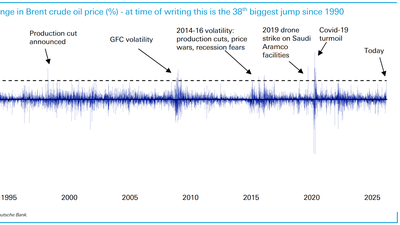

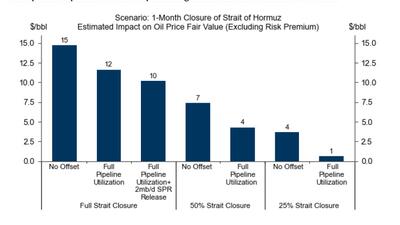

Today's oil surge - which is fading fast - is not that big in the grand scheme of geopolitical conflicts...

Buterin says AI coding still has “massive caveats", but people should expect Ethereum’s roadmap to be finished much faster than expected...

Trade W’s Multi-Platform (In-App, Web, MT4/5) Redefines Forex Trading

Sponsored Content By Trade W

Sponsored Content By Trade W

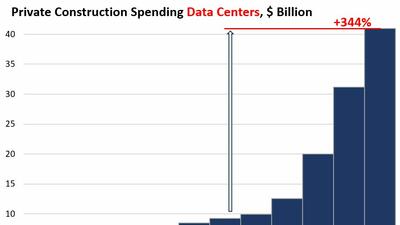

Despite the hoopla about data centers, spending on factory construction was five times larger.

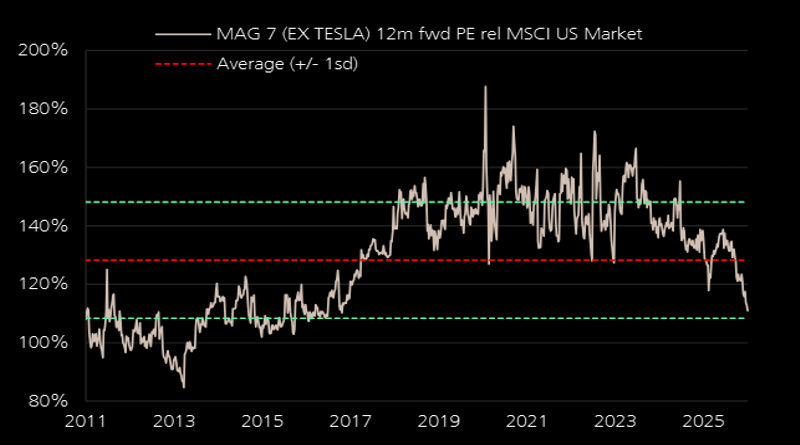

The SaaSpocalypse makes for dramatic headlines, but the idea that AI agents will simply devour enterprise software whole ignores both the data and the institutional complexity of the businesses being disrupted.

Beyond the risk of rare earth metals becoming a major focal point between Beijing and Washington (again), UAMY may also be rising, as antimony is a critical rare earth used...

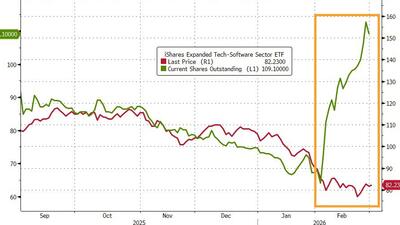

...did 'retail' just try to call the bottom in 'software'?

He suggested that Trump not only abused a minor, but that she was later bumped off to keep her from speaking...

In a nightmare deja vu moment for Europe, LNG prices exploded after Qatar shut LNG production in the world's largest export facility.

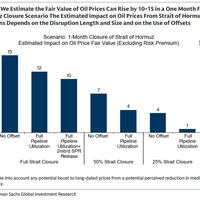

History shows that oil prices can rise significantly, and well above fair-value estimates when geopolitical uncertainty is high and when the market puts some weight on supply disruptions persisting

There is no safety net if the US doesn’t manage to land this manoeuvre" - Rabobank

Fires were still burning at key oil transit site Monday morning...

Production growth slowed in response to a near-stalling of orders from customers...

Iranian-made drones may have been launched from nearby Lebanon...

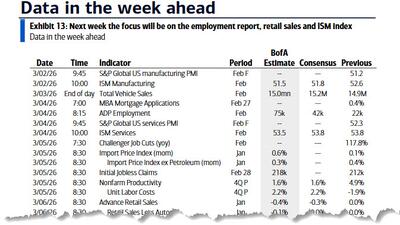

Key focus this week will be on the US jobs report on Friday, retail sales on the same day, the ISM indices (today and Wednesday), and the Fed’s Beige Book, also due on Wednesday

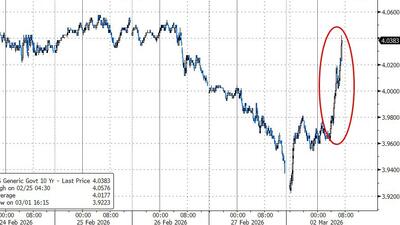

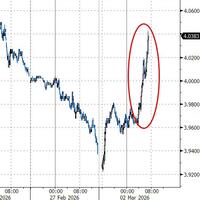

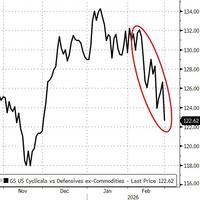

...this is what you see when investors get nervous but don’t want to “fully de-risk” at the index level.

...parallels US Haitian scandal