precious-metals

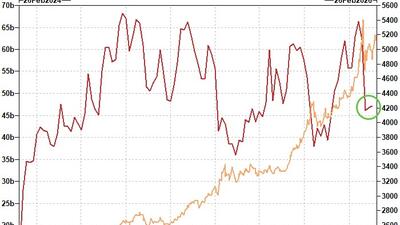

Elevated stagflation risks, following the US Admin's response to the Supreme Court ruling on IEEPA and a potential Middle East conflict, provided support...

...if you are still wondering about gold’s future price direction, just ask the big banks…

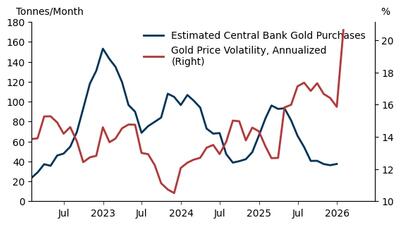

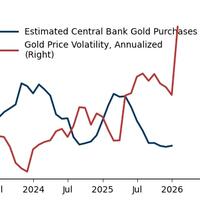

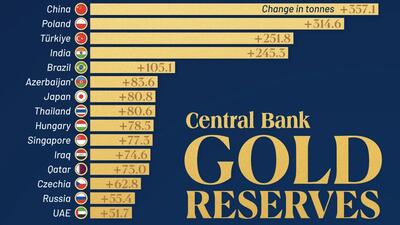

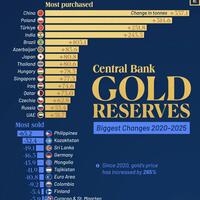

Our conversations suggest that reserve managers remain willing buyers of gold to hedge geopolitical and financial risks but prefer to delay purchases until prices stabilize...

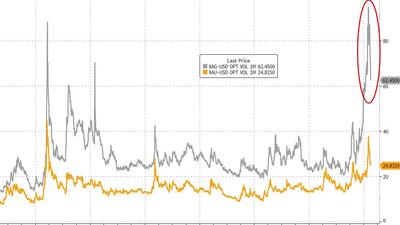

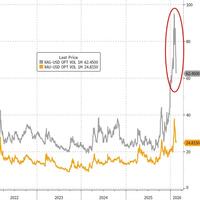

For years, bulls of gold and silver have complained about how derivatives have been used to suppress their prices. Their dreams of the practice ending could be coming true...

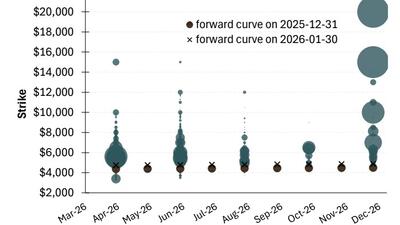

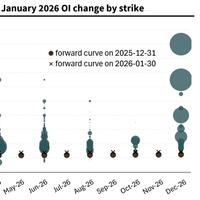

“It is plausible some traders see this as a cheap lottery ticket.”

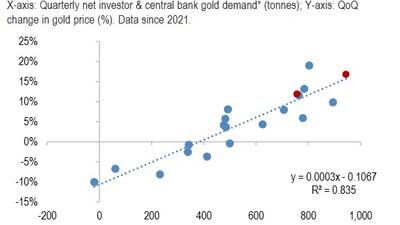

"...private investors join central banks in competing for the same limited gold bullion..."

The Philippines recorded the largest reduction, cutting reserves by more than 65 tonnes...

"The average check I'm writing is probably in the $8,000 to $10,000 range."

"The reason gold is going up is because of what’s happening in China..."

“We believe such worries are overdone, and that the rally in gold will resume...”

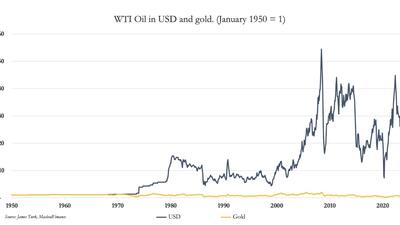

With no end of American wars and spending sprees in sight, the US dollar’s role as world reserve currency could well be in jeopardy...

Bian stands to make a net profit of around 1 billion yuan...

The gold euphoria should be tempered by an uncomfortable recognition...

...while the air is getting thinner the higher we go in gold prices, we are not yet close to a place where the structural rally in gold is at risk...

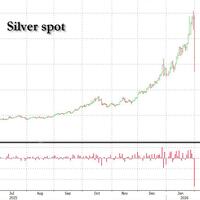

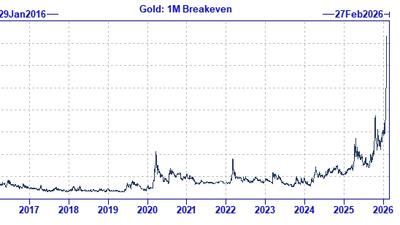

On Friday, January 30, 2026, the world learned (or rediscovered) just how grotesquely rigged the paper gold and silver markets truly are...

"I came to buy because the price of gold dropped today..."

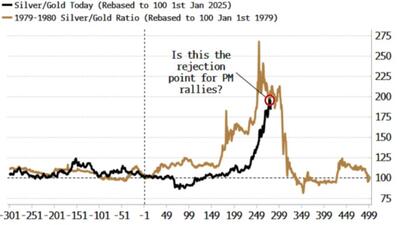

The parabolic rise of gold and silver partly reflected a growing fear that we’re losing our balance.

Goldman traders expose the numbers behind a quite extraordinary day...

"$3.5bn to sell in SLV and ~$650mm to sell in GLD today on QDS estimates"

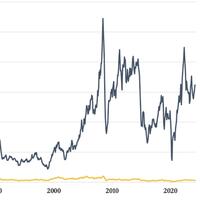

The silver/gold ratio has climbed almost as much as it did in the late 1970s, and today’s dramatic moves show that might have marked a rejection point...