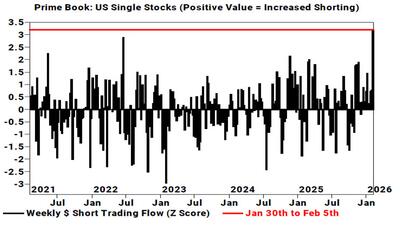

"This week’s notional short selling in US Single Stocks was the largest on our record" - Goldman Prime Brokerage

"Trump aggressive intervention to reduce price of energy, healthcare, credit, housing, electricity via Big Oil, Big Pharma, Big Banks, Big Tech means small & mid-cap best play for "boom" on Main St in run-up to US midterms" - Michael Hartnett, BofA

The mix of Molotov Cocktails and Faux Liquidity make for a challenging environment...

The Trump administration has drawn a line in the sand...

"I get phone calls every day from people who are seeing cancers and thyroid disease, respiratory and neurological issues..."

Estimate your earnings

oz

Calculate earnings

Every market development these days is judged with respect to the “Sell America” narrative, the latest one being the appointment of the next Fed chairman...

...alarming running tally since mid-January...

Tech investor calls out blatant media bias in protecting Democrat mega-donor...

Just a little PSA for the folks who are clearly confused...

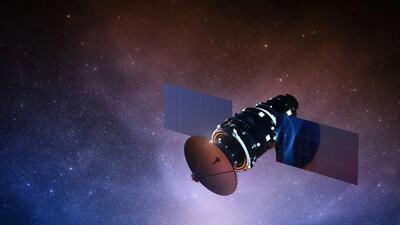

" ... by far the cheapest and most scalable way to generate tokens is space."

More than 1,200 vehicles were put out of service as part of a three-day federal government operation last month.

As of this writing, Takaichi's LDP is projected to reach around 300 seats or even higher, the highest percentage of seats in its history...

“These convenience stores were magnets for drug activity, and, in some cases, the stores were selling illegal drugs themselves...”

The secretary of war said the Ivy League school promotes ideology misaligned with military values.

The Russian craft observed lingering near their targets for weeks at a time...

The lawsuit seeking privileged access to data has fueled accusations that Brussels-linked actors are attempting to control the narrative in Hungary's upcoming vote...

China's ground-based microwave weapon with a power of over 20 gigawatt could be capable of seriously disrupting or even damaging satellites in low Earth orbit...