markets

The rally lifted the company’s valuation back toward $1.65 trillion, signaling renewed confidence in Musk’s long-term strategy despite recent financial pressures.

...the prevailing macro trends of 2025 had very forcefully extended in 2026

It’s hard to know how much capital was chasing the trade purely on the belief that Fed credibility was under threat...

"we wouldn’t say that the debasement trade or diversification from the US have now stopped" - Rabobank

Estimate your earnings

oz

Calculate earnings

“We advise against overdoing the Warsh hawkish trade across asset markets, and even see some risk of a whipsaw. We see Warsh as a pragmatist, not an ideological hawk in the tradition of the independent conservative central banker.”

"I have known Kevin for a long period of time, and have no doubt that he will go down as one of the GREAT Fed Chairmen, maybe the best. "

They may be proven right: after all, Warsh “never lets you down,” in President Trump’s own words...

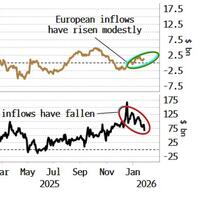

...but European investors seem unperturbed (and clearly not offended enough to start selling US assets)...

Faced with dramatic housing shortages, steadily rising rents, and exploding property prices, policymakers respond with even stronger regulation and rent controls. This is a policy of artificial scarcity, as investors retreat from the market due to declining expected returns.

"...the smell of liquidation in the morning..."

Those China numbers are very very fishy...

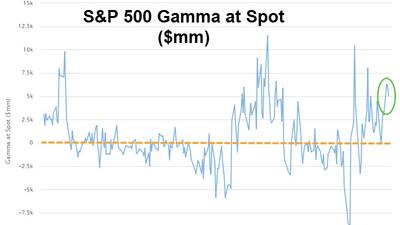

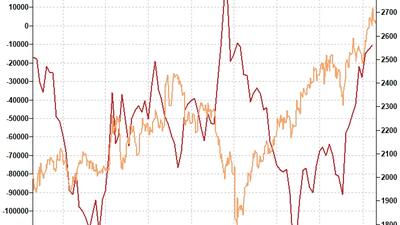

...here's the levels to watch for systematic selling.

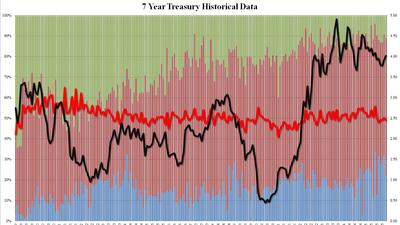

Overall this was a mediocre, tailing auction and while it could have been worse (foreign demand for example was still quite solid), it certainly could have been better.

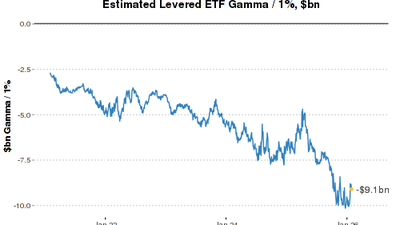

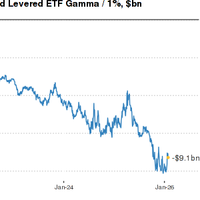

"...levered ETF rebalancing supply is est. to be in the top 20 largest days on record on QDS’s estimates."

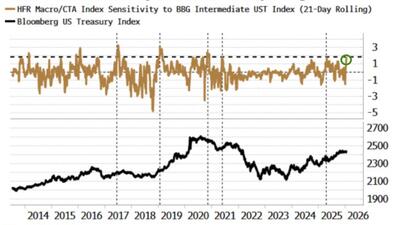

The key question is can Asset Managers absorb any Hedge Fund profit-taking...