markets

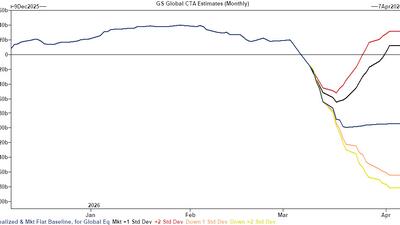

"Sell estimates over the next week are some of the largest we have seen" - Goldman

The gold market is quietly escaping central bank control

Sponsored Content By Monetary Metals

Sponsored Content By Monetary Metals

DOWN WITH AMERIC-AAAAAAAHHHH

...passing the SAVE Act is as consequential as ridding the Middle East of its chief chaos agent...

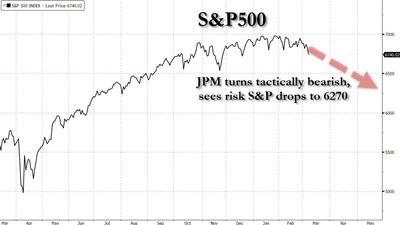

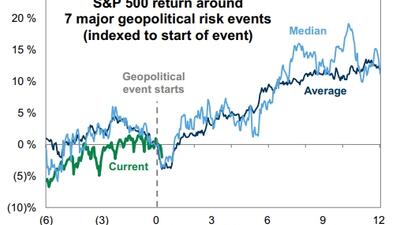

"We are now Tactically Bearish... there has been a lack of extreme de-risking with positioning currently neutral... A definitive off-ramp to the conflict will end this tactical call"

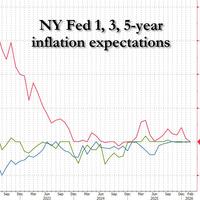

Just before the Iran war which sent oil prices soaring, the US economy was in surprisingly good shape according to the latest NY Fed consumer expectations survey.

These are the key levels to watch...

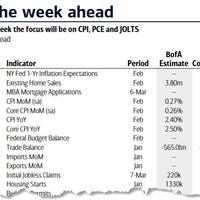

the key economic data releases this week are the CPI report on Wednesday and the durable goods and core PCE reports on Friday. Fed officials are in a blackout period so no speeches this week.

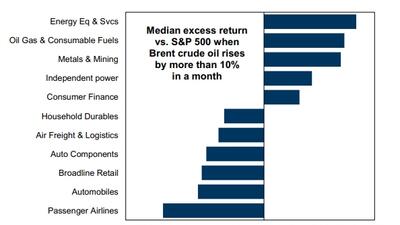

For US equities, the bigger risk is a sustained period of severe oil disruption that weighs on economic growth...

"This collaboration reflects what's possible globally..."

"The market is anticipating the worst-case scenario. The selloff is all about oil, it’s about the inflation that is deduced from it, it’s about the risk of stagflation."

...instinct is that once the dust settles this likely proves to be a buying opportunity for many of the assets people wanted but to own (EM/Asia). The difficulty is duration...

Many sellers who pulled their homes off the market last year are relisting now in hopes of capitalizing on spring homebuying "season..."

"That Is Going To Build Into A Massive Problem": Sunday Night Thoughts From Goldman's Commodity Desk

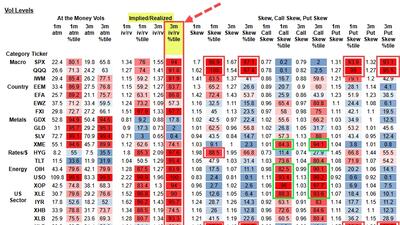

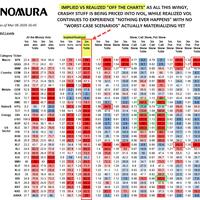

"I am concerned about the scale of the Open Interest (OI) in the options market…. If we look at the move in the vols that have happened over this week, they have been enormous… I do not think that option position has cleared…." - Goldman on Nat Gas

His decision comes four months after his congressional district was redrawn to favor Democrats.

Lee said in the government would "swifly implement and boldly impement" a maximum price system on petroleum products.