"No Longer Gold's Quiet Sidecar": Silver Surges To Record High As China Demand Exacerbates Squeeze

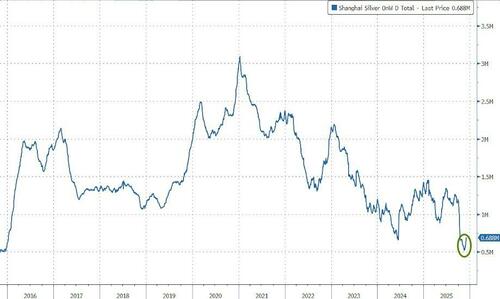

As we have detailed extensively recently (here, here, and here), silver's latest breakneck surge to record highs was in large part due to collapsing inventories of the precious metal in Chinese warehouses linked to the Shanghai Futures Exchange, which just hit the lowest level since 2015.

The squeeze continues to accelerate and this morning the white metal topped $59 - a new record high...

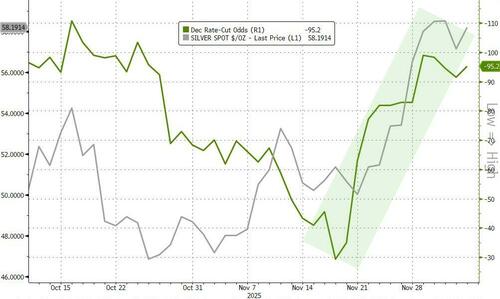

...as rising rate-cut odds support the buying...

...and Chinese demand continues to build back inventories...

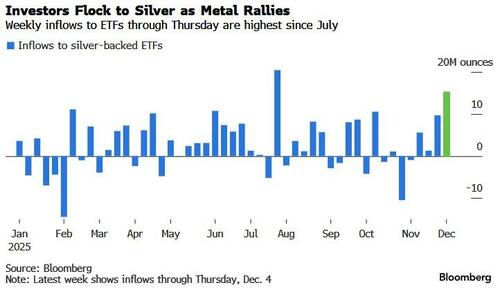

Strong inflows to exchange-traded funds added more impetus to a scorching rally, as Bloomberg reports, total additions to silver-backed ETFs in the four days through Thursday are already the highest for any full week since July, a strong signal of investor appetite despite signs silver’s gains may be overdone.

As Goldman notes, key catalysts for silver's recent rise include a depletion of Shanghai Futures Exchange inventories plus growing expectations for a dovish, Trump-backed Fed Chair.

“These flows can quickly amplify price moves and trigger short-term short squeezes,” said Dilin Wu, research strategist at Pepperstone Group Ltd.

Silver prices have roughly doubled this year, outpacing a 60% rise in gold. The rally accelerated in the last two months, in part thanks to a historic squeeze in London. While that crunch has eased in recent weeks as more metal was shipped to the world’s biggest silver trading hub, other markets are now seeing supply constraints. Chinese inventories are near their lowest in a decade.

“Silver’s outsized rally signals it’s no longer gold’s quiet sidecar,” said Hebe Chen, an analyst at Vantage Markets in Melbourne.

“The market is waking up to structural scarcity and fast-rising industrial demand, not just the haven story.”

Silver could rise to $62 an ounce in the coming three months “on the back of Fed cuts, robust investment demand, and physical deficit,” Citigroup Inc. analysts including Max Layton wrote in a note.

Additionally, in the latest note from UBS, Dominic Schnider and Wayne Gordon raised their silver price forecasts by USD 5–8/oz, projecting average prices of USD 60/oz in 2026, with upside excursions toward USD 65/oz possible but unlikely to persist.

“From a macro perspective, silver should benefit from the same drivers expected to support gold – a softer US dollar, Fed rate cuts, and renewed appetite for safe-haven assets amid geopolitical concerns,” said Ewa Manthey, a commodity strategist at ING Bank.

It's not all easy riding from here though, as a "hawkish cut" could spur some profit-taking, and Goldman's Robert Quinn notes that the annual commodity index rebalance looms with potential outflows representing 7-8% of total open interest.