Sure, Bill...

"a spike in private defaults could ripple across public markets, widening spreads and impairing liquidity."

He called every state in 2024. Here’s his midterm map

Sponsored Content By Polymarket

Sponsored Content By Polymarket

"Its retail stores experienced a further slowdown in sales momentum, driven by sustained..."

"The Cuban government is talking with us. They're in a big deal of trouble, as you know. They have no money..."

Here comes more of those “Hundreds of Billions”...

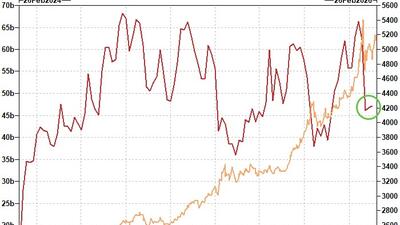

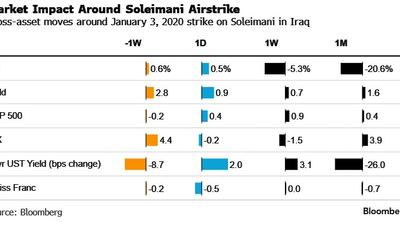

Elevated stagflation risks, following the US Admin's response to the Supreme Court ruling on IEEPA and a potential Middle East conflict, provided support...

US military action on Iran would result in sudden-yet-tradeable risk aversion...

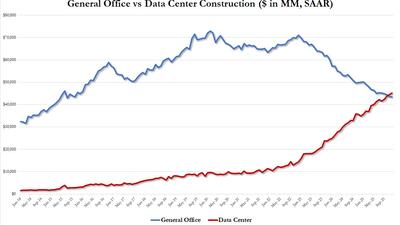

...a historical and very symbolic crossover which makes it clear that going forward machines, and not human workers will provide the bulk of US productivity.

...it’s a bull market, and the primary trend is higher, but S&P is a different asset today than it was in recent few years.

The arrangement came to light after Willis referenced the grant in December 2022 correspondence with DOJ Senior Advisor Scott Pestridge of the Office of Justice Programs...

Brave new world...

“You wouldn’t even believe what I’ve found since I’ve been in this department...”

Some MFS entities within the firm claimed in court filings that they were seeing "serious irregularities" and a "significant shortfall" in their collateral.

...devastating new ad exposes their refusal to stand for protecting Americans over illegals...

Pakistan Declares 'All-Out War' Against Afghanistan, Hundreds Dead In Overnight Clashes With Taliban

Rare Pakistani airstrikes on Kabul...

In total, the department has filed lawsuits against 29 states and the District of Columbia over voter roll access...

White House demands enriched uranium be handed over to US...

In the fourth quarter alone, NdPr production increased 74% year-over-year to 718 metric tons.