precious-metals

... gold is "logically a safer asset than any national currency."

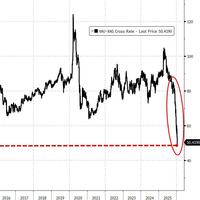

"A failure to deliver in gold will immediately spill over to the credit markets because gold is truly the anti-dollar or the anti-US Treasury..."

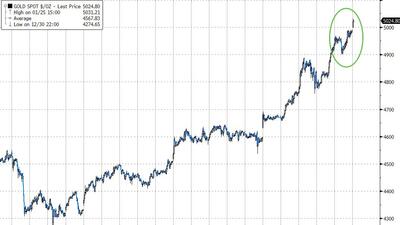

...whether bullish or bearish from here, consider selling short-dated to buy longer-dated options.

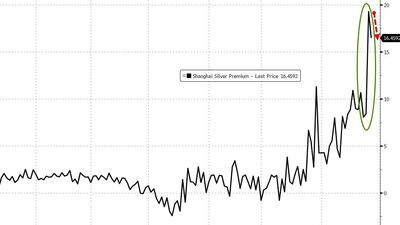

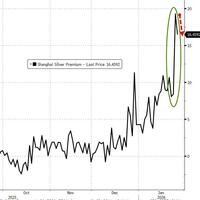

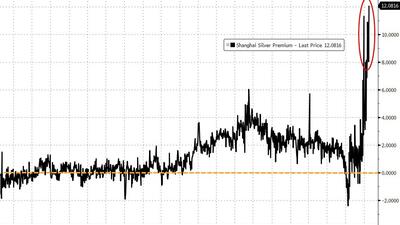

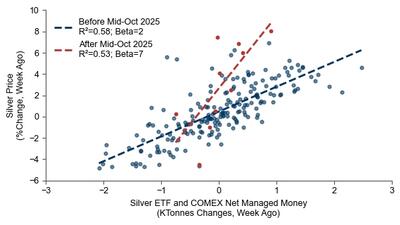

Silver (SLV) has officially become the new epicenter of retail fervor...

"This time, any selling that is attempted by bullion banks fails..."

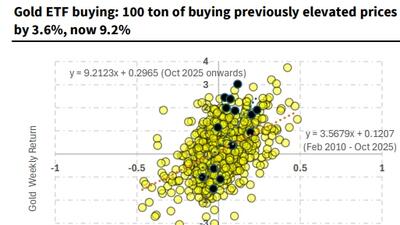

...the options market is “positioning for more than just a short-term price jump, consistent with gold carrying a geopolitical and confidence premium,”

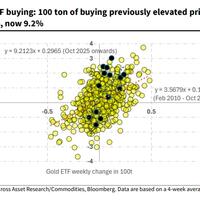

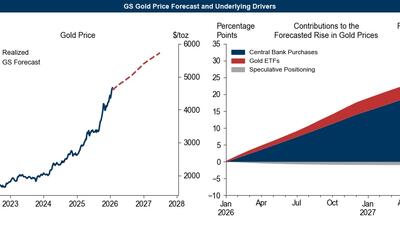

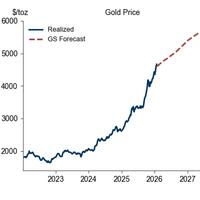

...the key upside risk Goldman had flagged - private sector diversification into gold - has started to realize...

Shift in relations and unpredictability of Donald Trump make it ‘risky to store so much gold in the US’, say experts...

...despite record highs prices, Goldman's commodity trading desk notes that spec positioning in New York and Shanghai remains close to the lows.

...three key questions (answered)

"They have done this before, after World War II, and they are going to do it again as soon as this year..."

...price has run too far but we’re reluctant to short until we see physical premia ease...

From shrinking physical inventories to record central bank buying, precious metals warn that the underlying issues aren’t resolved…

That valve has blown off. So what do we do now... take profit?

As gold continues to benefit from central bank buying and investor diversification, silver bulls may be left questioning price levels as the hype surrounding it dies down...

As long as silver remains dislocated in the US and liquidity in London is not restored with silver from elsewhere, prices could rise even further...

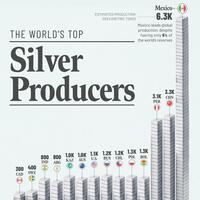

Mexico leads global silver production despite holding just 6% of the world’s known reserves...

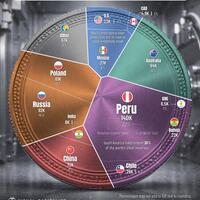

Peru alone holds roughly 22% of the world’s known silver reserves...

Tether moved to establish a new unit of account for gold, arguing that transactions denominated in "Scudo" could simplify digital payments.