markets

"Warsh becoming Fed chair won't lead to any major near-term shifts in monetary policy... Most of his comments, and historic disagreements with Fed policy, are on the balance sheet. However, the Fed has already gone down the path that he advocated against"

The deal gives SpaceX a valuation of $1 trillion, and xAI a value of $250 billion,

Overall, the report frames Tesla as a company in the middle of a major transformation...

Estimate your earnings

oz

Calculate earnings

...the Asia close/European open saw dip-buyers emerge across every asset-class... less systematic selling.

Though it still seems unlikely at this stage, if the reserve status of the dollar was genuinely threatened it would dramatically reduce the freedom to manoeuvre of US policy makers grappling with that “unsustainable” fiscal trajectory.

“You don’t have to be a genius... just don’t be a schmuck.”

...Goldman, Deutsche, and JPMorgan all remain bullish on central banks' buying bullion.

We will get a dense run of US macro releases, with the January jobs report set to dominate attention on Friday. We also have the ISM surveys, consumer sentiment and the latest Treasury’s quarterly refunding details

...an extremely hectic week with risk appetite sliding, especially for "fiat alternatives"... which were absolutely clobbered on the market's false assumption that Kevin Warsh will be hawkish.

Here comes the strategic rare earth reserve.

"This pullback looks healthy to me, there was really some excess across gold, silver and some tech stocks too"

" This is going to be a global contagion... It will be a liquidity crisis..."

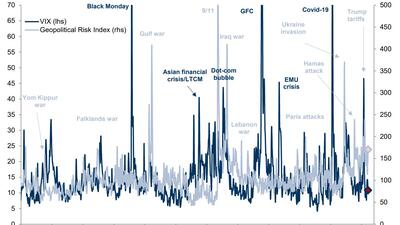

Finally, the inherent unpredictability of geopolitical events, including the possibility of a reversal of the shock, creates material market timing risk...

Suddenly the unthinkable is becoming all too possible...

Sigh. It's not parody... It's San Francisco...