markets

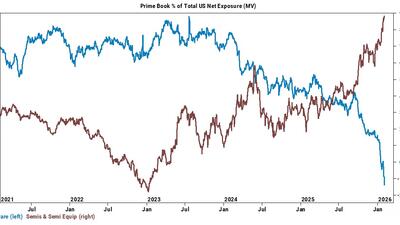

In sharp contrast to what’s going on in software, the cyclical parts of the market trade very well...

ECB says the economy “remains resilient in a challenging global environment”

BoE says “there should be scope for some further reduction in bank rate this year.”

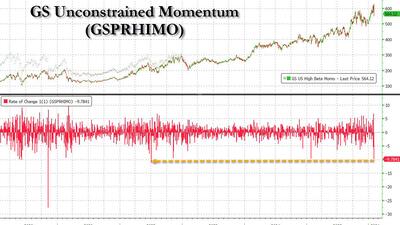

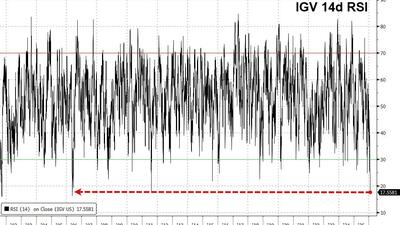

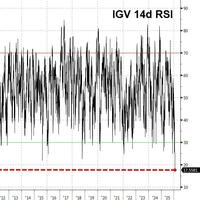

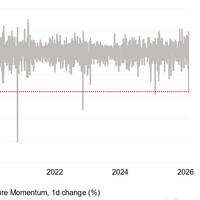

"Three quarters of software stocks are in oversold territory, and the momentum trade that has been the way to play tech and software last year is under severe pressure"

"We have a very tough market."

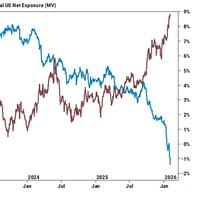

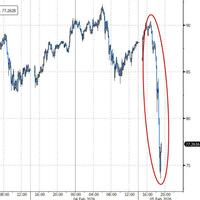

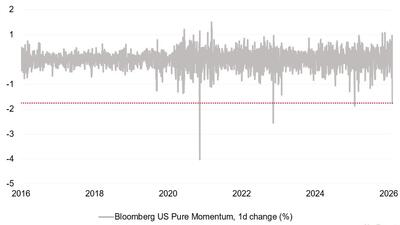

"Today’s session represents a clear escalation of the rotation and dispersion themes that surfaced yesterday - less about Software and more about a broader “re-risking to reversal” moment, where crowded Momentum exposure is being challenged aggressively" - Morgan Stanley

Estimate your earnings

oz

Calculate earnings

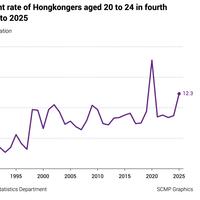

Recruiters say companies are now far more selective in their hiring.

...but “structural drivers remain intact and we continue to expect a rebuild to the upside.”

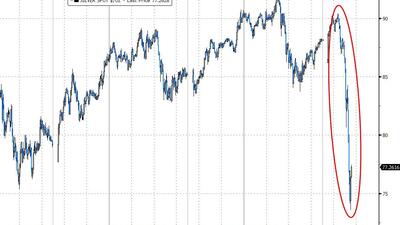

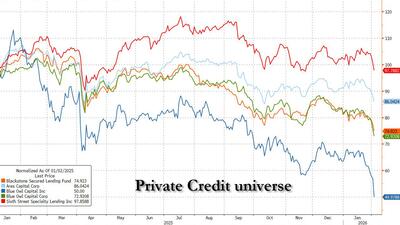

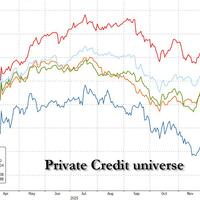

...trading is dominated by survival moves rather than fundamentals... as hedge funds were hammered...

Software stocks - secularly challenged but technically oversold - remain in the ‘too hard box’...

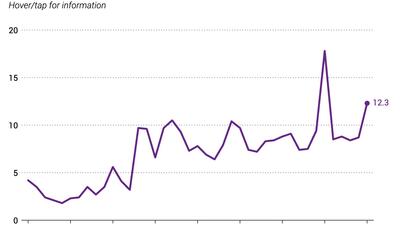

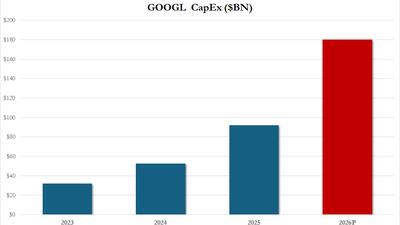

This capex number is... nuts.

"More of an unwind than rotation. More defense than offense. Retail is actually less active but also not supporting the tape. Buybacks are a at a seasonal low."

Perfection is priced in. Good luck getting anything more in this tape.

Japan's transition from a monetary- and fiscal-policy-dependent economy to a free-market economy could significantly affect a major source of global market liquidity...

“Until the dust settles, it’s a dangerous path to be standing in the way of AI.”

Who is most exposed, and how big are the projected losses?

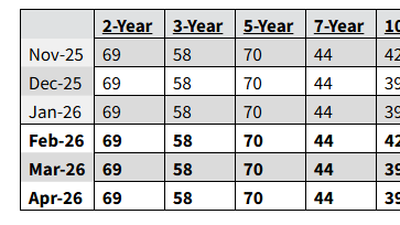

"Based on current projected borrowing needs, Treasury anticipates maintaining nominal coupon and FRN auction sizes for at least the next several quarters"