Trump administration officials including Commerce Secretary Howard Lutnick had laid out their expectations...

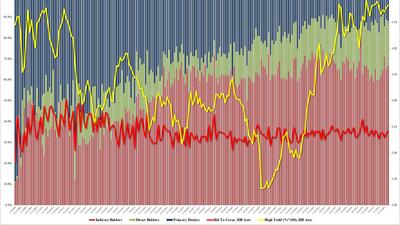

A very strong auction, which was also facilitated by today's surprisingly cool CPI report, which swung the long-end from an intraday high of 4.20% to a low of 4.15%, and was last trading at 4.165%.

Trump’s directive risks bringing more of that regime back...

“Continued economic momentum helped land 2025 holiday sales near the top of NRF’s forecast, reaffirming that consumers remain on solid footing...”

Estimate your earnings

oz

Calculate earnings

It doesn’t mean free trade – it means trade blocs. It doesn’t mean free markets – it means freeing markets from a focus on short-term profits. It doesn’t mean higher rates and lower fiscal spending – it means lower rates and higher fiscal spending...

"Once we get people in the bear trap, they're not getting out..."

The ‘Dilbert’ creator’s death was revealed by his former wife on his show on Tuesday.

"They are absolutely terrified about what may come next..”

"no winners in a tariff war."

Everyone is at risk from the resulting breakdown of basic human decency.

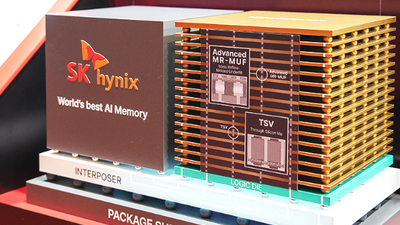

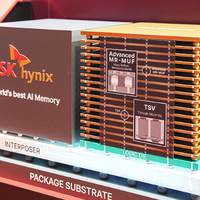

"We are receiving memory chip supply requests from many companies, and we are thinking hard about how to address all demands."

Starmer’s regime isn’t prioritizing kids... it’s weaponizing safety pretexts in an effort to crush X’s influence.

“The market does not care about Trump’s capricious tariff threats. Trump’s previous backdown from China has shown that bigger levers such as the supply of rare earths matter more in tariff negotiations. It is unlikely that he can afford to upset the trade truce with China just to pressure Iran.”

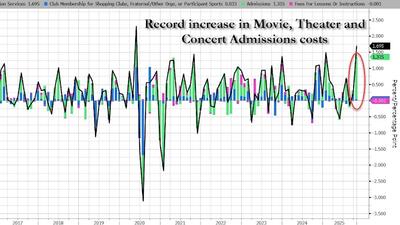

...despite a record increase in Movie & Sports Admission costs.

While Q4 earnings were a touch weaker than expected despite another blowout sales and trading quarter, the bank appeased market by projecting markets NII of $8bn, putting total NII modestly above consensus.

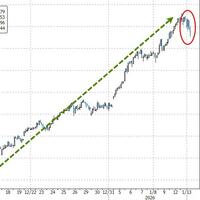

China rallied to new cycle highs overnight but all major indices closed in the red, marking the first pullback since Dec 17, 2025...

"The setup is one where markets are bulled up, but the data suggest that a hawkish print is more likely than a dovish print; but, the market outcomes are skewed bullishly"