads, especially since Chair Powell stopped reinvesting in MBS several years ago.

Citizens analyst James McCanless told clients, "If this directive actually happens, it could be favorable at face value for mortgage rates, especially with the Federal Reserve having stopped MBS reinvestment several years ago."

McCanless said, "Trump's post about buying MBS and the potential impact on rates was the first piece of potentially good news for the builders and their customers if it comes to fruition."

UBS analyst John Lovallo noted that "MBS purchases are one of several ways the government-sponsored enterprises (GSEs) can be leveraged to reduce mortgage rates/improve affordability in the near-term," adding, "GSEs could also potentially subsidize mortgages and reduce guarantee fees (G-fees), the latter of which equated to 65bps on a 30-year mortgage in 2024."

Jim Reid at Deutsche Bank said that $200 billion should be viewed in the overall context of a roughly $9 trillion agency MBS market and that "spreads between mortgage bonds and Treasuries tightened by nearly 10bps on the news with home-lender stocks gaining in after-hours trading."

Premarket stock reaction: LoanDepot jumped about 17%, while Rocket and Opendoor rose about 8%.

The State Street SPDR S&P Homebuilders ETF (XHB) is up a little more than half a percent.

UBS analyst Simon Penn told clients that Bill Pulte, director of the Federal Housing Finance Agency, was quoted as saying the mortgage-backed securities purchases can happen very quickly because both agencies have the cash on hand to do so.

The Trump administration appears to have moved on from the prospect of a 50-year mortgage, something we've told readers was a bad idea.

* * *

First, Trump short-circuited the Fed's rate-cut process. Now he is pursuing QE by launching his own version.

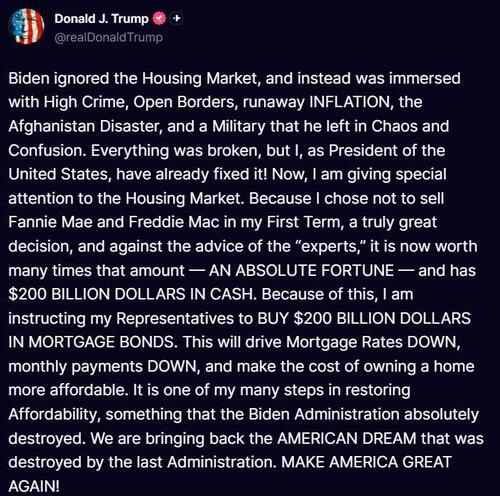

In a post on Truth Social late Thursday, President Trump said he was directing the purchase of $200 billion in mortgage bonds, which he framed as his latest effort to bring down housing costs ahead of the November midterm election.

"This will drive Mortgage Rates DOWN, monthly payments DOWN, and make the cost of owning a home more affordable," Trump wrote in his post.

He added that his decision not to sell Fannie Mae and Freddie Mac during his first term allowed them to amass "$200 BILLION DOLLARS IN CASH" and that he was making his announcement "because of that."

Federal Housing Finance Agency director Bill Pulte, said soon after that the president aims for Fannie Mae and Freddie Mae to execute the purchases. Pulte said Thursday the bond purchases "can be executed very quickly. We have the capability, we have the cash to do it, and we are going to go about executing it very smartly and in a very big way."

"It is one of my many steps in restoring Affordability, something that the Biden Administration absolutely destroyed," the president said. Mortgage backed securities rallied relative to Treasuries on the news.

Fannie Mae and Freddie Mac have added billions of dollars of mortgage-backed securities and home loans to their balance sheets in recent months, fueling speculation that they're trying to push down lending rates and boost their profitability ahead of a potential public offering; now those speculations have been validated.

The government-backed housing-finance giants increased their retained portfolios, the portion of bonds and loans they hold onto rather than sell to investors, by more than 25% in the five months through October, according to recent figures.

The announcement comes one day after Trump said on Wednesday that he would seek to ban institutional investors from buying single-family homes. The president's advisers have repeatedly raised alarms that affordability has become a political albatross for the GOP and could cost the party control of Congress in the elections this fall.

In keeping with Trump's housing obsession, overnight, Politico reported that the White House is drafting an executive order broadly targeted at addressing Americans' frustration with the cost of living, including a push to allow people to dip into their retirement and college savings accounts to afford down payments on homes.

Of course, by simply adding even more fuel to the demand side - which is what this kind of conversion from savings into home equity will do - it will achieve the opposite of what Trump is pursuing, which means even more mortgage bond purchases, which means even more rate cuts, which means even more direct intervention in the market by various third parties, which means even more endogenous liquidity generated, and so on. Of course, it also means we have barely scratched the surface of where gold and bitcoin will eventually trade.