"A small sales miss was expected and instead, we got a beat. This was also the first time they beat operating margins in the last..."

"...ready to take any necessary step..."

Japanese Prime Minister Sanae Takaichi expressed reservations about additional interest rate hikes during her meeting with Bank of Japan Governor Kazuo Ueda last week, Mainichi reported.

"We'll do it. That is absolutely clear. It is only a matter of time."

If code can increasingly write itself, barriers to entry in software development collapse and the rent extraction embedded in the SaaS model is structurally challenged...

Time to start the countdown clocks to tonight's piece of political theater... with what surprises for the viewing audience?

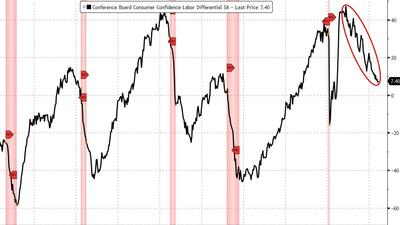

...but labor market weakness accelerates...

SVR specifically mentions French small-size TN-75 warhead...

"I'm confident that payers will accept and welcome these lower list prices, as they've been calling for them publicly."

"Unfortunately, we did see this in ’05, ’06 and ’07, almost the same thing..."

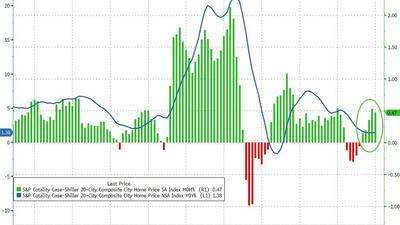

...stable prices and declining mortgage rates means more affordability.

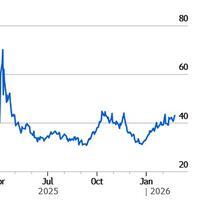

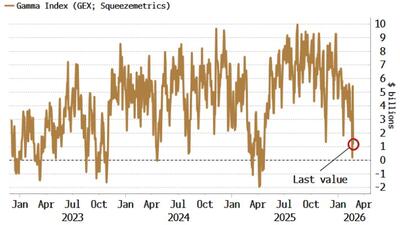

S&P gamma has fallen close to negative, which increases the risk that selloffs are reinforced by dealer selling...

Why is it that this police officer understands English law but others do not?

“Ongoing concerns over AI disruption and the possible exposure to private credit and private equity have made investor sentiment fragile. If we do get an escalation in geopolitical risks, markets may face some wobbles.”

"over the last month call volumes in mega cap stocks has fallen to levels last seen in 2017...its less fun chasing call options when they stop working and one experiences the true meaning of “theta decay." - Goldman